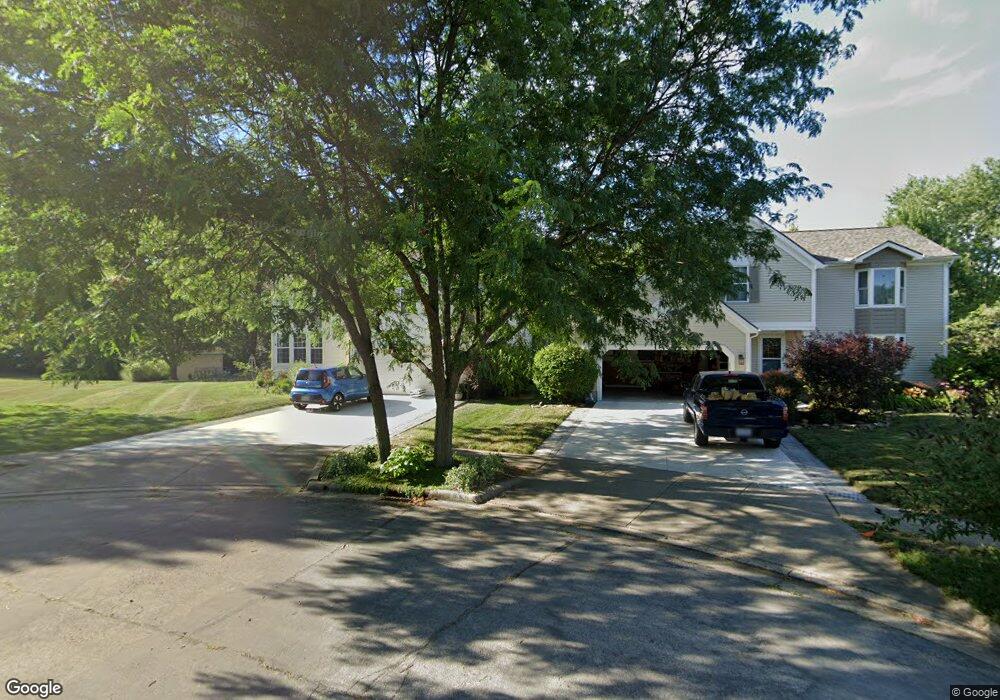

968 Crystal Cay Ct Columbus, OH 43230

Woodside Green NeighborhoodEstimated Value: $432,413 - $476,000

4

Beds

3

Baths

2,052

Sq Ft

$223/Sq Ft

Est. Value

About This Home

This home is located at 968 Crystal Cay Ct, Columbus, OH 43230 and is currently estimated at $457,103, approximately $222 per square foot. 968 Crystal Cay Ct is a home located in Franklin County with nearby schools including Chapelfield Elementary School, Gahanna West Middle School, and Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 26, 2012

Sold by

Kanser Frederick L and Kauser Rosemari S

Bought by

Kauser Frederick L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$226,620

Outstanding Balance

$157,581

Interest Rate

3.75%

Mortgage Type

FHA

Estimated Equity

$299,522

Purchase Details

Closed on

Jun 18, 1998

Sold by

M/I Schottenstein Homes Inc

Bought by

Kauser Frederick L and Kauser Rosemari S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$191,350

Interest Rate

7.22%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kauser Frederick L | -- | None Available | |

| Kauser Frederick L | $201,500 | Transohio Residential Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kauser Frederick L | $226,620 | |

| Previous Owner | Kauser Frederick L | $191,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,491 | $127,160 | $31,570 | $95,590 |

| 2023 | $7,397 | $127,160 | $31,570 | $95,590 |

| 2022 | $7,177 | $96,110 | $18,900 | $77,210 |

| 2021 | $6,942 | $96,110 | $18,900 | $77,210 |

| 2020 | $6,883 | $96,110 | $18,900 | $77,210 |

| 2019 | $5,853 | $81,550 | $15,750 | $65,800 |

| 2018 | $5,341 | $81,550 | $15,750 | $65,800 |

| 2017 | $5,372 | $81,550 | $15,750 | $65,800 |

| 2016 | $4,866 | $67,280 | $15,230 | $52,050 |

| 2015 | $4,870 | $67,280 | $15,230 | $52,050 |

| 2014 | $4,833 | $67,280 | $15,230 | $52,050 |

| 2013 | $2,400 | $67,270 | $15,225 | $52,045 |

Source: Public Records

Map

Nearby Homes

- 402 Bluestem Ave

- 459 Bluestem Ave

- 3544 Halpern St

- 0 Wendler Blvd

- 3555 Tami Place

- 536 Springwood Lake Dr

- 642 Ridenour Rd

- 638 Thistle Ave

- 111 Nob Hill Dr N

- 200 Glenhurst Ct

- 108 Walcreek Dr W

- 3150 Berkley Pointe Dr

- 167 Greenbank Rd

- 3118 Berkley Pointe Dr

- 3877 Hines Rd

- 158 Windrow Ct

- 5142 Cherryblossom Way

- 3954 Stapleford Dr Unit 3954

- 3931 Maidstone Dr

- 211 Crossing Creek N

- 956 Crystal Cay Ct

- 969 Crystal Cay Ct

- 441 Woodside Meadows Place

- 399 Woodside Meadows Place

- 957 Crystal Cay Ct

- 447 Woodside Meadows Place

- 407 Woodside Meadows Place

- 396 Evelyn Ln

- 400 Evelyn Ln

- 404 Evelyn Ln

- 387 Woodside Meadows Place

- 392 Evelyn Ln

- 408 Evelyn Ln

- 421 Woodside Meadows Place

- 388 Evelyn Ln

- 379 Woodside Meadows Place

- 412 Evelyn Ln

- 384 Evelyn Ln

- 4125 N Stygler Rd

- 380 Evelyn Ln