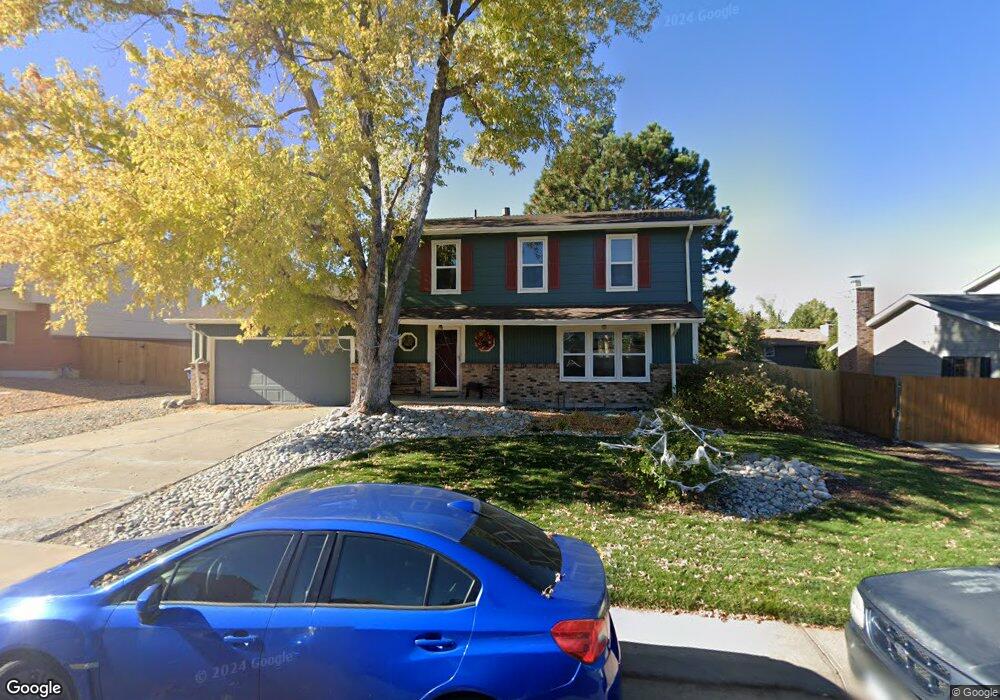

959 Mercury Cir Lone Tree, CO 80124

Estimated Value: $622,999 - $638,000

4

Beds

3

Baths

2,193

Sq Ft

$288/Sq Ft

Est. Value

About This Home

This home is located at 959 Mercury Cir, Lone Tree, CO 80124 and is currently estimated at $630,500, approximately $287 per square foot. 959 Mercury Cir is a home located in Douglas County with nearby schools including Acres Green Elementary School, Cresthill Middle School, and Highlands Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 25, 2006

Sold by

Northcut Eric J and Northcut Melonnie L

Bought by

Rose Darin and Rose Angela R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$223,920

Outstanding Balance

$133,986

Interest Rate

6.51%

Mortgage Type

Unknown

Estimated Equity

$496,514

Purchase Details

Closed on

Jan 15, 2004

Sold by

Ward David A and Ward Deetta L

Bought by

Northcut Eric J and Northcut Melonnie L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$184,600

Interest Rate

3.4%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 10, 1982

Sold by

Hatch Rex J and Hatch Bebe Joy

Bought by

Ward David A and Ward Deetta L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rose Darin | $279,900 | None Available | |

| Northcut Eric J | $233,000 | First American Heritage Titl | |

| Ward David A | $106,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rose Darin | $223,920 | |

| Previous Owner | Northcut Eric J | $184,600 | |

| Closed | Northcut Eric J | $25,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,689 | $43,890 | $7,930 | $35,960 |

| 2023 | $3,727 | $43,890 | $7,930 | $35,960 |

| 2022 | $2,771 | $31,120 | $6,730 | $24,390 |

| 2021 | $2,882 | $31,120 | $6,730 | $24,390 |

| 2020 | $2,793 | $30,900 | $6,350 | $24,550 |

| 2019 | $2,802 | $30,900 | $6,350 | $24,550 |

| 2018 | $2,224 | $26,270 | $5,530 | $20,740 |

| 2017 | $2,261 | $26,270 | $5,530 | $20,740 |

| 2016 | $2,062 | $23,470 | $3,890 | $19,580 |

| 2015 | $2,109 | $23,470 | $3,890 | $19,580 |

| 2014 | $1,933 | $20,140 | $3,980 | $16,160 |

Source: Public Records

Map

Nearby Homes

- 789 Hamal Dr

- 13117 Deneb Dr

- 13134 Deneb Dr

- 802 Altair Dr

- 8159 Lodgepole Trail

- 9275 Erminedale Dr

- 7057 Chestnut Hill St

- 7041 Chestnut Hill Trail

- 9412 La Quinta Way

- 6887 Chestnut Hill St

- 9308 Miles Dr Unit 5

- 13483 Achilles Dr

- 181 Dianna Dr

- 13542 Achilles Dr

- 130 Dianna Dr

- 108 Olympus Cir

- 7469 La Quinta Place

- 8860 Kachina Way

- 8822 Fiesta Terrace

- 9390 Yale Ln

- 965 Mercury Cir

- 955 Mercury Cir

- 13164 Peacock Dr

- 13174 Peacock Dr

- 13154 Peacock Dr

- 958 Mercury Cir

- 949 Mercury Cir

- 969 Mercury Cir

- 954 Mercury Cir

- 964 Mercury Cir

- 13184 Peacock Dr

- 13144 Peacock Dr

- 950 Mercury Cir

- 945 Mercury Cir

- 975 Mercury Cir

- 13163 Peacock Dr

- 13225 Rigel Dr

- 13173 Peacock Dr

- 974 Mercury Cir

- 13183 Rigel Dr