9415 Crossland Way Highlands Ranch, CO 80130

Eastridge NeighborhoodEstimated Value: $522,290 - $568,000

2

Beds

2

Baths

1,666

Sq Ft

$325/Sq Ft

Est. Value

About This Home

This home is located at 9415 Crossland Way, Highlands Ranch, CO 80130 and is currently estimated at $540,823, approximately $324 per square foot. 9415 Crossland Way is a home located in Douglas County with nearby schools including Fox Creek Elementary School, Cresthill Middle School, and Highlands Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 15, 2011

Sold by

Close Joan

Bought by

Joan Close Trust

Current Estimated Value

Purchase Details

Closed on

Nov 15, 2005

Sold by

Heinsohn Laurene

Bought by

Close Joan R

Purchase Details

Closed on

Jan 3, 2001

Sold by

Albert Eileen S

Bought by

Heinsohn Laurene

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$232,750

Interest Rate

7.55%

Purchase Details

Closed on

Mar 7, 1997

Sold by

Writer Corp

Bought by

Albert Eileen S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,850

Interest Rate

7.65%

Purchase Details

Closed on

Jun 30, 1995

Sold by

Mission Viejo Co

Bought by

Writer Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Joan Close Trust | -- | None Available | |

| Close Joan R | $265,000 | Land Title Guarantee Company | |

| Heinsohn Laurene | $245,000 | -- | |

| Albert Eileen S | $198,402 | Land Title | |

| Writer Corp | $553,700 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Heinsohn Laurene | $232,750 | |

| Previous Owner | Albert Eileen S | $138,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,466 | $36,540 | $6,090 | $30,450 |

| 2023 | $2,461 | $36,540 | $6,090 | $30,450 |

| 2022 | $1,878 | $27,510 | $2,090 | $25,420 |

| 2021 | $1,954 | $27,510 | $2,090 | $25,420 |

| 2020 | $1,896 | $27,600 | $2,060 | $25,540 |

| 2019 | $1,903 | $27,600 | $2,060 | $25,540 |

| 2018 | $1,495 | $23,010 | $1,800 | $21,210 |

| 2017 | $1,361 | $23,010 | $1,800 | $21,210 |

| 2016 | $1,180 | $21,420 | $1,990 | $19,430 |

| 2015 | $1,918 | $21,420 | $1,990 | $19,430 |

| 2014 | $1,835 | $18,920 | $1,990 | $16,930 |

Source: Public Records

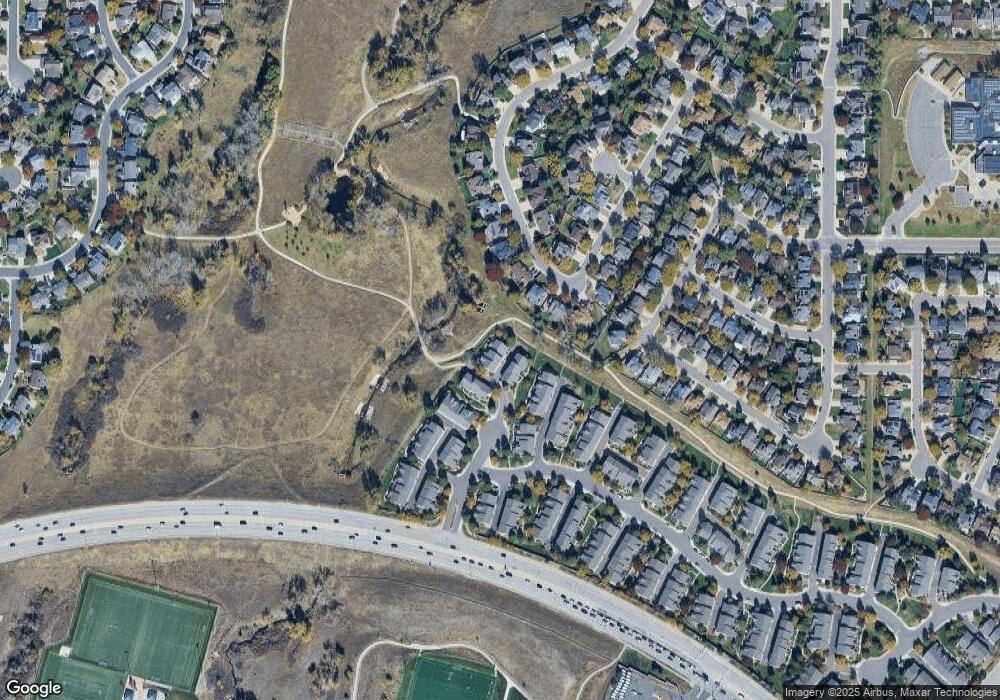

Map

Nearby Homes

- 6374 Harvard Ln

- 6340 Ashburn Ln

- 9522 Silver Spur Ln

- 9368 Harvard Dr

- 6550 Ashburn Ln

- 9390 Yale Ln

- 9222 Buttonhill Ct

- 9471 Burlington Ln

- 6723 Amherst Ct

- 7107 Mountain Brush Cir

- 6616 Millstone St

- 9224 Weeping Willow Place

- 7151 Palisade Dr

- 9571 Cordova Dr

- 9678 Rockhampton Way

- 7066 Newhall Dr

- 9720 Sydney Ln

- 5055 Weeping Willow Cir

- 14 Stonehaven Ct

- 5322 Shetland Ct

- 9417 Crossland Way

- 9419 Crossland Way

- 9411 Crossland Way

- 9407 Crossland Way

- 9425 Crossland Way

- 9423 Crossland Way

- 9427 Crossland Way

- 6021 Trailhead Rd

- 6019 Trailhead Rd

- 9321 Cornell Cir

- 6017 Trailhead Rd

- 9325 Cornell Cir

- 6015 Trailhead Rd

- 9317 Cornell Cir

- 9445 Crossland Way

- 9443 Crossland Way

- 9447 Crossland Way

- 9441 Crossland Way

- 6011 Trailhead Rd

- 6025 Trailhead Rd