94-1460 Kulewa Loop Unit 2C Waipahu, HI 96797

Estimated Value: $485,481 - $511,000

2

Beds

1

Bath

709

Sq Ft

$709/Sq Ft

Est. Value

About This Home

This home is located at 94-1460 Kulewa Loop Unit 2C, Waipahu, HI 96797 and is currently estimated at $502,370, approximately $708 per square foot. 94-1460 Kulewa Loop Unit 2C is a home located in Honolulu County with nearby schools including Kanoelani Elementary School, Highlands Intermediate School, and Pearl City High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 22, 2010

Sold by

Adriano Phyllis Mitsuyo

Bought by

Adriano Phyllis Mitsuyo and The Phyllis Mitsuyo Adriano Revocable Tr

Current Estimated Value

Purchase Details

Closed on

Jun 3, 2010

Sold by

Segui Mendoza Helen and Mendoza Alfredo Dela Cruz

Bought by

Adriano Phyllis Mitsuyo

Purchase Details

Closed on

Jan 25, 2006

Sold by

Lynch Jerry

Bought by

Segui Mendoza Alfredo Dela Cruz and Segui Mendoza Helen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,000

Interest Rate

6.28%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 25, 2003

Sold by

The Royal Palm Investment Co Llc

Bought by

Lynch Jerry

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Adriano Phyllis Mitsuyo | -- | None Available | |

| Adriano Phyllis Mitsuyo | $267,000 | Fam | |

| Segui Mendoza Alfredo Dela Cruz | $315,000 | None Available | |

| Lynch Jerry | $1,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Segui Mendoza Alfredo Dela Cruz | $252,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,161 | $499,400 | $214,900 | $284,500 |

| 2024 | $1,161 | $491,700 | $222,800 | $268,900 |

| 2023 | $886 | $493,000 | $222,800 | $270,200 |

| 2022 | $1,063 | $443,700 | $214,900 | $228,800 |

| 2021 | $918 | $402,200 | $206,900 | $195,300 |

| 2020 | $866 | $387,500 | $198,900 | $188,600 |

| 2019 | $985 | $401,400 | $250,800 | $150,600 |

| 2018 | $908 | $379,500 | $198,600 | $180,900 |

| 2017 | $718 | $325,000 | $163,000 | $162,000 |

| 2016 | $677 | $313,300 | $152,600 | $160,700 |

| 2015 | $638 | $302,200 | $146,300 | $155,900 |

| 2014 | $873 | $280,000 | $140,000 | $140,000 |

Source: Public Records

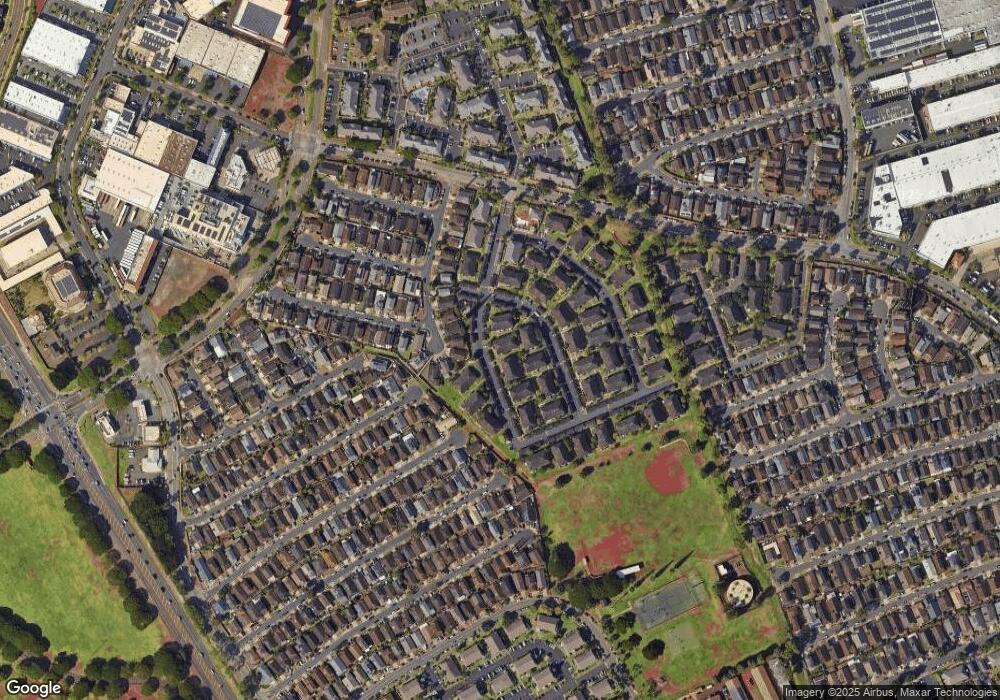

Map

Nearby Homes

- 94-1411 Kulewa Loop Unit 35V

- 94-1405 Polani St Unit 24S

- 94-1391 Polani St Unit 26

- 94-1404 Polani St Unit 29S

- 94-1405 Polani St Unit 24

- 94-1404 Polani St Unit 29

- 94-1340 Kulewa Loop Unit 6C

- 94-1375 Kulewa Loop Unit 13U

- 94-1336 Kulewa Loop Unit 5U

- 94-1394 Kulewa Loop Unit 41

- 94-1364 Kulewa Loop Unit 10

- 94-1359 Kulewa Loop Unit 16

- 94-609 Kawele Place

- 94-1459 Welina Loop Unit 1

- 94-1482 Manao St

- 94-1477 Waipio Uka St Unit G104

- 94-1449 Waipio Uka St Unit K106

- 94-1467 Waipio Uka St Unit T103

- 94-1092 Paawalu St Unit S5

- 94-733 Paaono St Unit G2

- 94-1425 Kulewa Loop Unit 33V

- 94-1412 Kulewa Loop Unit 38V

- 94-1411 Kulewa Loop Unit 35S

- 94-1425 Kulewa Loop Unit 33F

- 94-1412 Kulewa Loop Unit 38A

- 94-1411 Kulewa Loop Unit 35F

- 94-1450 Kulewa Loop Unit 3A

- 94-1450 Kulewa Loop Unit 3B

- 94-1411 Kulewa Loop Unit 35E

- 94-1450 Kulewa Loop Unit 3D

- 94-1411 Kulewa Loop Unit 38C

- 94-1420 Kulewa Loop Unit 37V

- 94-1411 Kulewa Loop Unit 35A

- 94-1431 Kulewa Loop Unit 32R

- 94-1412 Kulewa Loop Unit 38W

- 94-1411 Kulewa Loop Unit 21B

- 94-1419 Kulewa Loop Unit 34A

- 94-1425 Kulewa Loop Unit 33E

- 94-1411 Kulewa Loop Unit 34

- 94-1411 Kulewa Loop