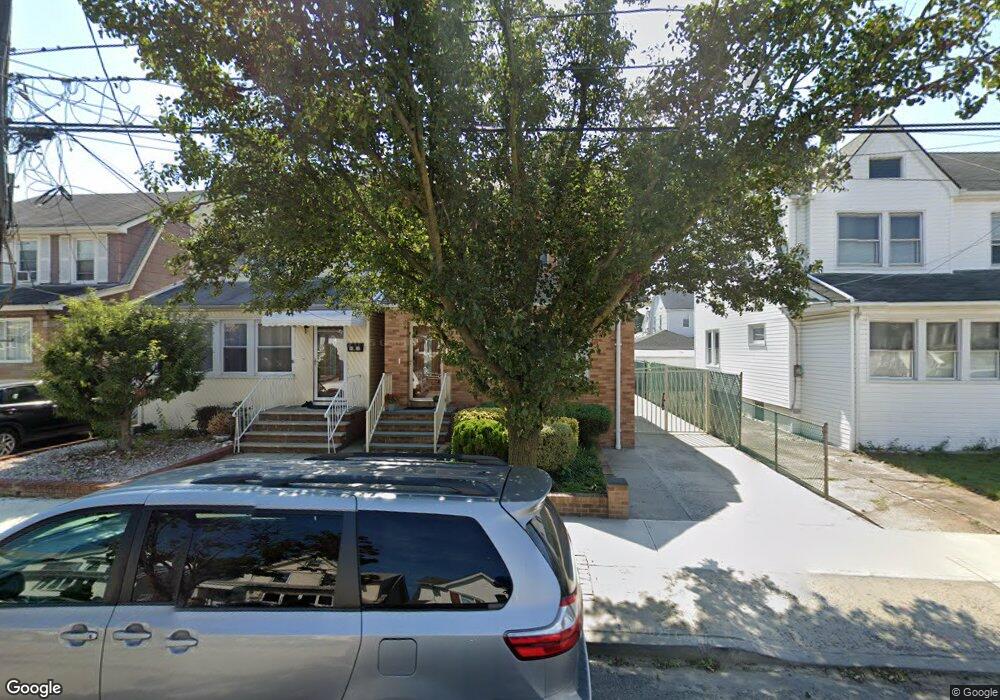

9428 Sutter Ave Ozone Park, NY 11417

Ozone Park NeighborhoodEstimated Value: $737,958 - $894,000

--

Bed

--

Bath

1,354

Sq Ft

$620/Sq Ft

Est. Value

About This Home

This home is located at 9428 Sutter Ave, Ozone Park, NY 11417 and is currently estimated at $838,990, approximately $619 per square foot. 9428 Sutter Ave is a home located in Queens County with nearby schools including P.S. 63 - Old South, Robert H. Goddard High School, and John Adams High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 21, 2018

Sold by

Tokarska-Szczotka Joanna

Bought by

Szczotka Dariusz B and Tokarska Szczotka Joanna

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$6,907

Outstanding Balance

$5,846

Interest Rate

4.15%

Mortgage Type

New Conventional

Estimated Equity

$833,144

Purchase Details

Closed on

Jan 19, 2006

Sold by

Tokarska Joanna

Bought by

Tokarska-Szczotka Joanna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$322,000

Interest Rate

6.32%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 1, 2003

Sold by

Scczotka Dariusz and Szczotka Joanna

Bought by

Tokarska Joanna

Purchase Details

Closed on

Jan 30, 2003

Sold by

Pisaniello Jose

Bought by

Szczotka Dariuse and Szczotka Joanna

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Szczotka Dariusz B | -- | -- | |

| Szczotka Dariusz B | -- | -- | |

| Szczotka Dariusz B | -- | -- | |

| Tokarska-Szczotka Joanna | -- | -- | |

| Tokarska-Szczotka Joanna | -- | -- | |

| Tokarska Joanna | -- | -- | |

| Tokarska Joanna | -- | -- | |

| Szczotka Dariuse | $360,000 | -- | |

| Szczotka Dariuse | $360,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Szczotka Dariusz B | $6,907 | |

| Closed | Szczotka Dariusz B | $6,907 | |

| Previous Owner | Tokarska-Szczotka Joanna | $322,000 | |

| Closed | Szczotka Dariuse | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,077 | $37,345 | $10,317 | $27,028 |

| 2024 | $7,077 | $35,233 | $10,579 | $24,654 |

| 2023 | $6,780 | $33,758 | $9,664 | $24,094 |

| 2022 | $6,358 | $38,580 | $13,260 | $25,320 |

| 2021 | $6,703 | $37,320 | $13,260 | $24,060 |

| 2020 | $6,587 | $36,000 | $13,260 | $22,740 |

| 2019 | $6,051 | $33,600 | $13,260 | $20,340 |

| 2018 | $5,735 | $28,132 | $12,688 | $15,444 |

| 2017 | $5,410 | $26,541 | $11,237 | $15,304 |

| 2016 | $5,306 | $26,541 | $11,237 | $15,304 |

| 2015 | $2,973 | $25,934 | $12,993 | $12,941 |

| 2014 | $2,973 | $24,468 | $12,437 | $12,031 |

Source: Public Records

Map

Nearby Homes

- 9426 Sutter Ave

- 107-62 93rd St

- 9439 134th Ave

- 10723 96th St

- 10719 96th St

- 13319 Crossbay Blvd

- 9108 Sutter Ave

- 106-38 95th St

- 96-06 134th Rd

- 107-20 92nd St

- 91-25 Gold Rd

- 95-18 Linden Blvd

- 132-01 100th St

- 13408 Sitka St

- 10010 133rd Ave

- 13421 Hawtree St

- 107-50 90th St

- 10751 89th St

- 84-07 Sutter Ave

- 92-18 Liberty Ave

- 94-30 Sutter Ave

- 9430 Sutter Ave

- 9432 Sutter Ave

- 9424 Sutter Ave

- 9436 Sutter Ave

- 9420 Sutter Ave

- 9431 Plattwood Ave

- 9427 Plattwood Ave

- 9435 Plattwood Ave

- 9423 Plattwood Ave

- 9438 Sutter Ave

- 9438 Sutter Ave

- 9421 Plattwood Ave

- 9439 Plattwood Ave

- 9419 Plattwood Ave

- 94-19 Plattwood Ave

- 9442 Sutter Ave

- 9443 Plattwood Ave

- 9431 Sutter Ave

- 9435 Sutter Ave