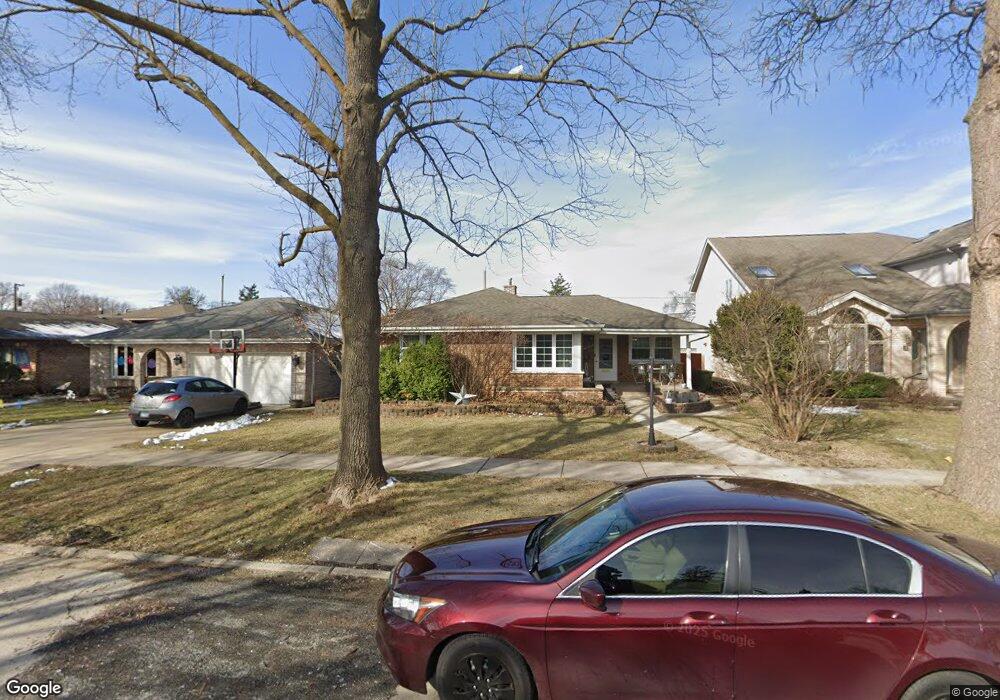

9326 S 55th Ave Oak Lawn, IL 60453

Estimated Value: $276,000 - $327,000

3

Beds

1

Bath

1,091

Sq Ft

$272/Sq Ft

Est. Value

About This Home

This home is located at 9326 S 55th Ave, Oak Lawn, IL 60453 and is currently estimated at $297,015, approximately $272 per square foot. 9326 S 55th Ave is a home located in Cook County with nearby schools including J Covington Elementary School, Hometown Elementary School, and Sward Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2021

Sold by

Rainsford Cosenza Jacqueline and Rainsford Jacqueline Cosenza

Bought by

Gomez Fernando Manuel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,162

Outstanding Balance

$272,717

Interest Rate

2.7%

Mortgage Type

FHA

Estimated Equity

$24,298

Purchase Details

Closed on

Apr 2, 2011

Sold by

Rainsford Jacqueline R

Bought by

Rainsford Cosenza Jacqueline and Jacqueline Rainsford Cosenza Trust

Purchase Details

Closed on

Feb 5, 2003

Sold by

Kahler Mary E

Bought by

Rainsford Jacqueline

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,100

Interest Rate

6.06%

Purchase Details

Closed on

Aug 12, 2002

Sold by

Weber John M and Siegel Doris D

Bought by

Kahler Mary E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

5.25%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gomez Fernando Manuel | $310,000 | Fidelity National Title | |

| Rainsford Cosenza Jacqueline | -- | None Available | |

| Rainsford Jacqueline | $182,500 | Cti | |

| Kahler Mary E | $169,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gomez Fernando Manuel | $300,162 | |

| Previous Owner | Rainsford Jacqueline | $155,100 | |

| Previous Owner | Kahler Mary E | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,163 | $12,001 | $2,188 | $9,813 |

| 2023 | $3,403 | $12,001 | $2,188 | $9,813 |

| 2022 | $3,403 | $8,985 | $1,875 | $7,110 |

| 2021 | $2,711 | $8,984 | $1,875 | $7,109 |

| 2020 | $2,698 | $8,984 | $1,875 | $7,109 |

| 2019 | $2,840 | $9,546 | $1,718 | $7,828 |

| 2018 | $2,731 | $9,546 | $1,718 | $7,828 |

| 2017 | $2,746 | $9,546 | $1,718 | $7,828 |

| 2016 | $2,430 | $7,882 | $1,406 | $6,476 |

| 2015 | $2,381 | $7,882 | $1,406 | $6,476 |

| 2014 | $2,363 | $7,882 | $1,406 | $6,476 |

| 2013 | $2,915 | $10,374 | $1,406 | $8,968 |

Source: Public Records

Map

Nearby Homes

- 9239 S 55th Ct

- 9228 S 55th Ct

- 9429 S 55th Ave

- 9422 Central Ave

- 9209 S 53rd Ct

- 9221 Raymond Ave

- 9420 Massasoit Ave

- 5368 W 96th St Unit 2S

- 5232 Cass St

- 9600 Central Ave

- 9542 Parkside Ave

- 9135 S 53rd Ave

- 9535 S 53rd Ave Unit 3S

- 9624 W Shore Dr

- 5368 Otto Place

- 9439 S 52nd Ave

- 5555 W 90th St

- 9336 Tulley Ave

- 5424 Franklin Ave

- 9704 W Shore Dr

- 9326 S 55th Ave

- 9342 S 55th Ave

- 9320 S 55th Ave

- 9346 S 55th Ave

- 9316 S 55th Ave

- 9350 S 55th Ave

- 9350 S 55th Ave

- 9331 S 55th Ct

- 9331 S 55th Ct

- 9323 S 55th Ct

- 9312 S 55th Ave

- 9335 S 55th Ct

- 9325 S 55th Ct

- 9319 S 55th Ct

- 9325 S 55th Ave

- 9325 S 55th Ave

- 9327 S 55th Ave

- 9339 S 55th Ct

- 9352 S 55th Ave

- 9352 S 55th Ave