9725 Mill Ct E Unit E2L4 Palos Park, IL 60464

Palos Park West NeighborhoodEstimated Value: $247,000 - $274,000

2

Beds

2

Baths

1,400

Sq Ft

$188/Sq Ft

Est. Value

About This Home

This home is located at 9725 Mill Ct E Unit E2L4, Palos Park, IL 60464 and is currently estimated at $263,590, approximately $188 per square foot. 9725 Mill Ct E Unit E2L4 is a home located in Cook County with nearby schools including Palos West Elementary School, Palos South Middle School, and Amos Alonzo Stagg High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 7, 2023

Sold by

Dela Zerda Rosio

Bought by

Mitchell Matthew

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$10,000

Outstanding Balance

$722

Interest Rate

6.96%

Mortgage Type

New Conventional

Estimated Equity

$262,868

Purchase Details

Closed on

Nov 20, 2019

Sold by

Haenke Rosie and Acree Carol Neiza

Bought by

Zerda Rosio De La

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,961

Interest Rate

3.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 15, 2019

Sold by

Marquette Bank

Bought by

Haenke Rosie and Acree Carol Neiza

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,000

Interest Rate

4.4%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mitchell Matthew | $240,000 | First American Title | |

| Zerda Rosio De La | -- | Citywide Title Corporation | |

| Haenke Rosie | $155,000 | Attorneys Ttl Guaranty Fund |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mitchell Matthew | $10,000 | |

| Open | Mitchell Matthew | $192,000 | |

| Previous Owner | Zerda Rosio De La | $124,961 | |

| Previous Owner | Haenke Rosie | $124,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,292 | $19,229 | $3,080 | $16,149 |

| 2024 | $4,292 | $19,229 | $3,080 | $16,149 |

| 2023 | $3,709 | $19,229 | $3,080 | $16,149 |

| 2022 | $3,709 | $13,547 | $2,484 | $11,063 |

| 2021 | $3,433 | $13,546 | $2,483 | $11,063 |

| 2020 | $1,945 | $13,546 | $2,483 | $11,063 |

| 2019 | $1,457 | $12,316 | $2,285 | $10,031 |

| 2018 | $1,053 | $12,316 | $2,285 | $10,031 |

| 2017 | $1,004 | $12,316 | $2,285 | $10,031 |

| 2016 | $1,671 | $11,732 | $1,986 | $9,746 |

| 2015 | $1,737 | $11,732 | $1,986 | $9,746 |

| 2014 | $1,698 | $11,732 | $1,986 | $9,746 |

| 2013 | $1,533 | $11,389 | $1,986 | $9,403 |

Source: Public Records

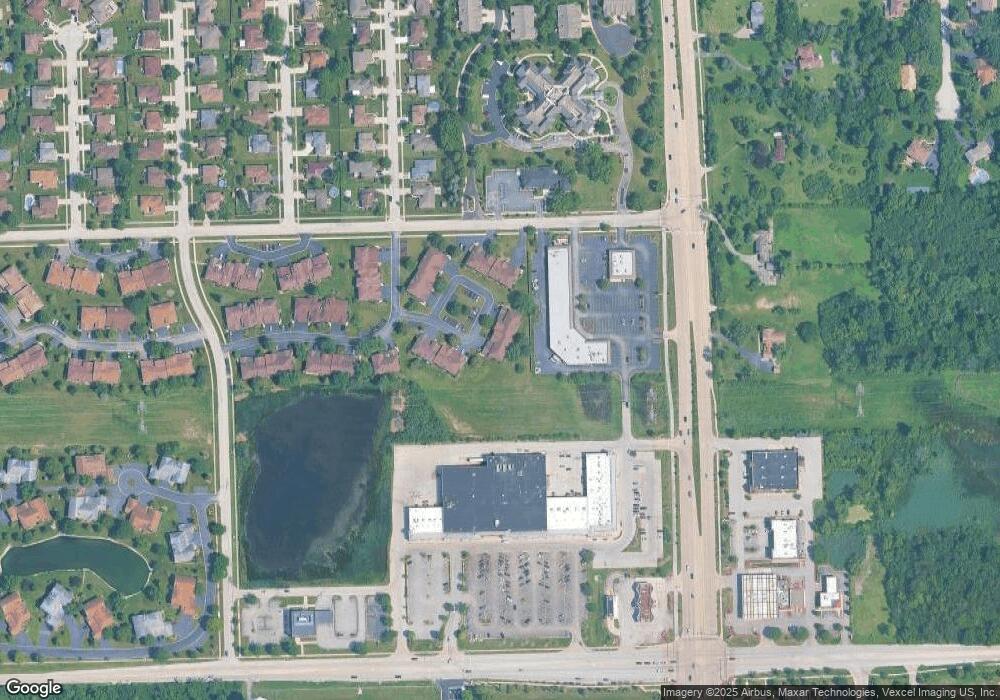

Map

Nearby Homes

- 9724 W Creek Rd Unit E2

- 9724 W Creek Rd Unit B2

- 12908 Mill Dr E Unit 1B

- 9748 Mill Dr E Unit 2E

- 7 Mccord Trace

- 12856 S Brian Place

- 9836 W Circle Pkwy

- 9590 Southmoor Dr

- 13330 Strandhill Dr

- 10050 W 127th St

- 11000 W 131st St

- 10300 Village Circle Dr Unit 1109

- 10300 Village Circle Dr Unit 4407

- 12407 S 91st Ave

- 13250 Jean Creek Dr

- 13332 S 88th Ave

- 13348 S Stephen Dr

- 8702 W 131st St

- 13801 92nd Ave

- 12314 S 88th Ave

- 9725 Mill Ct E Unit E2

- 9725 Mill Ct E Unit B1

- 9725 Mill Ct E Unit B2L4

- 9725 Mill Ct E Unit B1L4

- 9725 Mill Ct E Unit E1L4

- 9725 Mill Ct E Unit 9725

- 9725 Mill Ct E Unit B2

- 9725 Mill Creek Dr E Unit E2

- 9723 Mill Ct E Unit E2L3

- 9723 Mill Ct E Unit E1

- 9723 Mill Ct E Unit B2L3

- 9723 Mill Ct E Unit B1L3

- 9723 Mill Ct E Unit B2

- 9723 Mill Ct E Unit B1

- 9723 Mill Ct E Unit E2

- 9727 Mill Ct E Unit B2

- 9727 Mill Ct E Unit E2L5

- 9727 Mill Ct E Unit B1L5

- 9727 Mill Ct E Unit B2L5

- 9727 Mill Ct E Unit E1L5

Your Personal Tour Guide

Ask me questions while you tour the home.