Estimated Value: $928,000 - $1,240,000

4

Beds

2

Baths

1,334

Sq Ft

$771/Sq Ft

Est. Value

About This Home

This home is located at 98-232 Paleo Way Unit 31, Aiea, HI 96701 and is currently estimated at $1,028,715, approximately $771 per square foot. 98-232 Paleo Way Unit 31 is a home located in Honolulu County with nearby schools including Waimalu Elementary School, Aiea Intermediate School, and Aiea High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 19, 2014

Sold by

Hanson Mark Thomas and Osumi Jean Miyoko

Bought by

Hanson Mark T

Current Estimated Value

Purchase Details

Closed on

Jul 8, 1999

Sold by

Hasell Edward Laurens and Hasell Song

Bought by

Hanson Mark Thomas and Osumi Jean Miyoko

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$55,314

Interest Rate

7.4%

Estimated Equity

$973,401

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hanson Mark T | -- | None Available | |

| Hanson Mark T | -- | None Available | |

| Hanson Mark Thomas | $255,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hanson Mark Thomas | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,808 | $932,700 | $746,000 | $186,700 |

| 2024 | $2,808 | $922,400 | $746,000 | $176,400 |

| 2023 | $2,616 | $947,300 | $746,000 | $201,300 |

| 2022 | $2,542 | $826,400 | $573,900 | $252,500 |

| 2021 | $1,992 | $669,100 | $453,200 | $215,900 |

| 2020 | $2,196 | $727,400 | $521,300 | $206,100 |

| 2019 | $2,251 | $723,200 | $477,000 | $246,200 |

| 2018 | $1,993 | $649,300 | $460,000 | $189,300 |

| 2017 | $1,891 | $620,400 | $460,000 | $160,400 |

| 2016 | $1,803 | $595,200 | $415,100 | $180,100 |

| 2015 | $1,765 | $584,400 | $397,800 | $186,600 |

| 2014 | $1,499 | $572,600 | $389,400 | $183,200 |

Source: Public Records

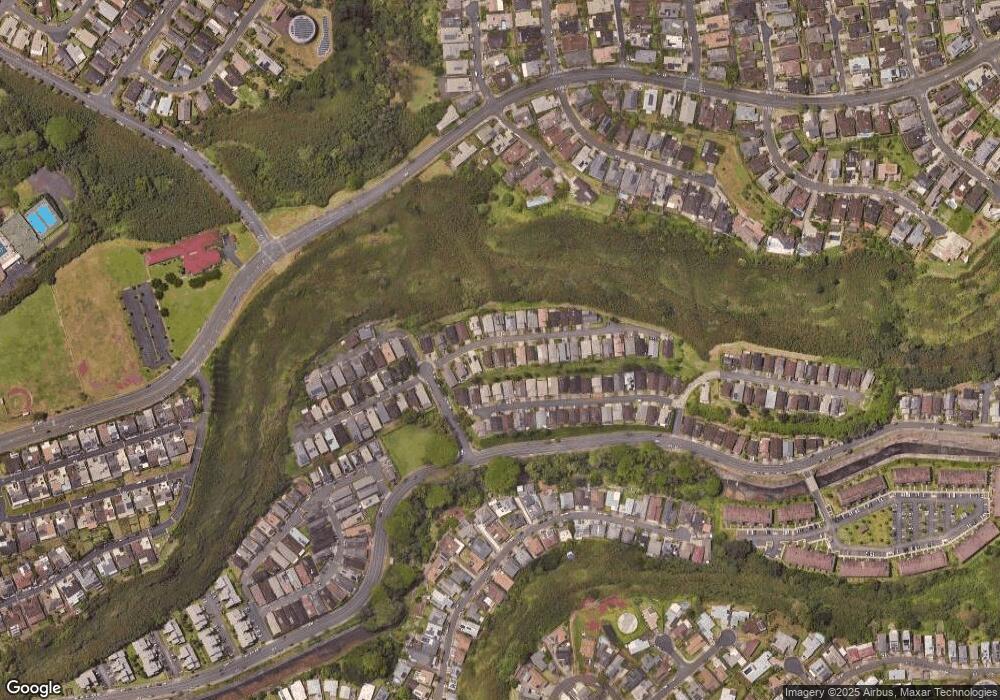

Map

Nearby Homes

- 98-628 Kuini St Unit 1801

- 98-635 Leke Place

- 98-621 Kilinoe St Unit 4B1

- 98-629 Kilinoe St Unit 2A1

- 98-615 Kilinoe St Unit 6G1

- 98-718-D Kaonohi St Unit 38

- 98-432 Ponohana Loop Unit 10G

- 98-512 Kaonohi St Unit 493

- 98-673 Kilinoe St

- 98-448 Kilinoe St Unit 9907

- 98-524 Lulu Place Unit 84

- 98-519 Lulu Place Unit 73

- 98-433 Kaonohi St Unit 331

- 98-441 Kaonohi St Unit 353

- 98-405 Kaonohi St Unit 242

- 98-1772 Piku Way

- 98-1794 Kupukupu St

- 98-685 Kaonohi St Unit F

- 98-1743 Ulu St

- 98-288 Kaonohi St Unit 4401

- 98-218 Paleo Way Unit 33

- 98-225 Paleo Way Unit 5

- 98-251 Paleo Way Unit 10

- 98-263 Paleo Way Unit 12

- 98-241 Paleo Way Unit 8

- 98-231 Paleo Way Unit 6

- 98-276 Paleo Way Unit 23

- 98-267 Paleo Way Unit 13

- 98-244 Paleo Way Unit 29

- 98-226 Paleo Way Unit 32

- 98-204 Paleo Way Unit 35

- 98-210 Paleo Way Unit 34

- 98-238 Paleo Way Unit 30

- 98-248 Paleo Way Unit 28

- 98-254 Paleo Way Unit 27

- 98-260 Paleo Way Unit 26

- 98-266 Paleo Way Unit 25

- 98-270 Paleo Way Unit 24

- 98-312 Paleo Way Unit 17

- 98-316 Paleo Way Unit 16