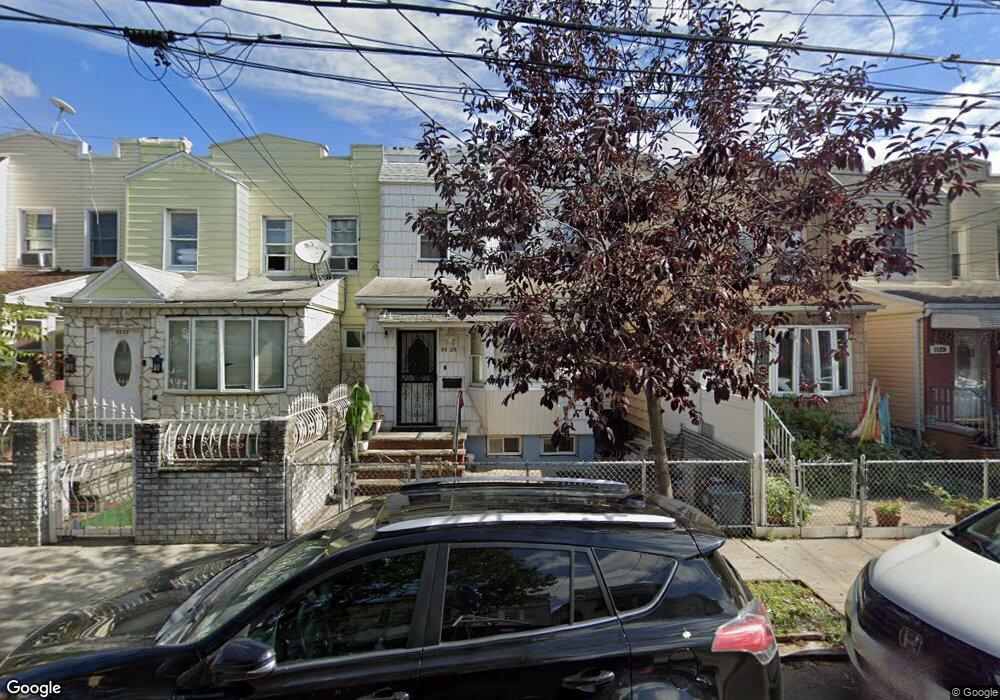

9523 78th St Ozone Park, NY 11416

Ozone Park NeighborhoodEstimated Value: $628,759 - $719,000

--

Bed

--

Bath

1,152

Sq Ft

$591/Sq Ft

Est. Value

About This Home

This home is located at 9523 78th St, Ozone Park, NY 11416 and is currently estimated at $680,940, approximately $591 per square foot. 9523 78th St is a home located in Queens County with nearby schools including P.S. 64 - Joseph P. Addabbo, Santiam Elementary School, and Jhs 210 Elizabeth Blackwell.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 17, 2007

Sold by

Ismael Julio B

Bought by

Barba Wladimir

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$418,500

Outstanding Balance

$262,075

Interest Rate

6.27%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$418,865

Purchase Details

Closed on

Nov 17, 1999

Sold by

Deacevedo Blanca B

Bought by

Barona Julio Ismael

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$174,000

Interest Rate

7.81%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barba Wladimir | $465,000 | -- | |

| Barba Wladimir | $465,000 | -- | |

| Barona Julio Ismael | $180,000 | Commonwealth Land Title Ins | |

| Barona Julio Ismael | $180,000 | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Barba Wladimir | $418,500 | |

| Closed | Barba Wladimir | $418,500 | |

| Previous Owner | Barona Julio Ismael | $174,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,814 | $26,873 | $8,376 | $18,497 |

| 2024 | $4,826 | $25,367 | $9,382 | $15,985 |

| 2023 | $4,734 | $24,970 | $8,147 | $16,823 |

| 2022 | $4,519 | $34,260 | $12,960 | $21,300 |

| 2021 | $4,695 | $36,060 | $12,960 | $23,100 |

| 2020 | $4,444 | $31,020 | $12,960 | $18,060 |

| 2019 | $4,129 | $27,480 | $12,960 | $14,520 |

| 2018 | $3,944 | $20,808 | $8,401 | $12,407 |

| 2017 | $3,790 | $20,062 | $9,962 | $10,100 |

| 2016 | $3,641 | $20,062 | $9,962 | $10,100 |

| 2015 | $2,063 | $18,662 | $11,543 | $7,119 |

| 2014 | $2,063 | $17,616 | $12,184 | $5,432 |

Source: Public Records

Map

Nearby Homes