9413 Whalers Cove Mentor, OH 44060

Estimated Value: $334,000 - $408,000

3

Beds

2

Baths

2,012

Sq Ft

$185/Sq Ft

Est. Value

About This Home

This home is located at 9413 Whalers Cove, Mentor, OH 44060 and is currently estimated at $373,026, approximately $185 per square foot. 9413 Whalers Cove is a home located in Lake County with nearby schools including Fairfax Elementary School, Memorial Middle School, and Mentor High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 27, 2012

Sold by

Wehner Robert and Wehner Luitgard E

Bought by

Wehner Robert and Wehner Luitgard E

Current Estimated Value

Purchase Details

Closed on

Jul 28, 2009

Sold by

Feliciano Alfredo R and Ramirez Josefa

Bought by

Wehner Robert E and Wehner Luitgard E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,000

Interest Rate

5.43%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 27, 1999

Sold by

Menhart Bertram J and Menhart Polly L

Bought by

Feliciano Alfredo R and Ramirez Josefa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Interest Rate

6.89%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wehner Robert | -- | Enterprise Title Agency Inc | |

| Wehner Robert E | $214,000 | Enterprise Title Agency Inc | |

| Feliciano Alfredo R | $178,900 | Real Estate Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Wehner Robert E | $154,000 | |

| Closed | Feliciano Alfredo R | $152,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $119,910 | $30,850 | $89,060 |

| 2023 | $9,413 | $90,590 | $25,700 | $64,890 |

| 2022 | $3,878 | $90,590 | $25,700 | $64,890 |

| 2021 | $3,870 | $90,590 | $25,700 | $64,890 |

| 2020 | $3,610 | $75,500 | $21,420 | $54,080 |

| 2019 | $3,614 | $75,500 | $21,420 | $54,080 |

| 2018 | $3,591 | $65,010 | $17,830 | $47,180 |

| 2017 | $3,189 | $65,010 | $17,830 | $47,180 |

| 2016 | $3,168 | $65,010 | $17,830 | $47,180 |

| 2015 | $2,818 | $65,010 | $17,830 | $47,180 |

| 2014 | $2,860 | $65,010 | $17,830 | $47,180 |

| 2013 | $2,863 | $65,010 | $17,830 | $47,180 |

Source: Public Records

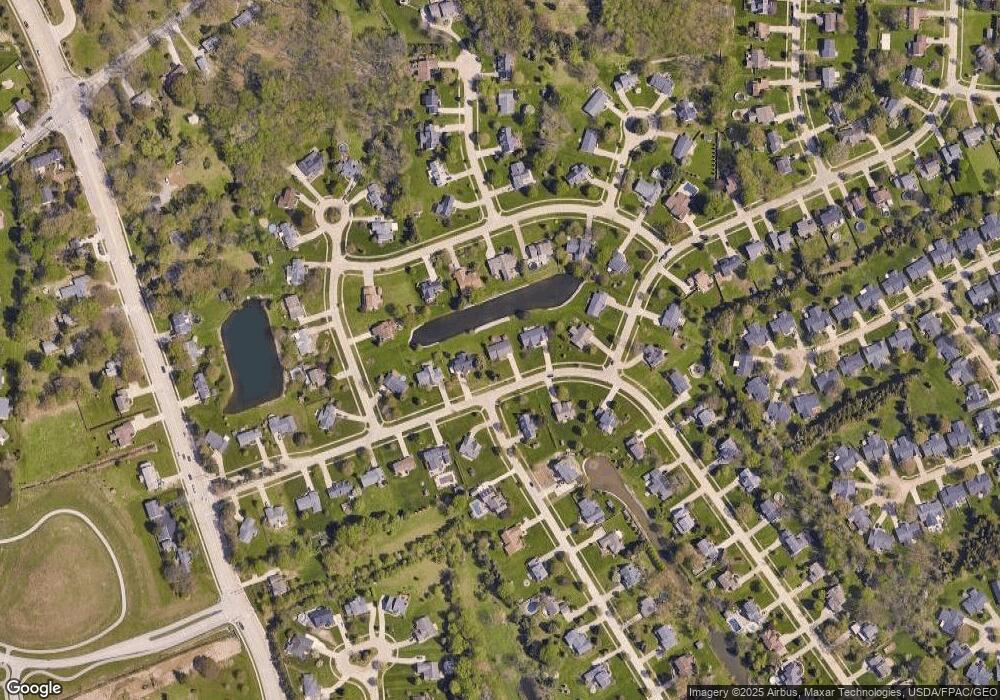

Map

Nearby Homes

- 9211 Sugarbush Dr

- 139 Mill Morr Dr

- 6509 Hudson Ave

- 9279 Jackson St

- 317 Chesapeake Cove Unit 317

- 1936 Mentor Ave

- 110 Hampshire Cove Unit 110

- 6738 Connecticut Colony Cir

- 9681 Abbeyshire Way

- 9025 Jackson St

- 6931 Chairmans Ct

- 146 Garfield Dr

- 135 Nantucket Cir

- 7119 Wayside Dr

- 104 Tulip Ln

- 9005 Jackson St

- 2155 Ridgebury Dr

- 153 N Doan Ave

- 41 Warrington Ln

- 6950 Hopkins Rd

- 9417 Whalers Cove

- 9409 Whalers Cove

- 9438 Freeport Ln

- 9450 Freeport Ln

- 9405 Whalers Cove

- 9426 Freeport Ln

- 9487 Graystone Ln

- 9418 Whalers Cove

- 9456 Freeport Ln

- 9491 Graystone Ln

- 9408 Whalers Cove

- 6675 Harborside Landing

- 9401 Whalers Cove

- 9464 Freeport Ln

- 9404 Whalers Cove

- 9424 Whalers Cove

- 9414 Freeport Ln

- 6646 Ocean Point

- 6713 Rockport Ln

- 9472 Freeport Ln