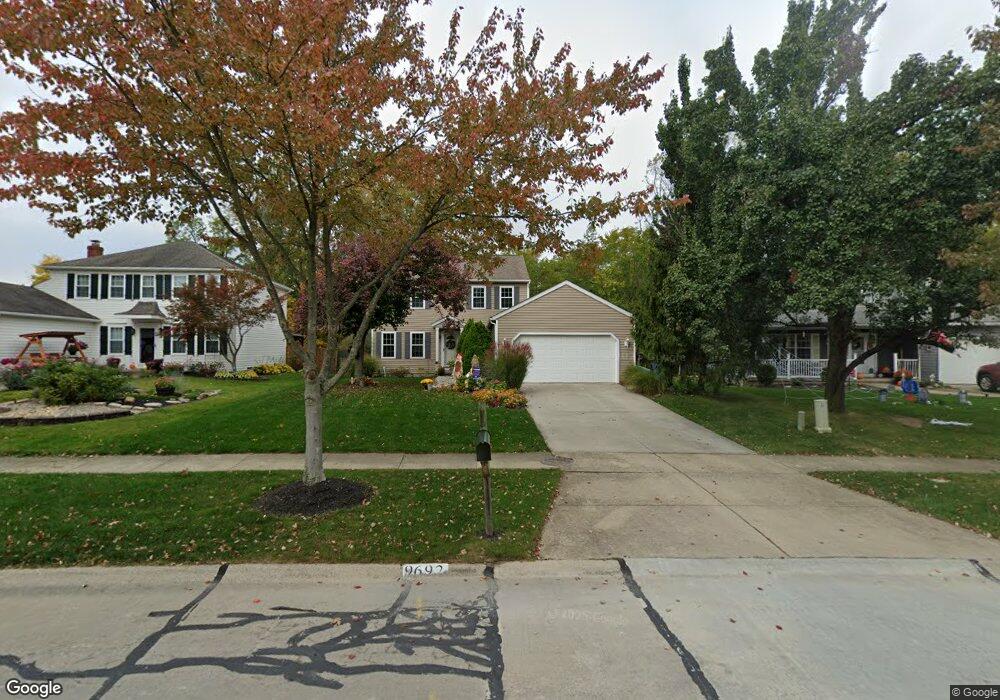

9692 Grist Mill Run Olmsted Falls, OH 44138

Estimated Value: $342,000 - $410,000

4

Beds

3

Baths

2,564

Sq Ft

$146/Sq Ft

Est. Value

About This Home

This home is located at 9692 Grist Mill Run, Olmsted Falls, OH 44138 and is currently estimated at $375,557, approximately $146 per square foot. 9692 Grist Mill Run is a home located in Cuyahoga County with nearby schools including Falls-Lenox Primary Elementary School, Olmsted Falls Intermediate Building, and Olmsted Falls Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 16, 2010

Sold by

Krauss Donald W and Krauss Ted C

Bought by

Zoscak Emily A and Zoscak Michael F

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,089

Outstanding Balance

$125,903

Interest Rate

4.5%

Mortgage Type

FHA

Estimated Equity

$249,654

Purchase Details

Closed on

Feb 10, 2009

Sold by

Fannie Mae

Bought by

Krauss Donald W and Krauss Ted C

Purchase Details

Closed on

Sep 10, 2008

Sold by

Soros Carl and Soros Cynthia

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Jul 13, 1988

Bought by

Soros Carl J

Purchase Details

Closed on

Jan 1, 1988

Bought by

Shorewest Const Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zoscak Emily A | $199,900 | Barristers Title Agency | |

| Krauss Donald W | $97,000 | Accutitle Agency Inc | |

| Federal National Mortgage Association | $88,667 | None Available | |

| Soros Carl J | $115,900 | -- | |

| Shorewest Const Co | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Zoscak Emily A | $190,089 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,054 | $109,025 | $16,485 | $92,540 |

| 2023 | $6,494 | $82,180 | $15,190 | $66,990 |

| 2022 | $6,444 | $82,180 | $15,190 | $66,990 |

| 2021 | $6,380 | $82,180 | $15,190 | $66,990 |

| 2020 | $6,300 | $72,100 | $13,340 | $58,770 |

| 2019 | $5,592 | $206,000 | $38,100 | $167,900 |

| 2018 | $5,578 | $72,100 | $13,340 | $58,770 |

| 2017 | $5,826 | $69,720 | $10,290 | $59,430 |

| 2016 | $5,798 | $69,720 | $10,290 | $59,430 |

| 2015 | $5,617 | $69,720 | $10,290 | $59,430 |

| 2014 | $5,617 | $65,770 | $9,700 | $56,070 |

Source: Public Records

Map

Nearby Homes

- 23514 Grist Mill Ct Unit 4

- 23390 Wainwright Terrace

- 9855 Dupont Dr

- 549 Wyleswood Dr

- 543 Wyleswood Dr

- 537 Wyleswood Dr

- 9797 Sugarbush Cir

- 23155 Wainwright Terrace

- V/L Aldridge Dr

- 23002 Chandlers Ln

- 23002 Chandlers Ln Unit 342

- 23002 Chandlers Ln Unit 221

- 23003 Chandlers Ln Unit 219

- 23003 Chandlers Ln Unit 230

- 396 Crossbrook Dr

- 24628 Sprague Rd

- 647 Tampico Ct Unit 7

- 8809 Leatherleaf Dr

- 412 Wyleswood Dr

- 8757 Roberts Ct Unit 25C

- 9696 Grist Mill Run

- 9688 Grist Mill Run

- 9700 Grist Mill Run

- 9684 Grist Mill Run

- 9693 Grist Mill Run

- 9704 Grist Mill Run

- 9680 Grist Mill Run

- 9697 Grist Mill Run

- 9701 Grist Mill Run

- 9689 Grist Mill Run

- 9708 Grist Mill Run

- 9676 Grist Mill Run

- 9705 Grist Mill Run

- 9708 Tannery Way

- 9712 Grist Mill Run

- 9672 Grist Mill Run

- 23742 Sawmill Bend

- 9712 Tannery Way

- 9704 Tannery Way

- 9716 Tannery Way