9820 SW 2nd St Pembroke Pines, FL 33025

Lakeside South NeighborhoodEstimated Value: $462,000 - $609,000

3

Beds

3

Baths

1,696

Sq Ft

$325/Sq Ft

Est. Value

About This Home

This home is located at 9820 SW 2nd St, Pembroke Pines, FL 33025 and is currently estimated at $551,465, approximately $325 per square foot. 9820 SW 2nd St is a home located in Broward County with nearby schools including Palm Cove Elementary School, Pines Middle School, and Charles W Flanagan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 31, 1994

Sold by

Mortellaro Rosella and Scaglione Frank S

Bought by

Jackson David S and Jackson Judith

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$35,000

Interest Rate

8.56%

Purchase Details

Closed on

Aug 30, 1994

Sold by

Spencer Angeline

Bought by

Jackson David S and Jackson Judith

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$35,000

Interest Rate

8.56%

Purchase Details

Closed on

Feb 28, 1994

Sold by

Gardenlake Assoc

Bought by

Ling Xiao C and Ling Su L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$94,400

Interest Rate

7.61%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jackson David S | $46,700 | -- | |

| Jackson David S | $46,700 | -- | |

| Jackson David S | $46,700 | -- | |

| Jackson David S | -- | -- | |

| Jackson David S | -- | -- | |

| Ling Xiao C | $118,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Jackson David S | $35,000 | |

| Previous Owner | Ling Xiao C | $94,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,971 | $179,770 | -- | -- |

| 2024 | $2,859 | $174,710 | -- | -- |

| 2023 | $2,859 | $169,630 | $0 | $0 |

| 2022 | $2,682 | $164,690 | $0 | $0 |

| 2021 | $2,607 | $159,900 | $0 | $0 |

| 2020 | $2,576 | $157,700 | $0 | $0 |

| 2019 | $2,512 | $154,160 | $0 | $0 |

| 2018 | $2,408 | $151,290 | $0 | $0 |

| 2017 | $2,373 | $148,180 | $0 | $0 |

| 2016 | $2,351 | $145,140 | $0 | $0 |

| 2015 | $2,382 | $144,140 | $0 | $0 |

| 2014 | $2,373 | $143,000 | $0 | $0 |

| 2013 | -- | $180,280 | $28,220 | $152,060 |

Source: Public Records

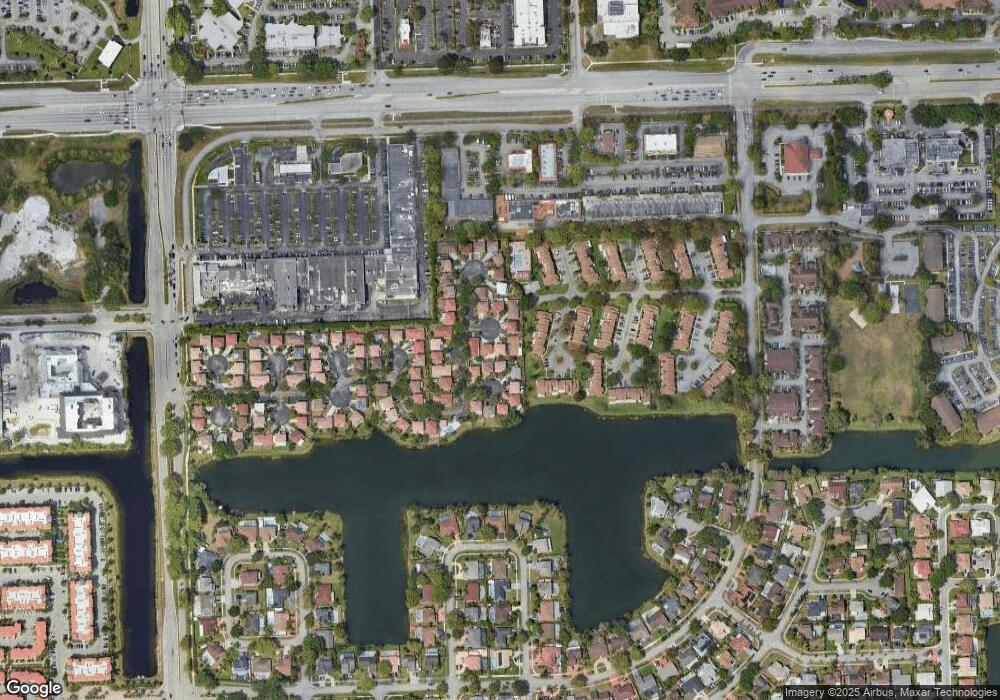

Map

Nearby Homes

- 340 SW 97th Ave

- 620 SW 98th Terrace

- 361 SW 95th Terrace

- 711 SW 95th Terrace

- 9645 NW 1st Ct Unit 1210

- 9645 NW 1st Ct Unit 1209

- 9640 NW 2nd St Unit 5206

- 251 Palm Cir W Unit 206

- 251 Palm Cir W Unit 207

- 250 Palm Cir W Unit 301

- 400 NW 98th Ave

- 910 SW 99th Ave

- 10000 SW 9th Ct

- 940 SW 96th Ave

- 961 SW 98th Ave

- 331 NW 101st Terrace

- 9317 NW 1st Ct Unit 105

- 151 NW 93rd Ave Unit 206

- 1001 SW 100th Terrace

- 9258 NW 1st St Unit 206

- 9830 SW 2nd St

- 9810 SW 2nd St

- 9800 SW 2nd St

- 9821 SW 3rd St

- 9831 SW 3rd St Unit R

- 9831 SW 3rd St

- 9811 SW 3rd St

- 250 SW 97th Terrace

- 9821 SW 2nd St

- 2nd Street 9811

- 240 SW 97th Terrace

- 9811 SW 2nd St

- 9831 SW 2nd St

- 230 SW 97th Terrace

- 9840 SW 2nd St

- 220 SW 97th Terrace Unit 220

- 220 SW 97th Terrace Unit 220

- 220 SW 97th Terrace Unit 220-11

- 300 SW 97th Terrace Unit 300

- 310 SW 97th Terrace