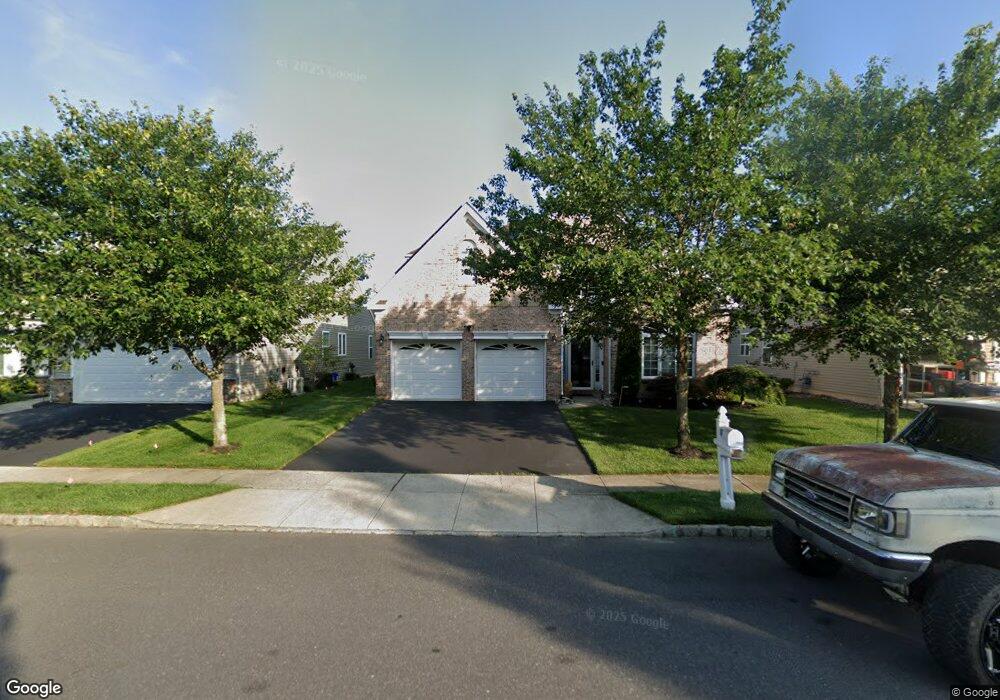

97 Keller Way Mays Landing, NJ 08330

Estimated Value: $492,435 - $570,000

3

Beds

3

Baths

2,697

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 97 Keller Way, Mays Landing, NJ 08330 and is currently estimated at $528,859, approximately $196 per square foot. 97 Keller Way is a home located in Atlantic County with nearby schools including Joseph Shaner School, George L. Hess Educational Complex, and William Davies Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 2017

Sold by

Shaw Patrick J and Shaw Nicole L

Bought by

Gustin Timothy M and Gustin Karen M

Current Estimated Value

Purchase Details

Closed on

Jul 3, 2013

Sold by

Fernmoor Homes At Woods Landing Llc

Bought by

Shaw Patrick J and Shaw Nicole L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,378

Interest Rate

3.92%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 31, 2009

Sold by

Ing Bank Fsb

Bought by

Fernmoor Homes At Woods Landing Llc

Purchase Details

Closed on

May 9, 2005

Sold by

Kabro Of Hamilton Llc

Bought by

Horizons At Woods Landing Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gustin Timothy M | $309,000 | City Abstract Llc | |

| Shaw Patrick J | $365,631 | Cape Atlantic Title Agency | |

| Fernmoor Homes At Woods Landing Llc | $1,800,000 | Trans County Title Agency Ll | |

| Horizons At Woods Landing Llc | $868,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Shaw Patrick J | $219,378 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,217 | $239,500 | $47,900 | $191,600 |

| 2024 | $8,217 | $239,500 | $47,900 | $191,600 |

| 2023 | $7,726 | $239,500 | $47,900 | $191,600 |

| 2022 | $7,726 | $239,500 | $47,900 | $191,600 |

| 2021 | $7,407 | $230,100 | $47,900 | $182,200 |

| 2020 | $7,407 | $230,100 | $47,900 | $182,200 |

| 2019 | $7,425 | $230,100 | $47,900 | $182,200 |

| 2018 | $7,165 | $230,100 | $47,900 | $182,200 |

| 2017 | $7,053 | $230,100 | $47,900 | $182,200 |

| 2016 | $6,855 | $230,100 | $47,900 | $182,200 |

| 2015 | $6,622 | $230,100 | $47,900 | $182,200 |

| 2014 | $6,541 | $249,000 | $57,400 | $191,600 |

Source: Public Records

Map

Nearby Homes

- 5906 Vine Dr

- 5910 Redwood Ct

- 55 Lewis Dr

- 5910 Somerset Dr

- 40 Vender Ln

- 5926 Berry Dr

- 94 Merlino Ln

- 18 Lewis Dr

- 0 Apple St

- 000 Apple St

- 42 Ernst Ct

- 22 Ernst Ct

- 5761 Cedar Ave

- 0 Cape May Ave

- Bl 531 Lot 8&9 Adams Ave

- Lot:11.02-12.02 Estelle Ave

- B:534 L:11.01 Estelle Ave

- B:534 L:12.02 Estelle Ave

- B:534 L:11.02 Estelle Ave

- Rt 50 and Cedar