941 Olde Sterling Way Dayton, OH 45459

Woodbourne-Hyde Park NeighborhoodEstimated Value: $771,000 - $932,000

5

Beds

5

Baths

5,145

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 941 Olde Sterling Way, Dayton, OH 45459 and is currently estimated at $849,102, approximately $165 per square foot. 941 Olde Sterling Way is a home located in Montgomery County with nearby schools including Primary Village North, John Hole Elementary, and Hadley E Watts Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 13, 2015

Sold by

Saxe Jonathan Mark and Saxe Susan J

Bought by

Macke John J and Macke Brooke D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$410,000

Outstanding Balance

$142,047

Interest Rate

2.88%

Mortgage Type

New Conventional

Estimated Equity

$707,055

Purchase Details

Closed on

Feb 23, 2005

Sold by

Saxe Susan J

Bought by

Saxe Jonathan Mark and Saxe Susan J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$462,000

Interest Rate

5.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 10, 2004

Sold by

Saxe Jonathan M and Saxe Susan J

Bought by

Saxe Susan J and The Susan J Saxe Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$464,000

Interest Rate

6.08%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jan 28, 2000

Sold by

Arnold Enterprises Inc

Bought by

Graziano Frank R and Graziano Mary E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$345,000

Interest Rate

7.62%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Macke John J | $516,900 | Home Services Title Llc | |

| Saxe Jonathan Mark | -- | None Available | |

| Saxe Susan J | -- | Midwest Abstract Company | |

| Saxe Jonathan | $580,000 | Midwest Abstract Company | |

| Graziano Frank R | $460,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Macke John J | $410,000 | |

| Previous Owner | Saxe Jonathan Mark | $462,000 | |

| Previous Owner | Saxe Jonathan | $464,000 | |

| Previous Owner | Graziano Frank R | $345,000 | |

| Previous Owner | Graziano Frank R | $75,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $13,287 | $215,970 | $31,500 | $184,470 |

| 2023 | $13,287 | $215,970 | $31,500 | $184,470 |

| 2022 | $16,786 | $215,970 | $31,500 | $184,470 |

| 2021 | $16,832 | $215,970 | $31,500 | $184,470 |

| 2020 | $16,809 | $215,970 | $31,500 | $184,470 |

| 2019 | $14,750 | $169,330 | $31,500 | $137,830 |

| 2018 | $15,780 | $169,330 | $31,500 | $137,830 |

| 2017 | $14,946 | $169,330 | $31,500 | $137,830 |

| 2016 | $15,684 | $167,700 | $31,500 | $136,200 |

| 2015 | $15,337 | $167,700 | $31,500 | $136,200 |

| 2014 | $15,337 | $167,700 | $31,500 | $136,200 |

| 2012 | -- | $168,480 | $38,500 | $129,980 |

Source: Public Records

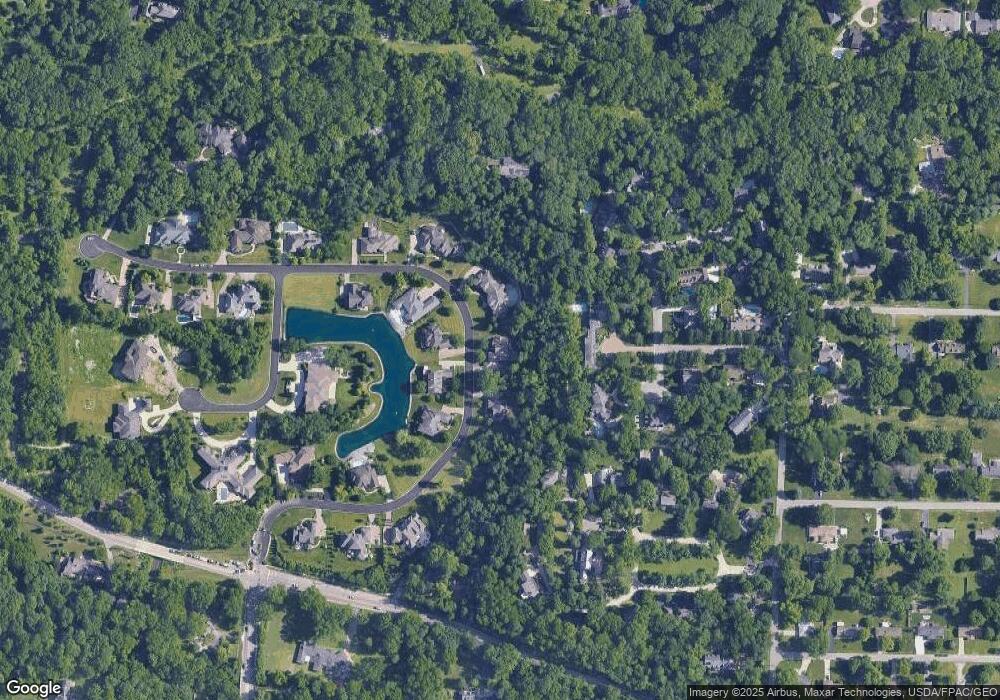

Map

Nearby Homes

- 950 Olde Sterling Way

- 901 Olde Sterling Way

- 6013 Gothic Place

- 6561 Fieldson Rd

- 5920 Mad River Rd

- 427 Meadowview Dr

- 1464 W Alex Bell Rd

- 480 Southbrook Dr

- 1221 Wood Mill Trail

- 6342 Seton Hill St

- 5451 Folkestone Dr

- 4286 Apple Branch Dr

- 6401 Broken Arrow Place

- 1553 Roamont Dr

- 6121 Old Spanish Trail

- 190 Winchcombe Dr

- 6106 Old Spanish Trail

- 7006 Cedar Pines Ct

- 1487 Beaushire Cir

- 341 Cardigan Rd

- 933 Olde Sterling Way

- 938 Olde Sterling Way

- 953 Olde Sterling Way

- 6477 Kings Grant Passage

- 6469 Kings Grant Passage

- 930 Olde Sterling Way

- 825 George Wythe Commons

- 825 George Wythe Commons

- 962 Olde Sterling Way

- 6453 Kings Grant Passage

- 965 Olde Sterling Way

- 819 George Wythe Commons

- 819 George Wythe Commons

- 6478 Kings Grant Passage

- 974 Olde Sterling Way

- 6445 Kings Grant Passage

- 6468 Kings Grant Passage

- 973 Olde Sterling Way

- 6460 Kings Grant Passage

- 912 Olde Sterling Way