936 W Court St Urbana, OH 43078

Estimated Value: $129,040 - $200,000

2

Beds

1

Bath

864

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 936 W Court St, Urbana, OH 43078 and is currently estimated at $157,510, approximately $182 per square foot. 936 W Court St is a home located in Champaign County with nearby schools including Urbana Elementary School, Urbana High School, and Urbana Community School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 23, 2013

Sold by

Callicoat Clinton and Callicoat Robin

Bought by

Babcock Jonathan L and Roosa Cassandra E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,591

Outstanding Balance

$63,647

Interest Rate

4.38%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$93,863

Purchase Details

Closed on

Apr 4, 2007

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Callicoat Clinton and Callicoat Robin

Purchase Details

Closed on

Jul 12, 2006

Sold by

Burke David B and Burke Pamela S

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Aug 4, 2005

Sold by

Burke Pamela S

Bought by

Burke David B

Purchase Details

Closed on

Jul 5, 1995

Sold by

Lacey Eric R

Bought by

Burke David B and Burke Pamela

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$47,000

Interest Rate

7.9%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Babcock Jonathan L | $82,900 | None Available | |

| Callicoat Clinton | $50,000 | None Available | |

| Federal Home Loan Mortgage Corporation | $46,667 | None Available | |

| Burke David B | -- | -- | |

| Burke David B | $45,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Babcock Jonathan L | $84,591 | |

| Previous Owner | Burke David B | $47,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $968 | $23,020 | $4,010 | $19,010 |

| 2023 | $968 | $23,020 | $4,010 | $19,010 |

| 2022 | $987 | $23,020 | $4,010 | $19,010 |

| 2021 | $957 | $19,770 | $3,200 | $16,570 |

| 2020 | $957 | $19,770 | $3,200 | $16,570 |

| 2019 | $945 | $19,770 | $3,200 | $16,570 |

| 2018 | $819 | $16,350 | $3,130 | $13,220 |

| 2017 | $813 | $16,350 | $3,130 | $13,220 |

| 2016 | $815 | $16,350 | $3,130 | $13,220 |

| 2015 | $816 | $15,880 | $3,130 | $12,750 |

| 2014 | $817 | $15,880 | $3,130 | $12,750 |

| 2013 | $698 | $15,880 | $3,130 | $12,750 |

Source: Public Records

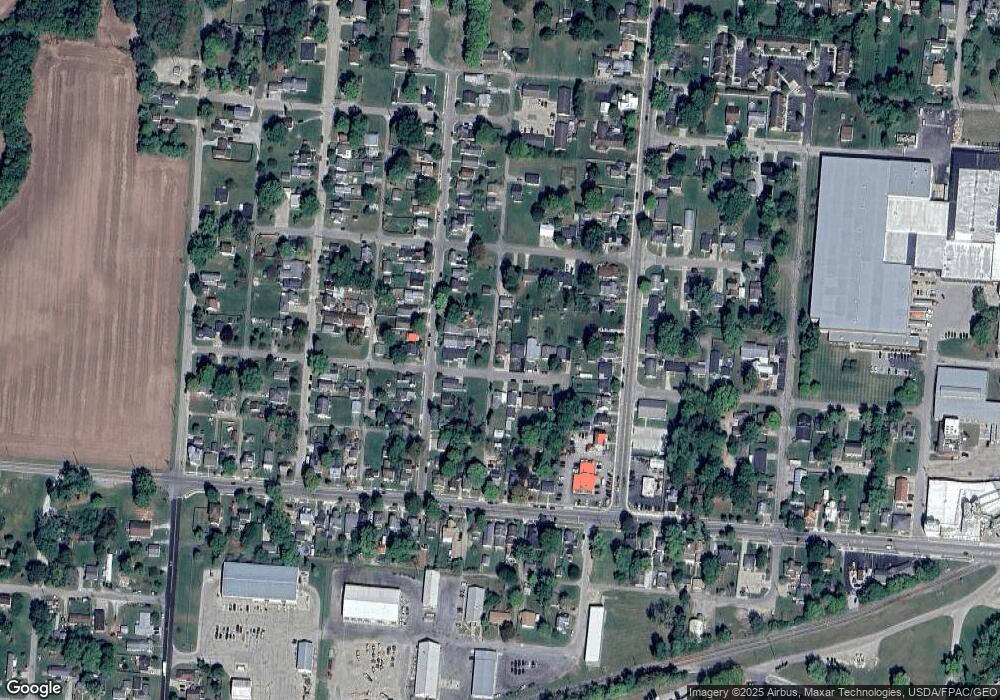

Map

Nearby Homes

- 1123 Miami St

- 728 N Oakland St

- 306 W Court St

- 311 W Church St

- 129 Gwynne St

- 0 Laurel Oak St Unit 225013949

- 0 Laurel Oak St Unit 1038292

- 241 Louden St

- 234 Laurel Oak St

- 242 Laurel Oak St

- 723 N Russell St

- 201 College St

- 119 College St

- 405 S Main St

- 614 S Main St

- 206 Lincoln Place

- 312 E Water St

- 0 S Kenton St Unit 1039146

- 0 S Kenton St Unit 225014751

- 0 S Kenton St Unit 1038404

- 932 W Court St

- 926 W Court St

- 207 Freeman Ave

- 201 Freeman Ave

- 215 Freeman Ave

- 131 Freeman Ave

- 219 Freeman Ave

- 918 W Court St

- 937 W Court St

- 933 W Court St

- 127 Freeman Ave

- 221 Freeman Ave

- 927 W Court St

- 939 W Church St

- 923 W Court St

- 919 W Court St

- 931 W Church St

- 119 Freeman Ave

- 229 Freeman Ave

- 206 N Oakland St