9458 Palm Island Cir Unit 1 North Fort Myers, FL 33903

Hancock NeighborhoodEstimated Value: $330,000 - $407,000

3

Beds

2

Baths

2,906

Sq Ft

$131/Sq Ft

Est. Value

About This Home

This home is located at 9458 Palm Island Cir Unit 1, North Fort Myers, FL 33903 and is currently estimated at $381,814, approximately $131 per square foot. 9458 Palm Island Cir Unit 1 is a home located in Lee County with nearby schools including Tropic Isles Elementary School, Hancock Creek Elementary School, and Caloosa Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 13, 2021

Sold by

Davis David M and Davis Anne Marie

Bought by

Davis David M and Davis Anne Marie

Current Estimated Value

Purchase Details

Closed on

May 18, 2004

Sold by

Alumbaugh Donald E and Alumbaugh Joyce I

Bought by

Davis David M and Davis Ann Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,000

Interest Rate

5.88%

Mortgage Type

Unknown

Purchase Details

Closed on

Mar 15, 1999

Sold by

Rheault Cy and Rheault Rollande

Bought by

Alumbaugh Donald E and Alumbaugh Joyce I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

6.74%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davis David M | -- | Accommodation | |

| Davis David M | $268,000 | Fidelity National Title Insu | |

| Alumbaugh Donald E | $150,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Davis David M | $212,000 | |

| Previous Owner | Alumbaugh Donald E | $120,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,665 | $374,992 | $73,281 | $242,317 |

| 2024 | $5,232 | $364,678 | $64,351 | $238,079 |

| 2023 | $5,232 | $332,892 | $50,249 | $244,393 |

| 2022 | $5,110 | $322,439 | $59,894 | $262,545 |

| 2021 | $3,926 | $238,987 | $57,656 | $181,331 |

| 2020 | $3,758 | $222,877 | $50,000 | $172,877 |

| 2019 | $4,276 | $254,374 | $60,000 | $194,374 |

| 2018 | $4,441 | $267,276 | $60,000 | $207,276 |

| 2017 | $4,186 | $247,907 | $60,000 | $187,907 |

| 2016 | $3,701 | $229,186 | $66,599 | $162,587 |

| 2015 | $3,384 | $196,402 | $38,898 | $157,504 |

| 2014 | $3,112 | $180,203 | $38,413 | $141,790 |

| 2013 | -- | $180,805 | $33,435 | $147,370 |

Source: Public Records

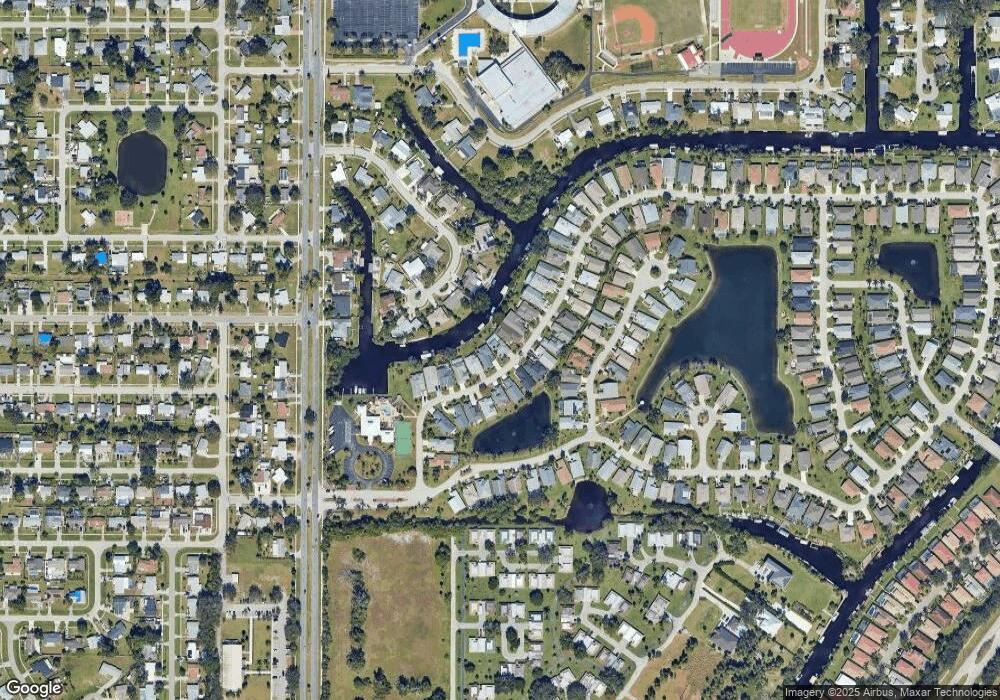

Map

Nearby Homes

- 9439 Palm Island Cir

- 13421 Wild Cotton Ct

- 13460 Wild Cotton Ct

- 4930 Orange Grove Blvd

- 857 Pangola Dr

- 938 Tropical Palm Ave

- 897 Iris Dr

- 13317 Queen Palm Run

- 9346 Palm Island Cir

- 13358 Queen Palm Run

- 13362 Queen Palm Run

- 927 Coconut Dr

- 992 Tropical Palm Ave

- 1429 Tropic Terrace

- 1409 Tropic Terrace

- 1407 Tropic Terrace

- 950 Lakeview Dr

- 1418 Tropic Terrace

- 1003 Tropic Terrace

- 1010 Tropic Terrace

- 9452 Palm Island Cir

- 9464 Palm Island Cir

- 9448 Palm Island Cir

- 9470 Palm Island Cir

- 9474 Palm Island Cir

- 9459 Palm Island Cir

- 9455 Palm Island Cir

- 9442 Palm Island Cir

- 9463 Palm Island Cir

- 9451 Palm Island Cir

- 9447 Palm Island Cir

- 794 Hydrangea Dr

- 9478 Palm Island Cir

- 9471 Palm Island Cir

- 790 Hydrangea Dr

- 9438 Palm Island Cir

- 9443 Palm Island Cir

- 9475 Palm Island Cir

- 800 Hydrangea Dr

- 9482 Palm Island Cir