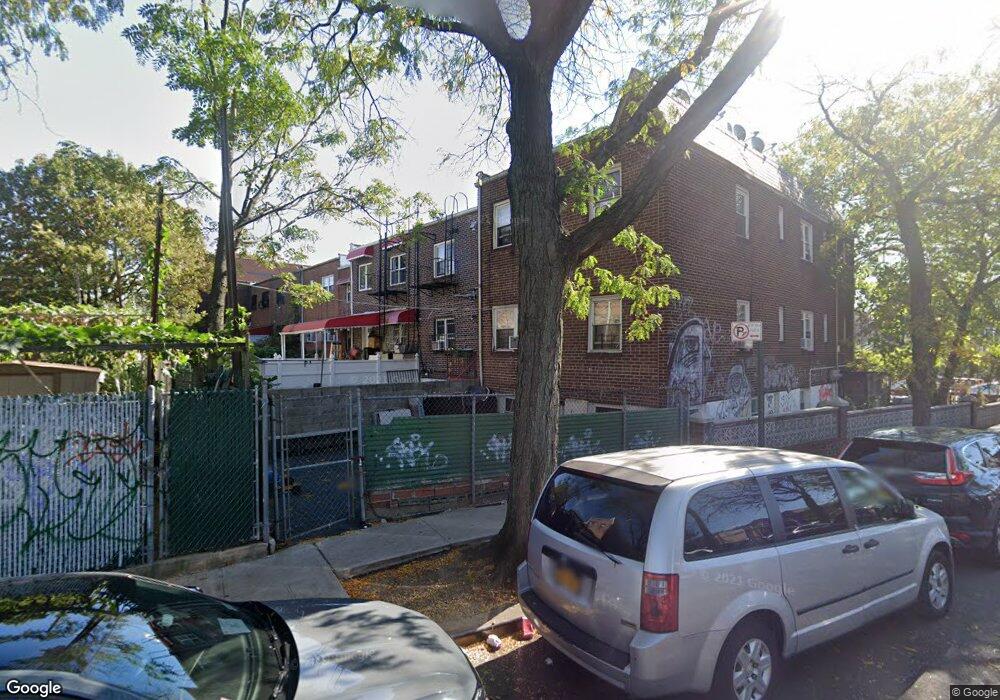

9405 Alstyne Ave Elmhurst, NY 11373

Elmhurst NeighborhoodEstimated Value: $1,333,000 - $1,563,000

--

Bed

--

Bath

2,405

Sq Ft

$599/Sq Ft

Est. Value

About This Home

This home is located at 9405 Alstyne Ave, Elmhurst, NY 11373 and is currently estimated at $1,440,333, approximately $598 per square foot. 9405 Alstyne Ave is a home located in Queens County with nearby schools including P.S. 110, Is 61 Leonardo Da Vinci, and Newtown High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 30, 2007

Sold by

Cordero Secivel and Meza Claudio

Bought by

Meza Claudio

Current Estimated Value

Purchase Details

Closed on

Feb 17, 2005

Sold by

Meza Claudio

Bought by

Cordero Secivel and Meza Claudio

Purchase Details

Closed on

Oct 20, 1999

Sold by

Zombori Nancy

Bought by

Marin Armando

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$265,000

Interest Rate

7.37%

Purchase Details

Closed on

Mar 16, 1998

Sold by

Molestina Ana

Bought by

Zombori Nancy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,500

Interest Rate

7.11%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meza Claudio | -- | -- | |

| Meza Claudio | -- | -- | |

| Cordero Secivel | -- | -- | |

| Cordero Secivel | -- | -- | |

| Marin Armando | $295,000 | Commonwealth Land Title Ins | |

| Marin Armando | $295,000 | Commonwealth Land Title Ins | |

| Zombori Nancy | $230,000 | -- | |

| Zombori Nancy | $230,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Marin Armando | $265,000 | |

| Previous Owner | Zombori Nancy | $172,500 | |

| Closed | Cordero Secivel | $0 | |

| Closed | Meza Claudio | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,577 | $49,766 | $14,792 | $34,974 |

| 2024 | $9,577 | $47,683 | $13,698 | $33,985 |

| 2023 | $9,036 | $44,988 | $11,133 | $33,855 |

| 2022 | $8,981 | $74,700 | $20,580 | $54,120 |

| 2021 | $9,251 | $63,600 | $20,580 | $43,020 |

| 2020 | $8,778 | $64,260 | $20,580 | $43,680 |

| 2019 | $8,312 | $67,500 | $20,580 | $46,920 |

| 2018 | $7,642 | $37,490 | $13,887 | $23,603 |

| 2017 | $7,642 | $37,490 | $15,437 | $22,053 |

| 2016 | $7,323 | $37,490 | $15,437 | $22,053 |

| 2015 | $4,046 | $34,560 | $19,741 | $14,819 |

| 2014 | $4,046 | $33,114 | $18,581 | $14,533 |

Source: Public Records

Map

Nearby Homes

- 94-14 Corona Ave

- 94-61 Alstyne Ave

- 9444 45th Ave

- 93-10 50th Ave

- 91-23 Corona Ave Unit 2B

- 91-23 Corona Ave Unit 6B

- 91-23 Corona Ave Unit 6C

- 91-23 Corona Ave Unit 5E

- 91-23 Corona Ave Unit 4A

- 91-23 Corona Ave Unit 2F

- 91-23 Corona Ave Unit 2A

- 4808 92nd St

- 94-30 50th Ave

- 93-09 43rd Ave

- 9411 43rd Ave Unit 2

- 94-66 45th Ave

- 9468 45th Ave

- 4512 Junction Blvd

- 43-30 Forley St

- 9414 51st Ave

- 9407 Alstyne Ave

- 9403 Alstyne Ave

- 9409 Alstyne Ave

- 94-09 Alstyne Ave

- 9401 Alstyne Ave

- 94-15 Alstyne Ave Unit 2Fl

- 9411 Alstyne Ave

- 94-05 Alstyne Ave

- 9413 Alstyne Ave

- 94-13 Alstyne Ave

- 9402 46th Ave

- 9415 Alstyne Ave

- 9404 46th Ave

- 9406 46th Ave

- 9408 46th Ave

- 9410 46th Ave

- 103 Alstyne Ave

- 9412 46th Ave

- 9401 Corona Ave

- 9414 46th Ave