9835 Palomino Oaks San Antonio, TX 78254

Estimated Value: $290,016 - $313,000

3

Beds

3

Baths

1,918

Sq Ft

$156/Sq Ft

Est. Value

About This Home

This home is located at 9835 Palomino Oaks, San Antonio, TX 78254 and is currently estimated at $299,754, approximately $156 per square foot. 9835 Palomino Oaks is a home located in Bexar County with nearby schools including Krueger Elementary School, Jefferson Middle School, and School of Science and Technology Hill Country.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 18, 2013

Sold by

Heinlen Heidi Kristin

Bought by

Valdez Anthony and Valdez Melissa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,102

Outstanding Balance

$111,294

Interest Rate

3.55%

Mortgage Type

FHA

Estimated Equity

$188,460

Purchase Details

Closed on

Aug 16, 2006

Sold by

Continental Homes Of Texas Lp

Bought by

Heinlen Heidi Kristin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,151

Interest Rate

6.79%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Valdez Anthony | -- | Stc | |

| Heinlen Heidi Kristin | -- | Dhi Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Valdez Anthony | $157,102 | |

| Previous Owner | Heinlen Heidi Kristin | $153,151 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,354 | $280,000 | $55,310 | $224,690 |

| 2024 | $5,354 | $289,000 | $55,310 | $233,690 |

| 2023 | $5,354 | $301,000 | $55,310 | $245,690 |

| 2022 | $5,961 | $293,480 | $46,120 | $247,360 |

| 2021 | $4,862 | $230,930 | $41,920 | $189,010 |

| 2020 | $4,768 | $221,710 | $41,920 | $179,790 |

| 2019 | $4,412 | $198,710 | $33,410 | $165,300 |

| 2018 | $4,147 | $186,610 | $33,410 | $153,200 |

| 2017 | $4,030 | $180,950 | $33,410 | $147,540 |

| 2016 | $3,910 | $175,580 | $33,410 | $142,170 |

| 2015 | $3,521 | $166,970 | $33,410 | $133,560 |

| 2014 | $3,521 | $157,140 | $0 | $0 |

Source: Public Records

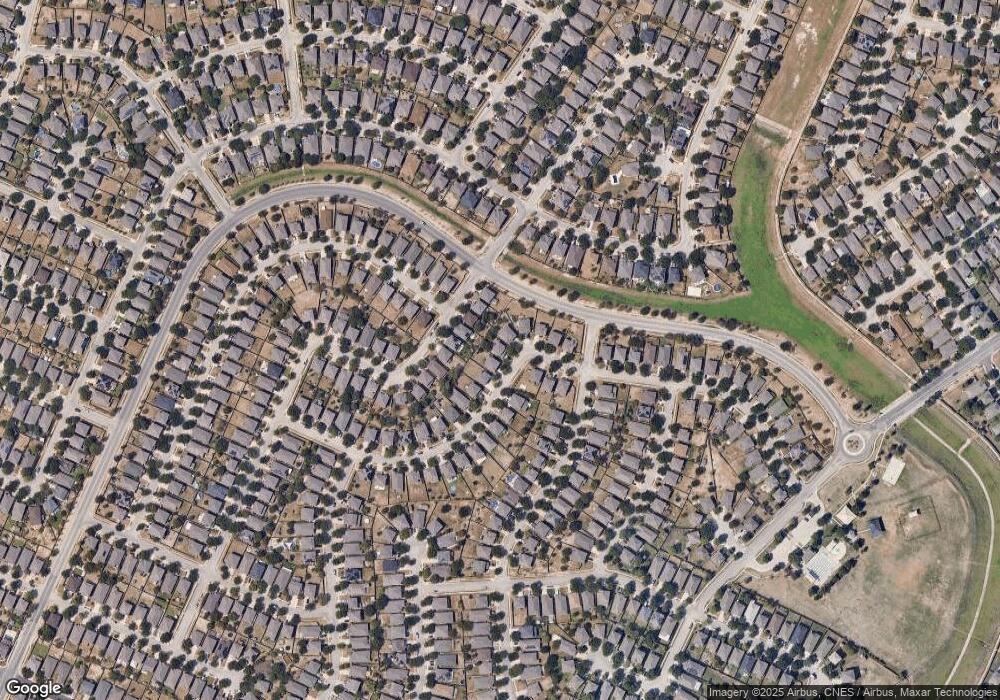

Map

Nearby Homes

- 9726 Palomino Oaks

- 10707 Arabian Sands

- 9714 Connemara Bend

- 10627 Arabian Sands

- 11019 Palomino Bend

- 10814 Shetland Hills

- 9807 Sandlet Trail

- 9510 Caspian Forest

- 10767 Pharaoh Run

- 10706 Pharaoh Run

- 10707 Pharaoh Run

- 9951 Sandlet Trail

- 9407 Pegasus Run Rd

- 9707 Mustang Bay

- 9950 Sandlet Trail

- 10814 Mustang Oak Dr

- 10511 Marengo Ln

- 11463 Feather Vale

- 11420 Feather Vale

- 11451 Feather Vale

- 9831 Palomino Oaks

- 9839 Palomino Oaks

- 9827 Palomino Oaks

- 9726 Pony Spur

- 9730 Pony Spur

- 10815 Arabian Sands

- 9722 Pony Spur

- 9734 Pony Spur

- 10810 Arabian Sands

- 9823 Palomino Oaks

- 10811 Arabian Sands

- 9718 Pony Spur

- 9738 Pony Spur

- 9826 Palomino Oaks

- 10807 Arabian Sands

- 10806 Arabian Sands

- 10806

- 9714 Pony Spur

- 9815 Palomino Oaks

- 9822 Palomino Oaks