940 Gardenia Curve Unit 137 Canton, GA 30114

Estimated Value: $366,150 - $386,000

3

Beds

3

Baths

1,888

Sq Ft

$199/Sq Ft

Est. Value

About This Home

This home is located at 940 Gardenia Curve Unit 137, Canton, GA 30114 and is currently estimated at $376,075, approximately $199 per square foot. 940 Gardenia Curve Unit 137 is a home located in Cherokee County with nearby schools including Liberty Elementary School, Freedom Middle School, and Cherokee High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2022

Sold by

Elliott Matthew J

Bought by

Fkh Sfr Propco K Lp

Current Estimated Value

Purchase Details

Closed on

Apr 29, 2020

Sold by

Griswell Joel

Bought by

Elliott Matthew J and Elliott Amanda Rae

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$221,906

Interest Rate

3.75%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 7, 2016

Sold by

Turner Jacob

Bought by

Griswell Joel and Griswell Rachel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$167,200

Interest Rate

3.57%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 15, 2005

Sold by

Bowen Family Homes Inc

Bought by

Turner Jake

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,200

Interest Rate

5.75%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fkh Sfr Propco K Lp | $379,000 | -- | |

| Elliott Matthew J | $226,140 | -- | |

| Griswell Joel | $176,000 | -- | |

| Turner Jake | $156,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Elliott Matthew J | $221,906 | |

| Previous Owner | Elliott Matthew J | $7,910 | |

| Previous Owner | Griswell Joel | $167,200 | |

| Previous Owner | Turner Jake | $125,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,292 | $149,176 | $31,200 | $117,976 |

| 2024 | $3,879 | $135,512 | $27,600 | $107,912 |

| 2023 | $3,818 | $133,372 | $28,400 | $104,972 |

| 2022 | $2,979 | $111,512 | $22,400 | $89,112 |

| 2021 | $2,557 | $87,332 | $19,200 | $68,132 |

| 2020 | $2,250 | $78,912 | $17,200 | $61,712 |

| 2019 | $2,108 | $73,240 | $16,400 | $56,840 |

| 2018 | $1,999 | $68,560 | $14,800 | $53,760 |

| 2017 | $1,560 | $160,100 | $14,000 | $50,040 |

| 2016 | $1,560 | $151,500 | $12,800 | $47,800 |

| 2015 | $1,433 | $138,000 | $10,800 | $44,400 |

| 2014 | $1,608 | $124,800 | $10,800 | $39,120 |

Source: Public Records

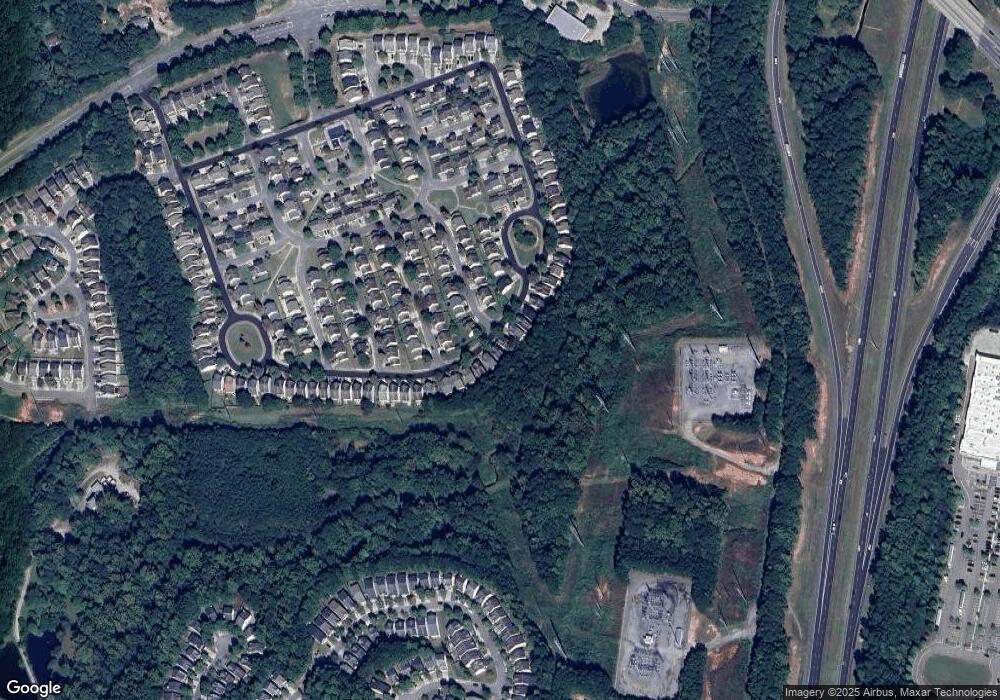

Map

Nearby Homes

- 529 Poplar Bend

- 533 Poplar Bend

- 922 Gardenia Curve

- 808 Inkberry Rd

- 220 Hidden Creek Point

- 116 Spring Way Square

- 137 Nacoochee Way

- 168 Spring Way Square

- 151 Nacoochee Way

- 230 Valley Crossing

- 295 Lori Ln

- 132 Nacoochee Way

- 256 Valley Crossing

- 262 Valley Crossing

- 288 Valley Crossing

- 810 Ash St

- 265 Valley Crossing

- 940 Gardenia Curve

- 938 Gardenia Curve

- 938 Gardenia Curve

- 942 Gardenia Curve

- 936 Gardenia Curve

- 944 Gardenia Curve

- 934 Gardenia Curve

- 200 Quince Rd

- 200 Quince Rd

- 200 Quince Rd Unit 200

- 932 Gardenia Curve

- 948 Gardenia Curve

- 948 Gardenia Curve

- 525 Poplar Bend

- 201 Quince Rd

- 100 Plumeria St

- 930 Gardenia Curve

- 0 Quince Rd Unit 7228112

- 0 Quince Rd Unit 7441190

- 0 Quince Rd Unit 3137480