95 Corrinne St Danielson, CT 06239

Estimated Value: $332,000 - $368,886

2

Beds

3

Baths

1,554

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 95 Corrinne St, Danielson, CT 06239 and is currently estimated at $351,722, approximately $226 per square foot. 95 Corrinne St is a home located in Windham County with nearby schools including Killingly Central School, Killingly Memorial School, and Killingly Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 4, 2020

Sold by

Rivers Kelly

Bought by

Mineau Paula M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$184,203

Outstanding Balance

$163,446

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$188,276

Purchase Details

Closed on

Dec 30, 2014

Sold by

Polanski John B

Bought by

Rivers Kelly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,000

Interest Rate

4.02%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mineau Paula M | $189,900 | None Available | |

| Mineau Paula M | $189,900 | None Available | |

| Rivers Kelly | $130,000 | -- | |

| Rivers Kelly | $130,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mineau Paula M | $184,203 | |

| Closed | Mineau Paula M | $184,203 | |

| Previous Owner | Rivers Kelly | $130,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,942 | $197,300 | $29,850 | $167,450 |

| 2024 | $4,718 | $197,300 | $29,850 | $167,450 |

| 2023 | $4,177 | $130,160 | $24,780 | $105,380 |

| 2022 | $3,930 | $130,160 | $24,780 | $105,380 |

| 2021 | $3,939 | $130,480 | $27,230 | $103,250 |

| 2020 | $3,801 | $128,030 | $24,780 | $103,250 |

| 2019 | $3,916 | $130,480 | $27,230 | $103,250 |

| 2017 | $3,326 | $103,110 | $17,640 | $85,470 |

| 2016 | $3,326 | $103,110 | $17,640 | $85,470 |

| 2015 | $3,259 | $103,110 | $17,640 | $85,470 |

| 2014 | $3,182 | $103,110 | $17,640 | $85,470 |

Source: Public Records

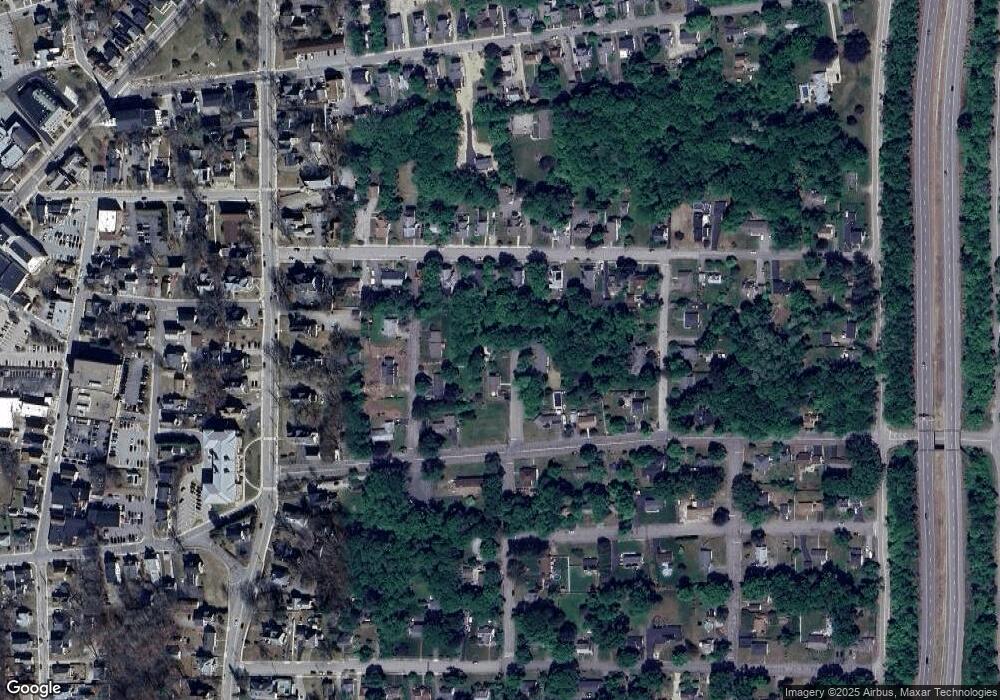

Map

Nearby Homes

- 102 Cottage St

- 24 Center St

- 72 Main St

- 513 Lhomme Street Extension

- 94 Mechanic St

- 110 Franklin St

- 409 Main St

- 51 Maple St

- 37 Katherine Ave

- 133 Maple St

- 69 Peckham Ln

- 144 Prospect Ave

- 58 Athol St Unit 58

- 78 Athol St

- 16 James St

- 48 Athol St Unit 48

- 65 Stone St

- 69 Wauregan Rd

- 405 South St

- 64 Westcott Rd