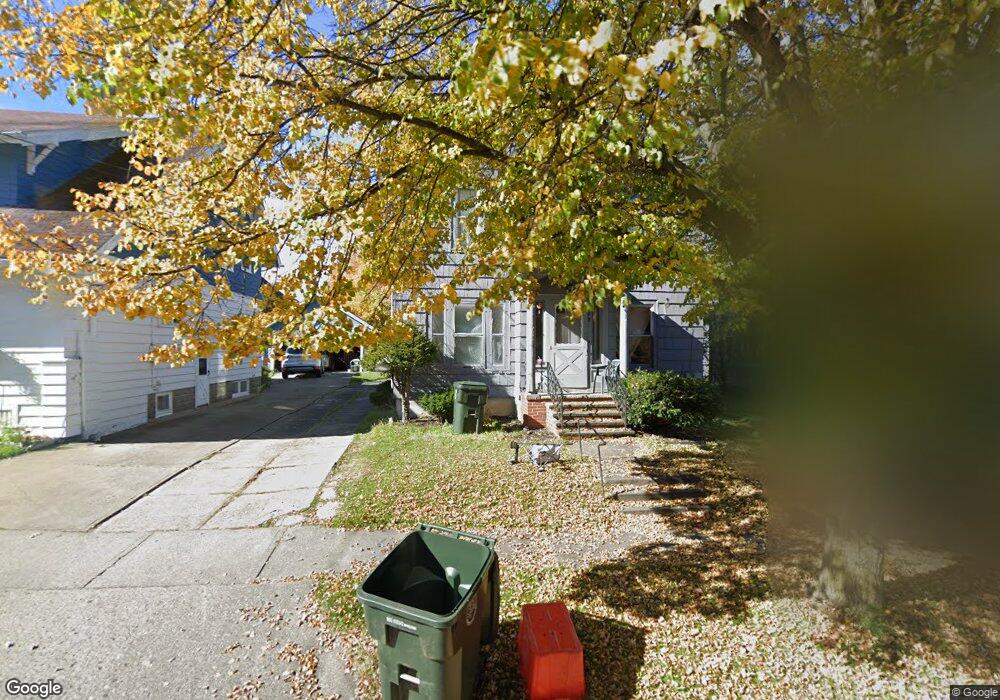

98 Myrtle St Jamestown, NY 14701

Estimated Value: $63,000 - $108,000

4

Beds

2

Baths

1,872

Sq Ft

$44/Sq Ft

Est. Value

About This Home

This home is located at 98 Myrtle St, Jamestown, NY 14701 and is currently estimated at $81,837, approximately $43 per square foot. 98 Myrtle St is a home located in Chautauqua County with nearby schools including Jamestown High School, Catholic Academy of The Holy Family, and Chautauqua Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 20, 2023

Sold by

Cornerstone Cap Jmst Llc

Bought by

Pinnacle Re Llc

Current Estimated Value

Purchase Details

Closed on

Dec 19, 2022

Sold by

Rental Excellence Llc

Bought by

Cornerstone Cap Jmst Llc

Purchase Details

Closed on

Apr 4, 2018

Sold by

Sigular Jordan

Bought by

Merkand Irshad A

Purchase Details

Closed on

Nov 12, 2010

Sold by

Deutsche Bank Natl Trust

Bought by

Rental Excellence Llc

Purchase Details

Closed on

Sep 29, 2010

Sold by

Bishop Dennis

Bought by

Deutsche Bank Natl Trust Co

Purchase Details

Closed on

Jun 9, 2003

Sold by

Bishop Karen Ann

Bought by

Bishop Dennis

Purchase Details

Closed on

Jun 24, 1996

Purchase Details

Closed on

Apr 25, 1995

Sold by

Smith Neil F Helen J

Bought by

Bishop Dennis

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pinnacle Re Llc | -- | None Listed On Document | |

| Cornerstone Cap Jmst Llc | -- | -- | |

| Merkand Irshad A | $67,000 | -- | |

| Rental Excellence Llc | $11,880 | Thomas Flowers | |

| Deutsche Bank Natl Trust Co | $28,674 | Steven Baum | |

| Bishop Dennis | -- | Dale Robbins | |

| -- | -- | -- | |

| Bishop Dennis | $34,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,516 | $29,000 | $3,400 | $25,600 |

| 2023 | $1,513 | $29,000 | $3,400 | $25,600 |

| 2022 | $1,634 | $29,000 | $3,400 | $25,600 |

| 2021 | $1,637 | $29,000 | $3,400 | $25,600 |

| 2020 | $1,851 | $29,000 | $3,400 | $25,600 |

| 2019 | $980 | $29,000 | $3,400 | $25,600 |

| 2018 | $1,544 | $29,000 | $3,400 | $25,600 |

| 2017 | $1,580 | $29,000 | $3,400 | $25,600 |

| 2016 | $1,504 | $29,000 | $3,400 | $25,600 |

| 2015 | -- | $29,000 | $3,400 | $25,600 |

| 2014 | -- | $29,000 | $3,400 | $25,600 |

Source: Public Records

Map

Nearby Homes

- 94 Myrtle St

- 102 Myrtle St

- 50 Fairfield Ave

- 110 Superior St

- 44 Fairfield Ave

- 114 Superior St

- 40 Fairfield Ave

- 95 Myrtle St

- 99 Myrtle St

- 91 Myrtle St

- 103 Myrtle St

- 86 Myrtle St

- 36 Fairfield Ave

- 118 Superior St

- 101 Superior St

- 105 Superior St

- 84 Myrtle St

- 19 Superior St

- 32 Fairfield Ave

- 122 Superior St