Estimated Value: $451,481

--

Bed

1

Bath

1,152

Sq Ft

$392/Sq Ft

Est. Value

About This Home

This home is located at 936 Chambers Ct Unit A10, Eagle, CO 81631 and is currently estimated at $451,481, approximately $391 per square foot. 936 Chambers Ct Unit A10 is a home located in Eagle County with nearby schools including Eagle Valley Elementary School, Eagle Valley Middle School, and Eagle Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 8, 2024

Sold by

Bruce W Lammers 2014 Revocable Trust

Bought by

Rocosas High Mountain Living Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$273,000

Outstanding Balance

$219,178

Interest Rate

7.29%

Mortgage Type

New Conventional

Estimated Equity

$232,303

Purchase Details

Closed on

Jan 4, 2024

Sold by

Smith Jeffrey Karl and Egli Roger

Bought by

Chambers Court A10 Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$273,000

Outstanding Balance

$219,178

Interest Rate

7.29%

Mortgage Type

New Conventional

Estimated Equity

$232,303

Purchase Details

Closed on

Oct 6, 2004

Sold by

Smith Jeffrey Karl

Bought by

Smith Jeffrey Karl and Egli Roger

Purchase Details

Closed on

Jul 10, 2003

Sold by

Atkins Robert L and Pensabene Paul V

Bought by

Smith Jeffrey Karl

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,900

Interest Rate

8%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rocosas High Mountain Living Llc | $2,050,000 | Land Title Guarantee | |

| Chambers Court A10 Llc | $390,000 | Land Title Guarantee Company | |

| Smith Jeffrey Karl | -- | Stewart Title | |

| Smith Jeffrey Karl | $150,000 | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chambers Court A10 Llc | $273,000 | |

| Previous Owner | Smith Jeffrey Karl | $149,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,731 | $50,680 | -- | $50,680 |

| 2023 | $2,731 | $50,680 | $0 | $50,680 |

| 2022 | $2,233 | $36,840 | $0 | $36,840 |

| 2021 | $2,234 | $36,840 | $0 | $36,840 |

| 2020 | $2,261 | $37,750 | $0 | $37,750 |

| 2019 | $2,255 | $37,750 | $0 | $37,750 |

| 2018 | $1,350 | $22,210 | $0 | $22,210 |

| 2017 | $1,318 | $22,210 | $0 | $22,210 |

| 2016 | $1,346 | $21,990 | $0 | $21,990 |

| 2015 | -- | $21,990 | $0 | $21,990 |

| 2014 | $1,299 | $22,600 | $0 | $22,600 |

Source: Public Records

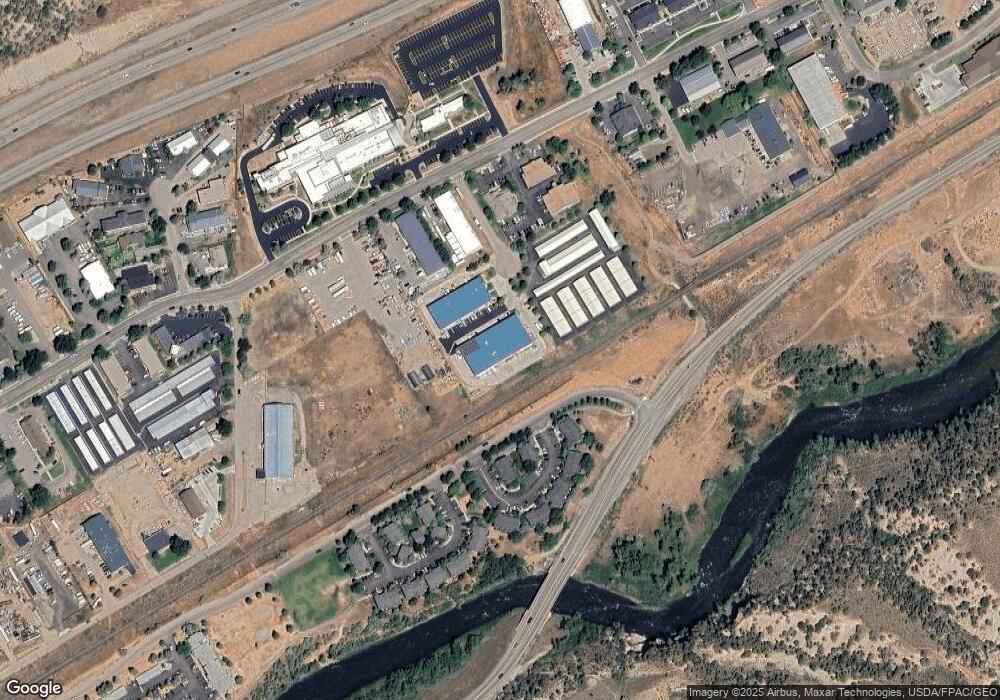

Map

Nearby Homes

- 1120 Chambers Ave Unit 4

- 245 Marmot Ln Unit 1

- 60 Mill Rd Unit J1

- 705 Nogal Rd Unit A8

- 108 Howard St

- 85 Chambers Ave Unit 10

- 378 Blacksmith Rd

- 226 Capitol St

- 236 Capitol St

- 246 Capitol St

- 101 Ping Ln

- 13 Pinion Ln

- 425 Broadway St

- 409 Washington St

- 432 W Fifth St

- 546 Grand Ave

- 001 Street 8

- 510 Brush Creek Terrace Unit G3

- 762 Castle Dr

- 768 Castle Dr

- 936 Chambers Ct Unit A5 and A6

- 936 Chambers Ct Unit A6

- 936 Chambers Ct Unit A5

- 936 Chambers Ct Unit A9

- 936 Chambers Ct Unit A8

- 936 Chambers Ct Unit B2B, B3, and B4

- 936 Chambers Ct Unit B4

- 936 Chambers Ct

- 936 Chambers Ct Unit A7 &A4

- 916 Chambers Ave

- 930 Chambers Ave

- 15 Christian Ct

- 916 Chambers Ave Unit A

- 916 Chambers Ave Unit C

- 916 Chambers Ave

- 17 Christian Ct

- 16 Christian Ct

- 19 Christian Ct

- 894 Chambers Ave Unit 2

- 18 Christian Ct Unit 49