9415 Reston Grove Ln Houston, TX 77095

Estimated Value: $398,088 - $417,000

4

Beds

4

Baths

3,089

Sq Ft

$132/Sq Ft

Est. Value

About This Home

This home is located at 9415 Reston Grove Ln, Houston, TX 77095 and is currently estimated at $407,022, approximately $131 per square foot. 9415 Reston Grove Ln is a home located in Harris County with nearby schools including Fiest Elementary School, Labay Middle School, and Cypress Falls High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 28, 2014

Sold by

Parasuram Hemanth and Parasuram Sairoopa

Bought by

Hemanth Parasuram Revocable Trust and Parasuram Sairoopa

Current Estimated Value

Purchase Details

Closed on

May 21, 2013

Sold by

Caine Bobby J and Caine Sandra L

Bought by

Parasuram Hemanth and Parasuram Sairoopa

Purchase Details

Closed on

Oct 30, 2002

Sold by

Brighton Homes Ltd

Bought by

Caine Bobby J and Caine Sandra L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,900

Interest Rate

7.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hemanth Parasuram Revocable Trust | -- | None Available | |

| Parasuram Hemanth | -- | Chicago Title Park Ten | |

| Caine Bobby J | -- | Alamo Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Caine Bobby J | $130,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,210 | $364,157 | $79,194 | $284,963 |

| 2024 | $8,210 | $364,373 | $75,576 | $288,797 |

| 2023 | $8,210 | $396,886 | $75,576 | $321,310 |

| 2022 | $8,574 | $366,694 | $53,868 | $312,826 |

| 2021 | $6,824 | $279,548 | $53,868 | $225,680 |

| 2020 | $6,212 | $247,058 | $44,622 | $202,436 |

| 2019 | $6,352 | $243,781 | $41,004 | $202,777 |

| 2018 | $3,594 | $249,595 | $41,004 | $208,591 |

| 2017 | $6,580 | $249,595 | $41,004 | $208,591 |

| 2016 | $6,580 | $249,595 | $41,004 | $208,591 |

| 2015 | $6,029 | $241,345 | $41,004 | $200,341 |

| 2014 | $6,029 | $220,524 | $41,004 | $179,520 |

Source: Public Records

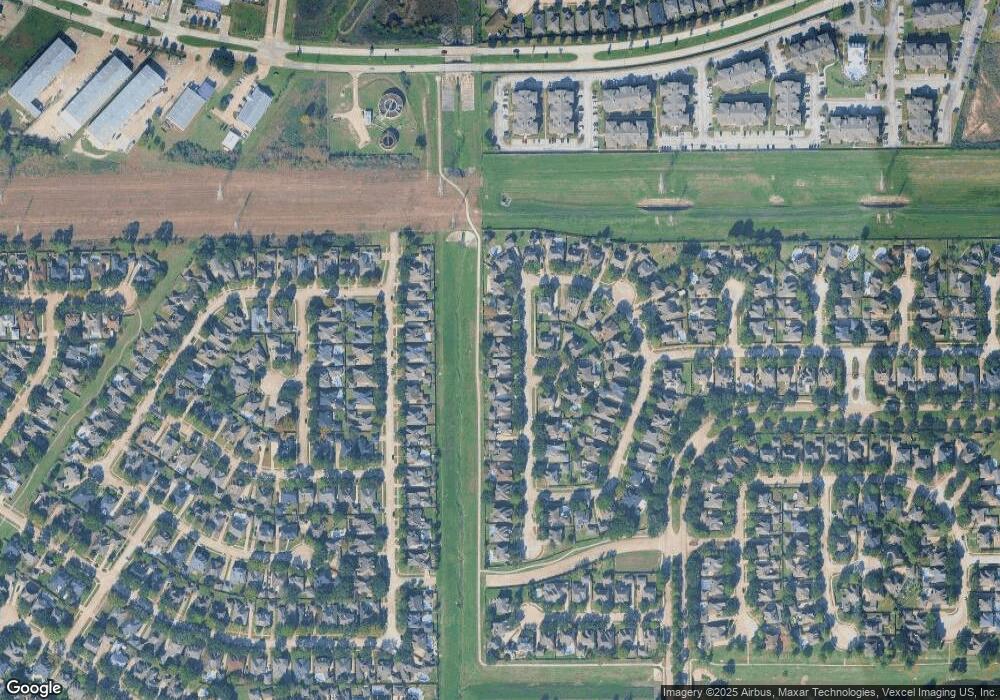

Map

Nearby Homes

- 9303 Reston Grove Ln

- 9111 Sunny Ridge Dr

- 9138 Shango Ln

- 15627 Kentwater Ct

- 15802 Aberdeen Trails Dr

- 15610 Manorford Ct

- 15407 Copper Branch Ln

- 21218 Branchport Dr

- 15610 Tarpon Springs Ct

- 15303 Baber Ct

- 9003 Canton Park Ln

- 15735 Jamie Lee Dr

- 9119 Baber Dr

- 15634 Haleys Landing Ln

- 9111 Baber Dr

- 15906 Marwick Ct

- 9307 Rush Mill Ct

- 21327 Colton Cove Dr

- 9303 Rush Mill Ct

- 15227 Garett Green Cir

- 9419 Reston Grove Ln

- 9411 Reston Grove Ln

- 9407 Reston Grove Ln

- 9423 Reston Grove Ln

- 15610 Reston Grove Ct

- 9403 Reston Grove Ln

- 9435 Hudson Bend Cir

- 9427 Reston Grove Ln

- 15611 Reston Grove Ct

- 15606 Reston Grove Ct

- 9427 Hudson Bend Cir

- 9327 Reston Grove Ln

- 9122 Sunny Ridge Dr

- 9126 Sunny Ridge Dr

- 9118 Sunny Ridge Dr

- 15603 Reston Grove Ct

- 15607 Reston Grove Ct

- 9419 Hudson Bend Cir

- 9114 Sunny Ridge Dr

- 9438 Hudson Bend Cir