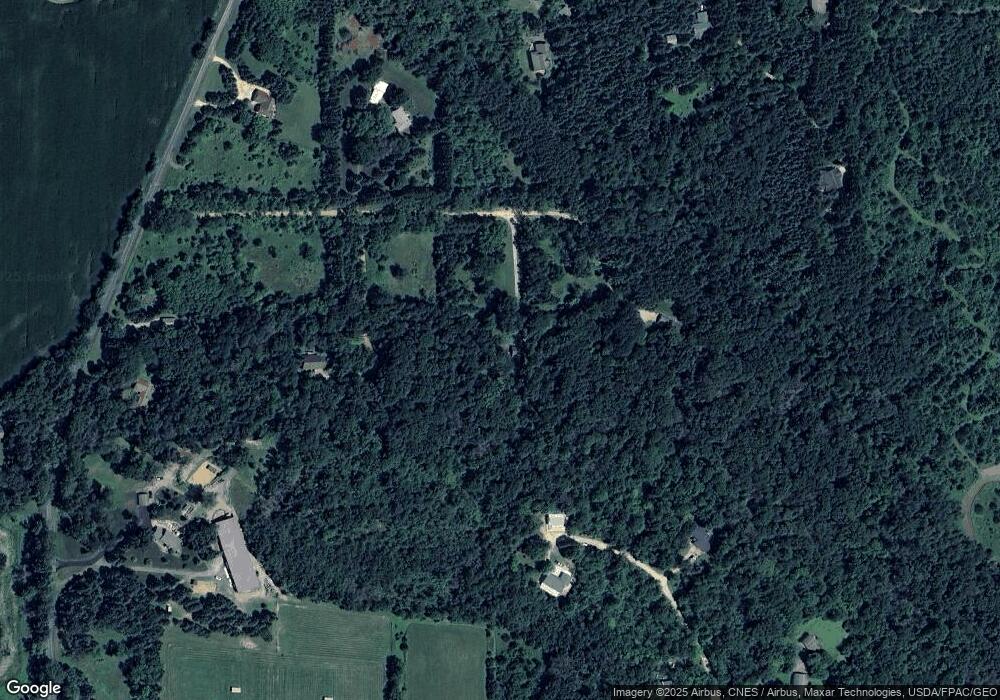

957 104th Ave Roberts, WI 54023

Warren NeighborhoodEstimated Value: $439,000 - $490,635

3

Beds

2

Baths

2,016

Sq Ft

$232/Sq Ft

Est. Value

About This Home

This home is located at 957 104th Ave, Roberts, WI 54023 and is currently estimated at $467,409, approximately $231 per square foot. 957 104th Ave is a home located in St. Croix County with nearby schools including Saint Croix Central Elementary School, Saint Croix Central Middle School, and St. Croix Central High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 10, 2022

Sold by

Adolphson Brad J and Adolphson Jennifer

Bought by

Warzenski Dylan Joseph

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$313,200

Outstanding Balance

$299,881

Interest Rate

5.7%

Mortgage Type

New Conventional

Estimated Equity

$167,528

Purchase Details

Closed on

Sep 28, 2005

Sold by

Hunt Beatrice M

Bought by

Adolphson Brad J and Hutchens Jennifer

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$186,912

Interest Rate

5.83%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Warzenski Dylan Joseph | $391,500 | Results Title | |

| Adolphson Brad J | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Warzenski Dylan Joseph | $313,200 | |

| Previous Owner | Adolphson Brad J | $186,912 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $47 | $436,200 | $157,800 | $278,400 |

| 2023 | $4,091 | $259,900 | $97,100 | $162,800 |

| 2022 | $3,774 | $259,900 | $97,100 | $162,800 |

| 2021 | $3,847 | $259,900 | $97,100 | $162,800 |

| 2020 | $3,685 | $259,900 | $97,100 | $162,800 |

| 2019 | $3,503 | $259,900 | $97,100 | $162,800 |

| 2018 | $3,498 | $259,900 | $97,100 | $162,800 |

| 2017 | $3,703 | $193,900 | $63,100 | $130,800 |

| 2016 | $3,703 | $193,900 | $63,100 | $130,800 |

| 2015 | $3,298 | $193,900 | $63,100 | $130,800 |

| 2014 | $3,276 | $193,900 | $63,100 | $130,800 |

| 2013 | $3,125 | $193,900 | $63,100 | $130,800 |

Source: Public Records

Map

Nearby Homes

- 902 Crane Hill Trail

- 1006 Moon Glow Rd

- 1002 Moon Glow Rd

- 987 Moon Glow Rd

- 1009 Moon Glow Rd

- 1069 Hunter Ridge

- 882 Yellowstone Trail

- 880 110th St

- 1031 Labarge Rd

- 725 Packer Dr

- 827 Badlands Rd

- 966 Florence Ln

- 870 Bradley Dr

- 877 Highlander Trail

- 1224 US Highway 12

- 753 Regal Ridge

- 1193 121st St

- TBD 119th Ave

- 247 Eagle Ridge Dr

- 200 N Vine St