970 High St Unit J1 Worthington, OH 43085

Estimated Value: $288,000 - $412,000

2

Beds

2

Baths

1,246

Sq Ft

$279/Sq Ft

Est. Value

About This Home

This home is located at 970 High St Unit J1, Worthington, OH 43085 and is currently estimated at $347,444, approximately $278 per square foot. 970 High St Unit J1 is a home located in Franklin County with nearby schools including Wilson Hill Elementary School, Kilbourne Middle School, and Thomas Worthington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 10, 2008

Sold by

Durst Elizabeth J

Bought by

Reuther James J and Reuther Theresa M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,400

Interest Rate

6.09%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 10, 2001

Sold by

Banfield Zoe E

Bought by

Durst Elizabeth J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,000

Interest Rate

7.28%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 10, 1979

Bought by

Banfield Zoe E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reuther James J | -- | Attorney | |

| Durst Elizabeth J | $152,000 | Chicago Title | |

| Banfield Zoe E | $65,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Reuther James J | $158,400 | |

| Previous Owner | Durst Elizabeth J | $105,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,966 | $94,010 | $24,500 | $69,510 |

| 2023 | $5,713 | $94,010 | $24,500 | $69,510 |

| 2022 | $5,508 | $72,420 | $14,110 | $58,310 |

| 2021 | $5,093 | $72,420 | $14,110 | $58,310 |

| 2020 | $4,911 | $72,420 | $14,110 | $58,310 |

| 2019 | $4,718 | $62,970 | $12,250 | $50,720 |

| 2018 | $3,847 | $62,970 | $12,250 | $50,720 |

| 2017 | $3,681 | $62,970 | $12,250 | $50,720 |

| 2016 | $3,120 | $42,700 | $8,750 | $33,950 |

| 2015 | $3,120 | $42,700 | $8,750 | $33,950 |

| 2014 | $3,119 | $42,700 | $8,750 | $33,950 |

| 2013 | $1,552 | $42,700 | $8,750 | $33,950 |

Source: Public Records

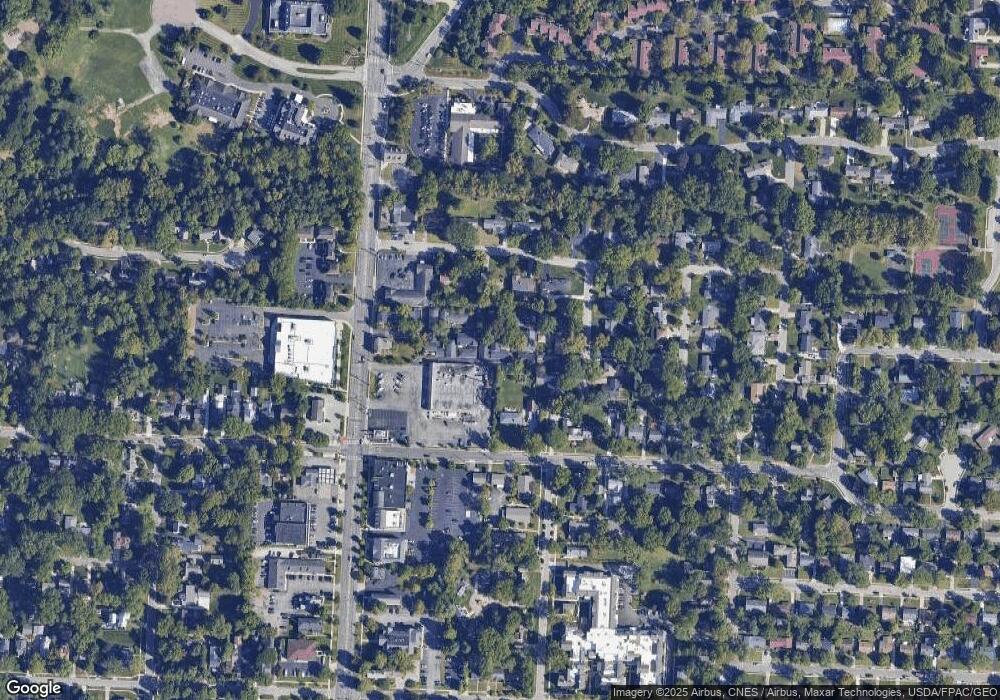

Map

Nearby Homes

- 675 Plymouth St

- 127 Heischman Ave

- 6730 Kensington Way

- 463 E North St Unit D-5

- 551 Oxford St

- 6813 Hayhurst St

- 0 Proprietors Rd Unit 225002452

- 143 W South St

- 930 Proprietors Rd

- 264 E South St

- 6750 Worthington Galena Rd

- 120 Caren Ave

- 5818 Crescent Ct

- 365 Pinney Dr

- 210 Saint Antoine St Unit 25D

- 251 Northigh Dr

- 503 Meadoway Park

- 6380 Plesenton Dr

- 254 E Selby Blvd

- 554 Haymore Ave N

- 970 High St Unit F2

- 970 High St Unit C2

- 970 High St Unit H2

- 970 High St Unit A2

- 970 High St Unit E1

- 970 High St Unit A1

- 970 High St Unit H1

- 970 High St Unit L1

- 970 High St Unit K2

- 970 High St Unit K1

- 970 High St Unit M1

- 970 High St Unit D2

- 970 High St Unit B1

- 970 High St Unit C1

- 970 High St Unit G1

- 970 High St Unit F1

- 970 High St Unit D1

- 970 High St Unit A4

- 970 High St Unit A3

- 970 High St Unit E