9331 Highway 157 Rising Fawn, GA 30738

Durham NeighborhoodEstimated Value: $285,000 - $575,000

4

Beds

3

Baths

2,218

Sq Ft

$179/Sq Ft

Est. Value

About This Home

This home is located at 9331 Highway 157, Rising Fawn, GA 30738 and is currently estimated at $396,671, approximately $178 per square foot. 9331 Highway 157 is a home located in Walker County with nearby schools including Fairyland Elementary School, Chattanooga Valley Middle School, and Ridgeland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 28, 2024

Sold by

Strauss Angela

Bought by

Strauss Bradley Caleb

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,000

Outstanding Balance

$213,440

Interest Rate

7.03%

Mortgage Type

New Conventional

Estimated Equity

$183,231

Purchase Details

Closed on

Mar 28, 2019

Sold by

Lebron Daniel

Bought by

Strauss Gene and Strauss Angela

Purchase Details

Closed on

Jan 8, 2015

Sold by

Daniel Lebron

Bought by

Daniel Lebron and Daniel Karen

Purchase Details

Closed on

Feb 20, 1997

Sold by

Williams James Thomas

Bought by

Daniel Lebron and Daniel Karen

Purchase Details

Closed on

Jan 1, 1972

Bought by

Williams James Thomas

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Strauss Bradley Caleb | $270,000 | -- | |

| Strauss Gene | $90,955 | -- | |

| Daniel Lebron | -- | -- | |

| Daniel Lebron | $27,000 | -- | |

| Williams James Thomas | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Strauss Bradley Caleb | $216,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,421 | $103,885 | $24,898 | $78,987 |

| 2023 | $2,275 | $94,779 | $19,760 | $75,019 |

| 2022 | $1,889 | $71,732 | $9,801 | $61,931 |

| 2021 | $1,896 | $65,085 | $9,801 | $55,284 |

| 2020 | $1,463 | $54,001 | $9,801 | $44,200 |

| 2019 | $1,742 | $56,155 | $9,801 | $46,354 |

| 2018 | $1,484 | $56,078 | $9,724 | $46,354 |

| 2017 | $1,895 | $56,078 | $9,724 | $46,354 |

| 2016 | $1,453 | $56,078 | $9,724 | $46,354 |

| 2015 | $1,361 | $49,257 | $11,272 | $37,985 |

| 2014 | $1,257 | $49,257 | $11,272 | $37,985 |

| 2013 | -- | $49,256 | $11,272 | $37,984 |

Source: Public Records

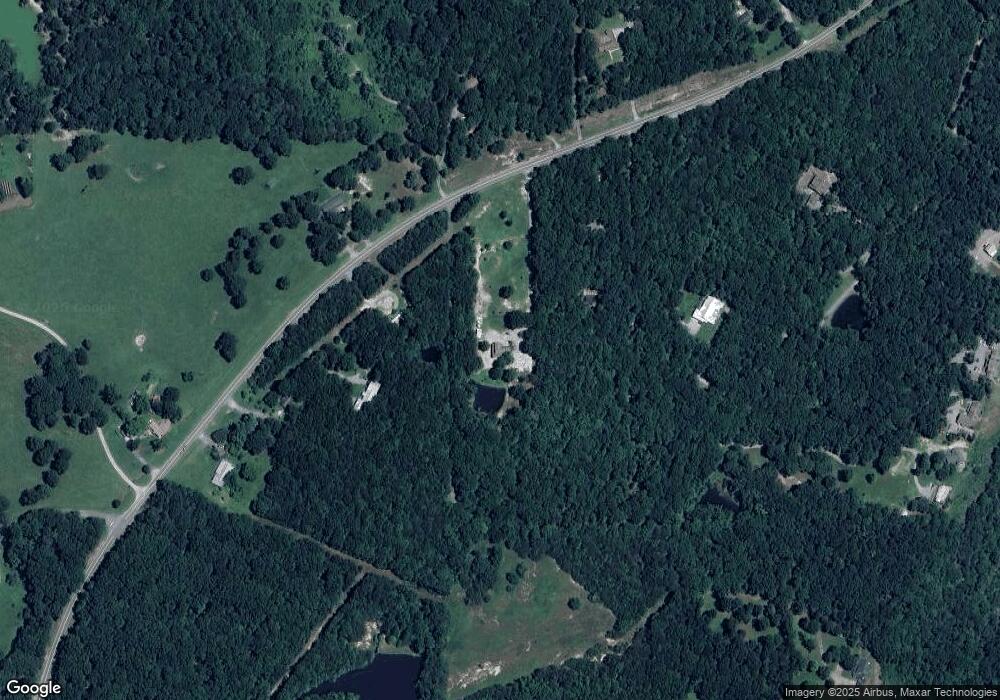

Map

Nearby Homes

- 8515 Highway 157

- 96 Lookout Dr

- 443 Back Valley Rd

- 174 Lookout Dr

- 0 Pebble Dr Unit RTC2899418

- 0 Pebble Dr Unit 1513970

- 9984 Georgia 136

- 382 Plum Nelly Rd

- 0 Old Rocky Trail Unit 130442

- 0 Old Rocky Trail Unit RTC2866646

- 0 Old Rocky Trail Unit 1510719

- 159 Powell Dr

- 1860 Plum Nelly Rd

- 8668 W Highway 136

- 0 Stewart Ln Unit 1521388

- 0 S Shivas Crest Unit 10473535

- 12 Shivas Crest

- 00 Shivas Crest

- 000 Stewart Ln

- 0 Hampton Way Unit 10593499

- 9571 Highway 157

- 9295 Highway 157

- 9693 Highway 157

- 9255 Highway 157

- 9255 Hwy 157

- 9384 Highway 157

- 9608 Highway 157

- 9608 Highway 157

- 9733 Highway 157

- 9733 Georgia 157

- 9278 Highway 157

- 9278 Hwy 157

- 9388 Highway 157

- 9740 Highway 157

- 216 Browhaven Ln

- 9128 Highway 157

- 4 Brow Haven

- 4 Brow Haven Unit A

- 371 Browhaven Ln

- 9385 Highway 157