94 Cove Ln Unit 94 East Setauket, NY 11733

Estimated Value: $712,000 - $772,000

2

Beds

3

Baths

1,773

Sq Ft

$414/Sq Ft

Est. Value

About This Home

This home is located at 94 Cove Ln Unit 94, East Setauket, NY 11733 and is currently estimated at $733,827, approximately $413 per square foot. 94 Cove Ln Unit 94 is a home located in Suffolk County with nearby schools including Minnesauke Elementary School, Paul J Gelinas Junior High School, and Ward Melville Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 31, 2023

Sold by

Galasso Michele

Bought by

Michele Galasso Lt and Galasso

Current Estimated Value

Purchase Details

Closed on

Feb 21, 2023

Sold by

Rochard E Kozlowski T E and Rochard Kozlowski

Bought by

Galasso Michel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

6.13%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Feb 18, 2005

Sold by

Setauket Meadows Llc

Bought by

Kozlowsky Richard

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Michele Galasso Lt | -- | None Available | |

| Michele Galasso Lt | -- | None Available | |

| Galasso Michel | -- | None Available | |

| Galasso Michel | -- | Misc Company | |

| Kozlowsky Richard | $419,000 | Paul Killian | |

| Kozlowsky Richard | $419,000 | Paul Killian |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Galasso Michel | $300,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,016 | $1,334 | $200 | $1,134 |

| 2023 | $4,016 | $1,334 | $200 | $1,134 |

| 2022 | $3,340 | $1,334 | $200 | $1,134 |

| 2021 | $3,340 | $1,334 | $200 | $1,134 |

| 2020 | $3,504 | $1,334 | $200 | $1,134 |

| 2019 | $3,504 | $0 | $0 | $0 |

| 2018 | $3,267 | $1,334 | $200 | $1,134 |

| 2017 | $3,267 | $1,334 | $200 | $1,134 |

| 2016 | $3,209 | $1,334 | $200 | $1,134 |

| 2015 | -- | $1,334 | $200 | $1,134 |

| 2014 | -- | $1,334 | $200 | $1,134 |

Source: Public Records

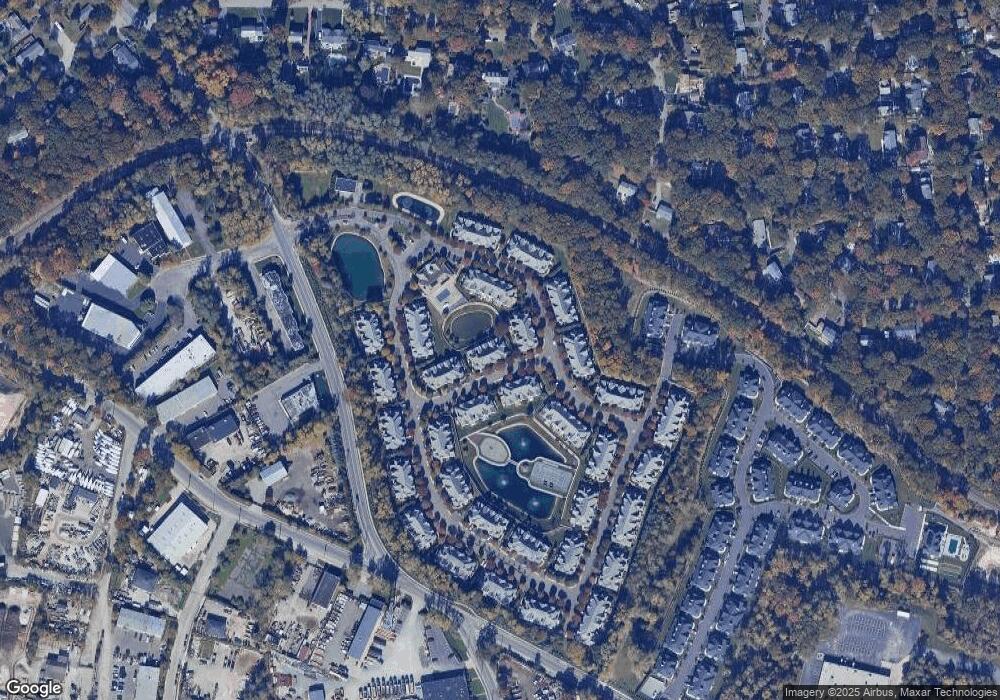

Map

Nearby Homes

- 131 Emilys Way

- 128 Blair Rd

- 106 Lowell Place

- 216 Glenwood Ln

- 101 Wilson Dr

- 9 Hare Ln

- 109 Dogwood Ln

- 121 Foxdale Ln

- 0 Dark Hollow Rd

- 0 Harborview Ave Unit KEY885496

- 118 Brook Rd

- 0 Park Ave

- 318 Sheep Pasture Rd

- 0 Samantha Ln Unit KEY885499

- 105 Willis Ave

- 508 W Broadway

- 2 Little Hill Rd

- 35 Woodchuck Ln

- 127 Barnum Ave

- 19 Pheasant Ln