9773 Pebble View Dr Cincinnati, OH 45252

Estimated Value: $627,000 - $763,692

3

Beds

4

Baths

4,697

Sq Ft

$147/Sq Ft

Est. Value

About This Home

This home is located at 9773 Pebble View Dr, Cincinnati, OH 45252 and is currently estimated at $688,923, approximately $146 per square foot. 9773 Pebble View Dr is a home located in Hamilton County with nearby schools including Colerain Elementary School, Colerain Middle School, and Colerain High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2002

Sold by

Pebble View Llc

Bought by

Sprenger Theodor and Sprenger Elisabeth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,000

Outstanding Balance

$140,431

Interest Rate

6.5%

Estimated Equity

$548,492

Purchase Details

Closed on

Oct 10, 2001

Sold by

Eagle Golf Inc

Bought by

Pebble View Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$298,000

Interest Rate

6.99%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sprenger Theodor | $389,000 | -- | |

| Pebble View Llc | $1,500,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sprenger Theodor | $350,000 | |

| Previous Owner | Pebble View Llc | $298,000 | |

| Closed | Pebble View Llc | $30,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,290 | $230,559 | $38,500 | $192,059 |

| 2023 | $12,365 | $230,559 | $38,500 | $192,059 |

| 2022 | $11,349 | $172,606 | $38,150 | $134,456 |

| 2021 | $11,250 | $172,606 | $38,150 | $134,456 |

| 2020 | $11,369 | $172,606 | $38,150 | $134,456 |

| 2019 | $11,171 | $158,354 | $35,000 | $123,354 |

| 2018 | $10,017 | $158,354 | $35,000 | $123,354 |

| 2017 | $9,487 | $158,354 | $35,000 | $123,354 |

| 2016 | $6,938 | $114,184 | $33,250 | $80,934 |

| 2015 | $7,006 | $114,184 | $33,250 | $80,934 |

| 2014 | $7,018 | $114,184 | $33,250 | $80,934 |

| 2013 | $7,029 | $120,194 | $35,000 | $85,194 |

Source: Public Records

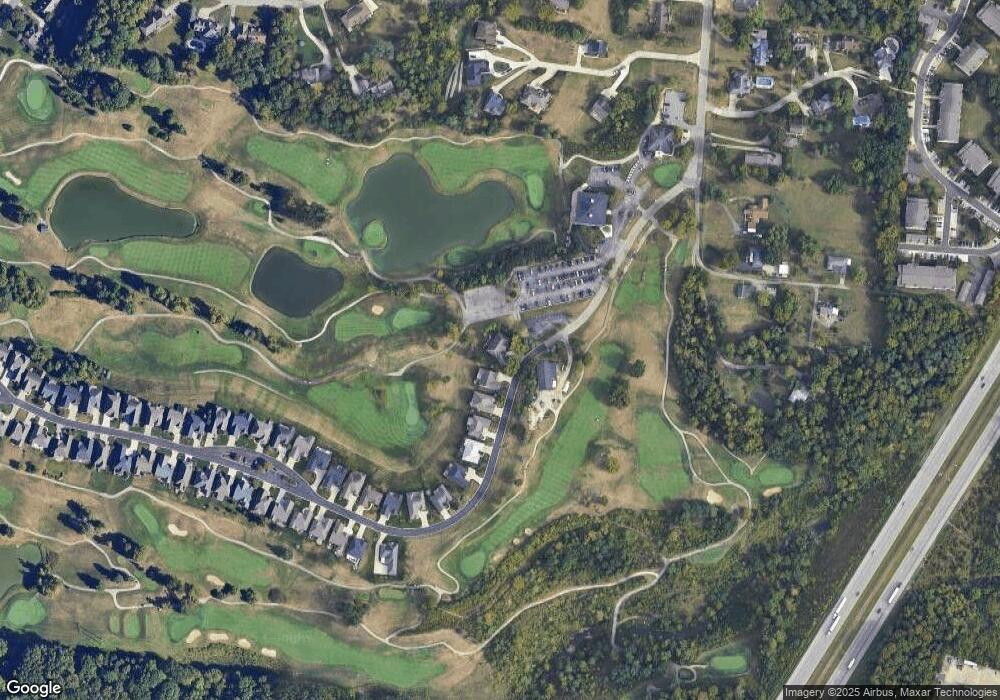

Map

Nearby Homes

- 9858 Prechtel Rd

- 9873 Kittywood Dr

- 9940 Prechtel Rd

- 9901 Regatta Dr

- 9905 Regatta Dr

- 4220 Endeavor Dr

- 4200 Endeavor Dr

- 9908 Pebbleknoll Dr

- 4302 Courageous Cir Unit 83

- 5077 Pebblevalley Dr

- 4280 Defender Dr

- 4352 Courageous Cir Unit 59

- 9940 Regatta Dr

- 10054 Prechtel Rd

- 9995 Weatherly Ct

- 4198 Intrepid Dr

- 0 Springdale Rd Unit 1850271

- 3719 Sagebrush Ln

- 3834 Enterprise Cir

- 5576 Sheits Rd

- 9771 Pebble View Dr

- 9769 Pebble View Dr

- 9767 Pebble View Dr

- 9757 Pebble View Dr

- 9753 Pebble View Dr

- 9747 Pebble View Dr

- 9739 Pebble View Dr

- 9735 Pebble View Dr

- 9731 Pebble View Dr

- 9727 Pebble View Dr

- 9719 Pebble View Dr

- 9715 Pebble View Dr

- 9736 Pebble View Dr

- 9732 Pebble View Dr

- 9711 Pebble View Dr

- 9728 Pebble View Dr

- 9722 Pebble View Dr

- 9844 Island View Dr

- 9822 Island View Dr

- 9705 Pebble View Dr