Estimated Value: $335,523 - $383,000

3

Beds

2

Baths

1,533

Sq Ft

$238/Sq Ft

Est. Value

About This Home

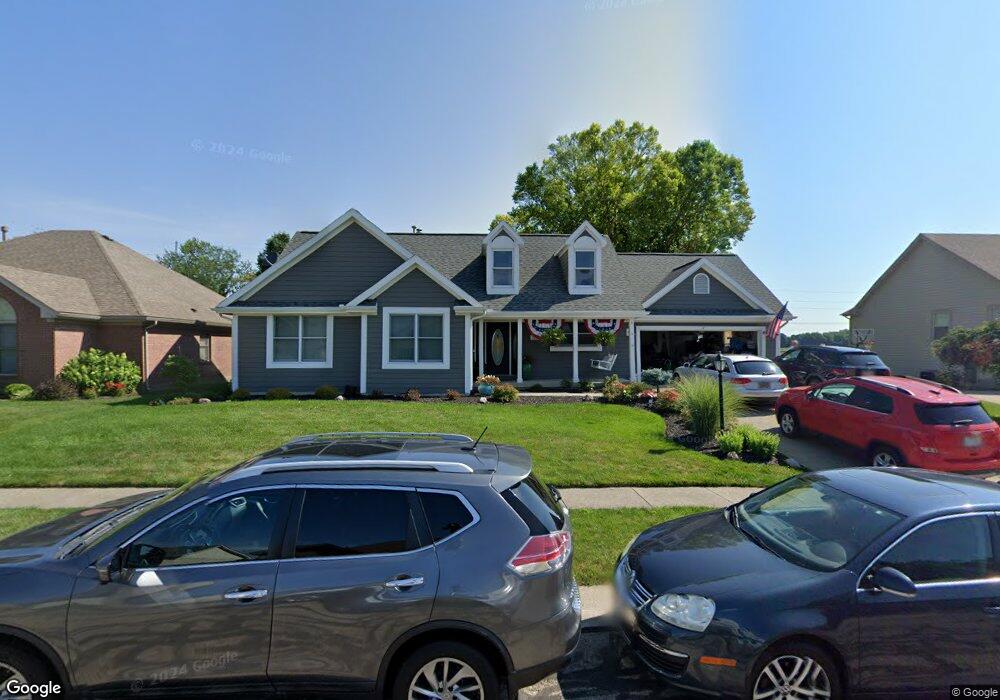

This home is located at 960 Orville Way, Xenia, OH 45385 and is currently estimated at $365,131, approximately $238 per square foot. 960 Orville Way is a home located in Greene County with nearby schools including Xenia High School, Summit Academy Community School for Alternative Learners - Xenia, and Legacy Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 7, 2007

Sold by

Jones Ricky D and Jones Victoria A

Bought by

Merritt Jason E and Merritt Melissa B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,400

Outstanding Balance

$96,507

Interest Rate

6.2%

Mortgage Type

Unknown

Estimated Equity

$268,624

Purchase Details

Closed on

Aug 10, 2000

Sold by

Sibco

Bought by

Jones Ricky D and Jones Victoria

Purchase Details

Closed on

Mar 23, 1999

Sold by

P F D Development P Ll

Bought by

Jones Ricky D and Jones Victoria A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,500

Interest Rate

6.5%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Merritt Jason E | $198,000 | Midwest Title Company | |

| Jones Ricky D | $1,500 | Midwest Title Company | |

| Jones Ricky D | $27,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Merritt Jason E | $158,400 | |

| Previous Owner | Jones Ricky D | $128,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,318 | $100,910 | $23,100 | $77,810 |

| 2023 | $4,318 | $100,910 | $23,100 | $77,810 |

| 2022 | $3,798 | $75,710 | $15,400 | $60,310 |

| 2021 | $3,849 | $75,710 | $15,400 | $60,310 |

| 2020 | $3,688 | $75,710 | $15,400 | $60,310 |

| 2019 | $3,492 | $67,480 | $15,620 | $51,860 |

| 2018 | $3,505 | $61,980 | $15,620 | $46,360 |

| 2017 | $3,070 | $61,980 | $15,620 | $46,360 |

| 2016 | $3,071 | $58,010 | $15,620 | $42,390 |

| 2015 | $3,079 | $58,010 | $15,620 | $42,390 |

| 2014 | $2,949 | $58,010 | $15,620 | $42,390 |

Source: Public Records

Map

Nearby Homes

- 2102 High Wheel Dr

- 920 Wright Cycle Blvd

- 926 Wright Cycle Blvd

- 1348 Berkshire Dr

- 2499 Jenny Marie Dr

- 1255 Colorado Dr

- 2421 Louisiana Dr

- 0 Berkshire Dr Unit 949217

- 1750 Roxbury Dr

- 2784 Greystoke Dr

- 1403 Texas Dr

- 1829 Gayhart Dr

- 2821 Raxit Ct

- 1778 Arapaho Dr

- 1272 Bellbrook Ave

- 1358 Shannon Ln

- 1318 Prem Place

- 1248 Prem Place

- 1304 Baybury Ave

- 1298 Baybury Ave

- 968 Orville Way

- 952 Orville Way

- 976 Orville Way

- 961 Orville Way

- 969 Orville Way

- 953 Orville Way

- 977 Orville Way

- 984 Orville Way

- 936 Orville Way

- 2000 Tandem Dr

- 989 Orville Way

- 939 Orville Way

- 988 Wright Ave

- 970 Wright Ave

- 992 Orville Way

- 996 Wright Ave

- 924 Orville Way

- 980 Wright Ave

- 929 Orville Way

- 2010 Tandem Dr