9704 S Reidar Rd Laveen, AZ 85339

Laveen NeighborhoodEstimated Value: $418,087 - $501,000

--

Bed

3

Baths

1,912

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 9704 S Reidar Rd, Laveen, AZ 85339 and is currently estimated at $475,522, approximately $248 per square foot. 9704 S Reidar Rd is a home located in Maricopa County with nearby schools including Betty Fairfax High School, Phoenix Coding Academy, and Legacy Traditional School - Laveen Village.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 1, 2006

Sold by

Engle/Sunbelt Llc

Bought by

Warren Robert Wesley and Warren Tasha Janet Linda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,170

Interest Rate

6.16%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 30, 2005

Sold by

Tousa Homes Inc

Bought by

Engle/Sunbelt Llc

Purchase Details

Closed on

Jun 27, 2005

Sold by

Scc Phoenix 2 Llc

Bought by

Tousa Homes Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Warren Robert Wesley | $342,170 | Universal Land Title Agency | |

| Engle/Sunbelt Llc | $897,100 | -- | |

| Tousa Homes Inc | $727,555 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Warren Robert Wesley | $45,170 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,673 | $19,228 | -- | -- |

| 2024 | $2,623 | $18,312 | -- | -- |

| 2023 | $2,623 | $34,320 | $6,860 | $27,460 |

| 2022 | $2,544 | $25,610 | $5,120 | $20,490 |

| 2021 | $2,564 | $24,720 | $4,940 | $19,780 |

| 2020 | $2,496 | $22,460 | $4,490 | $17,970 |

| 2019 | $2,503 | $21,180 | $4,230 | $16,950 |

| 2018 | $2,381 | $19,010 | $3,800 | $15,210 |

| 2017 | $2,251 | $16,580 | $3,310 | $13,270 |

| 2016 | $2,136 | $16,410 | $3,280 | $13,130 |

| 2015 | $1,924 | $15,230 | $3,040 | $12,190 |

Source: Public Records

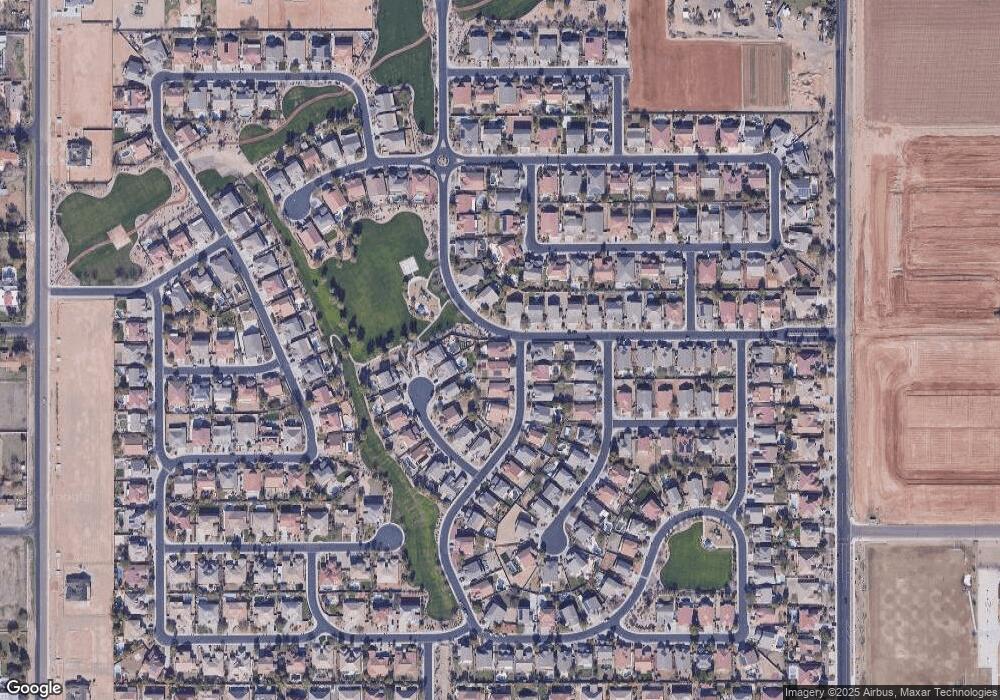

Map

Nearby Homes

- 4429 W Paseo Way

- 4507 W Summerside Rd

- 4314 W Summerside Rd

- 4306 W Summerside Rd

- 9815 S 43rd Ln

- 4620 W Olney Ave

- 4222 W Carmen St

- 4302 W Dobbins Rd

- 4423 W Lodge Dr

- 10212 S 47th Ave

- 4004 W Sunrise Dr Unit 4

- 4003 W Sunrise Dr Unit 3

- 8913 S 41st Glen

- 8615 S 45th Glen

- 4005 W Sunrise Dr Unit 5

- 8616 S 46th Ln

- 4217 W Allen St

- 4828 W Stargazer Place

- 8912 S 40th Dr

- 3913 W Mcneil St

- 9708 S Reidar Rd

- 9712 S Reidar Rd

- 9531 S 45th Ave

- 9711 S 45th Ave

- 9705 S Reidar Rd

- 9527 S 45th Ave

- 9709 S Reidar Rd

- 9707 S 45th Ave

- 9715 S 45th Ave

- 9713 S Reidar Rd

- 9716 S Reidar Rd

- 4416 W Piedmont Rd

- 9719 S 45th Ave

- 4417 W Monte Way

- 4412 W Piedmont Rd

- 9706 S 44th Dr

- 9723 S 45th Ave

- 9710 S 44th Dr

- 9518 S 44th Ln