957 Eagle Run Dr Dayton, OH 45458

Estimated Value: $543,000 - $654,000

3

Beds

3

Baths

3,077

Sq Ft

$199/Sq Ft

Est. Value

About This Home

This home is located at 957 Eagle Run Dr, Dayton, OH 45458 and is currently estimated at $611,292, approximately $198 per square foot. 957 Eagle Run Dr is a home located in Montgomery County with nearby schools including Primary Village South, Normandy Elementary School, and Hadley E Watts Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 31, 2021

Sold by

Ninlawong Amy and Gillen Kyle

Bought by

James William K and James Rita A

Current Estimated Value

Purchase Details

Closed on

Oct 11, 2017

Sold by

Geitner Frederick and Geitner Augetine

Bought by

Ninlawong Amy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,000

Interest Rate

3.78%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 13, 2004

Sold by

R A Rhoads Inc

Bought by

Geitner Frederick and Geitner Angeline

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$178,472

Interest Rate

4.87%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| James William K | $475,000 | Landmark Ttl Agcy South Inc | |

| Ninlawong Amy | $365,000 | Fidelity Lawyers Title Agenc | |

| Geitner Frederick | $378,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ninlawong Amy | $292,000 | |

| Previous Owner | Geitner Frederick | $178,472 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,305 | $184,680 | $40,430 | $144,250 |

| 2024 | $11,301 | $184,680 | $40,430 | $144,250 |

| 2023 | $11,301 | $184,680 | $40,430 | $144,250 |

| 2022 | $10,265 | $131,910 | $28,880 | $103,030 |

| 2021 | $10,291 | $131,910 | $28,880 | $103,030 |

| 2020 | $10,282 | $131,910 | $28,880 | $103,030 |

| 2019 | $10,104 | $115,610 | $26,250 | $89,360 |

| 2018 | $9,024 | $115,610 | $26,250 | $89,360 |

| 2017 | $8,279 | $115,610 | $26,250 | $89,360 |

| 2016 | $8,563 | $113,340 | $26,250 | $87,090 |

| 2015 | $8,481 | $113,340 | $26,250 | $87,090 |

| 2014 | $8,481 | $113,340 | $26,250 | $87,090 |

| 2012 | -- | $118,560 | $35,000 | $83,560 |

Source: Public Records

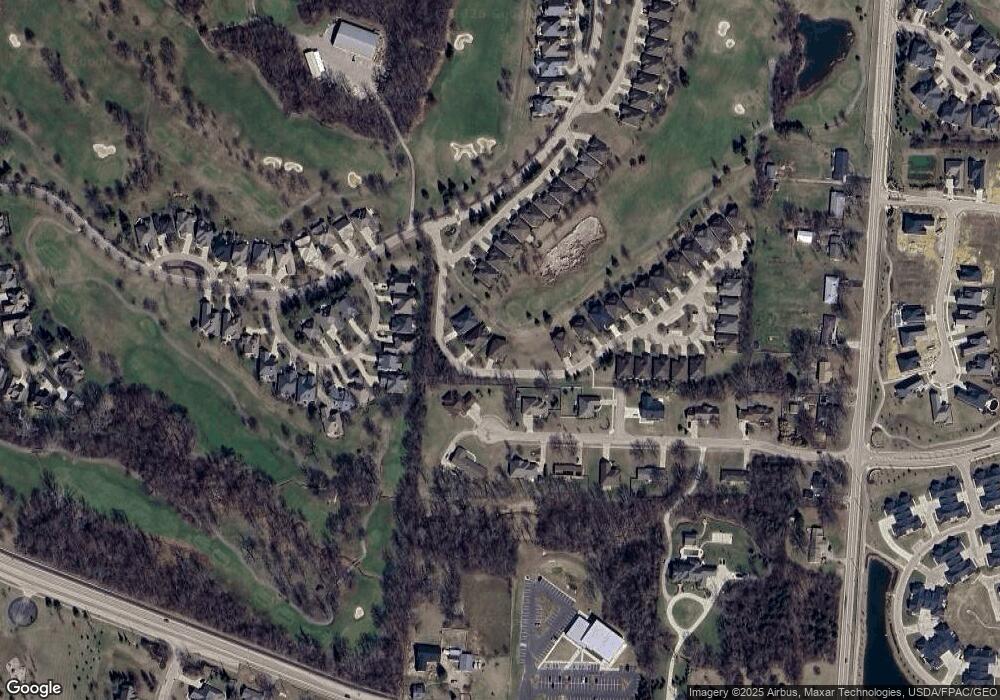

Map

Nearby Homes

- 1384 Courtyard Place

- 10500 Wallingsford Cir

- 10600 Chestnut Hill Ln

- 1174 Club View Dr

- 475 Legendary Way

- 9881 Rose Arbor Dr

- 812 Hidden Branches Dr

- 669 Carrick Dr

- 1023 Mckinney Ln

- 1557 Ashbury Woods Dr

- 9550 Paragon Rd

- 9823 Scotch Pine Dr

- 1629 Glade Valley Dr Unit 88

- 575 Carrick Dr

- 434 Hines Cir

- 10126 Kindle Dr

- 1620 Glade Valley Dr

- 348 Beck Dr

- 543 Hines Cir

- 1701 Glade Valley Dr

- 981 Eagle Run Dr

- 921 El Kenna Ct

- 933 Eagle Run Dr

- 905 El Kenna Ct

- 10309 Belleterrace Place

- 921 Eagle Run Dr

- 10297 Belleterrace Place

- 1032 Greenskeeper Way

- 1040 Greenskeeper Way

- 10285 Belleterrace Place

- 1024 Greenskeeper Way

- 1048 Greenskeeper Way

- 909 Eagle Run Dr

- 10333 Commander Trail

- 1056 Greenskeeper Way

- 10273 Belleterrace Place

- 920 El Kenna Ct

- 897 Eagle Run Dr

- 908 Eagle Run Dr

- 10261 Belleterrace Place

Your Personal Tour Guide

Ask me questions while you tour the home.