Estimated Value: $355,417 - $405,000

3

Beds

3

Baths

1,978

Sq Ft

$195/Sq Ft

Est. Value

About This Home

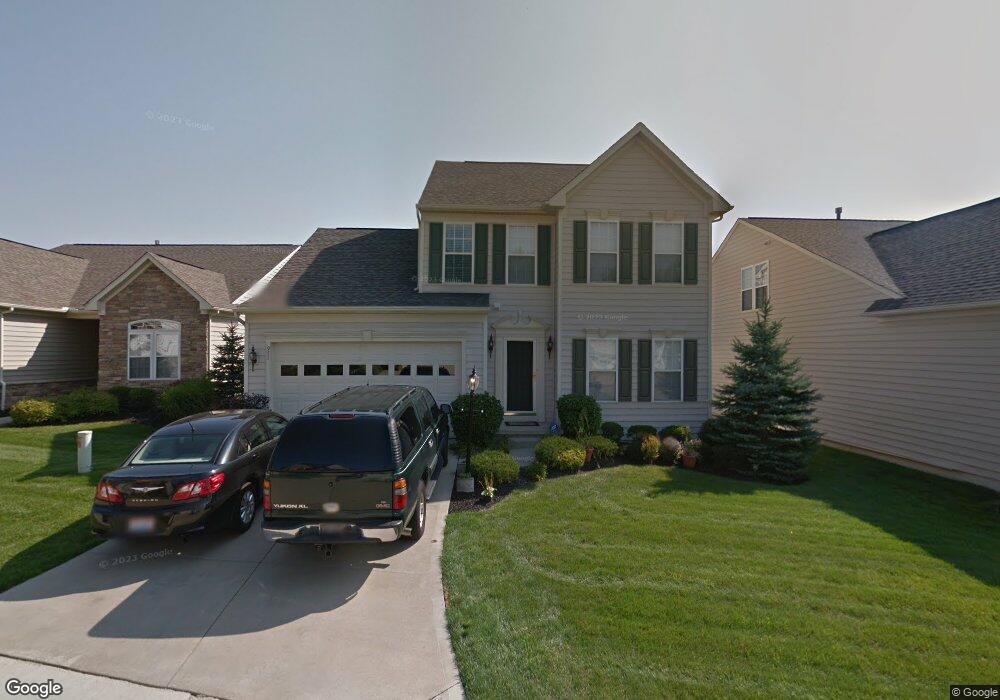

This home is located at 971 Alder Run Way, Akron, OH 44333 and is currently estimated at $386,104, approximately $195 per square foot. 971 Alder Run Way is a home located in Summit County with nearby schools including Richfield Elementary School, Bath Elementary School, and Revere Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 18, 2025

Sold by

Jackson Rosemarie J

Bought by

Kennerly Darnell

Current Estimated Value

Purchase Details

Closed on

Dec 7, 2010

Sold by

Petsko Kathleen E and Petsko David

Bought by

Jackson Rosemarie J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

4.23%

Mortgage Type

VA

Purchase Details

Closed on

Feb 15, 2005

Sold by

Nvr Homes Inc

Bought by

Petsko Kathleen E

Purchase Details

Closed on

Jan 4, 2005

Sold by

Pride One Smith Road Llc

Bought by

Nvr Homes Inc and Ryan Homes

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kennerly Darnell | $23,000 | None Listed On Document | |

| Jackson Rosemarie J | $200,000 | Barristers | |

| Petsko Kathleen E | $226,265 | Nvr Title Agency Llc | |

| Nvr Homes Inc | $45,275 | Nvr Title Agency Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jackson Rosemarie J | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,795 | $97,553 | $20,556 | $76,997 |

| 2024 | $4,795 | $97,553 | $20,556 | $76,997 |

| 2023 | $4,795 | $97,553 | $20,556 | $76,997 |

| 2022 | $4,657 | $84,932 | $17,875 | $67,057 |

| 2021 | $4,655 | $84,932 | $17,875 | $67,057 |

| 2020 | $4,557 | $84,940 | $17,880 | $67,060 |

| 2019 | $4,453 | $78,510 | $17,880 | $60,630 |

| 2018 | $4,398 | $78,510 | $17,880 | $60,630 |

| 2017 | $4,089 | $78,510 | $17,880 | $60,630 |

| 2016 | $4,263 | $72,330 | $17,880 | $54,450 |

| 2015 | $4,089 | $72,330 | $17,880 | $54,450 |

| 2014 | $4,063 | $72,330 | $17,880 | $54,450 |

| 2013 | $4,091 | $73,660 | $17,880 | $55,780 |

Source: Public Records

Map

Nearby Homes

- 2286 Bent Branch Ct

- 889 Alder Run Way

- 755 Sand Run Rd

- 2079 Heather Ct Unit 1

- 908 Foxhollow Ct Unit 112

- 944 Hampton Ridge Dr Unit 8B

- 889 Lynnhaven Ln

- 2239 Woodpark Rd

- 881 Hampton Ridge Dr

- 1091 Sand Run Rd

- 1061 Wycliff Ln

- 987 Hampton Ridge Dr Unit 987

- 441 Sandhurst Rd

- 364 Mowbray Rd

- 736 Hampton Ridge Dr Unit 736

- 2426 Banbury Rd

- 1185 Sand Run Rd

- 309 Shiawassee Ave

- 177 Caladonia Ave

- 229 Shiawassee Ave

- 975 Alder Run Way

- 967 Alder Run Way

- 979 Alder Run Way

- 963 Alder Run Way

- 882 Willow Creek Dr

- 878 Willow Creek Dr

- 972 Alder Run Way

- 968 Alder Run Way

- 886 Willow Creek Dr

- 976 Alder Run Way

- 874 Willow Creek Dr

- 983 Alder Run Way

- 890 Willow Creek Dr

- 964 Alder Run Way

- 959 Alder Run Way

- 870 Willow Creek Dr

- 980 Alder Run Way

- 894 Willow Creek Dr

- 960 Alder Run Way

- 955 Alder Run Way