9870 Orchid Tree Trail Unit A Boynton Beach, FL 33436

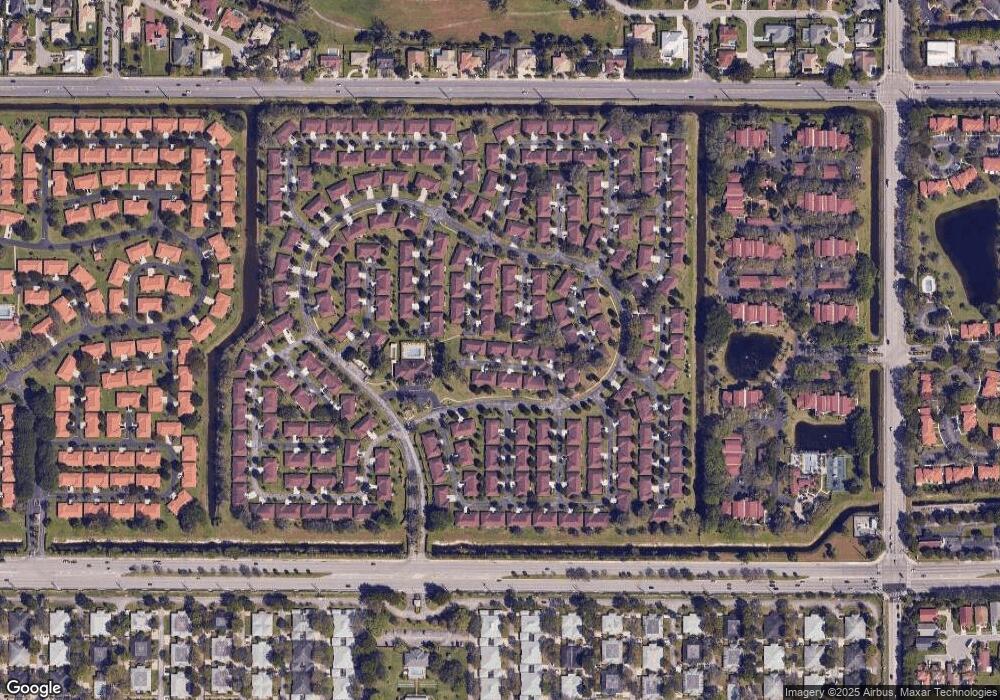

Cypress Creek NeighborhoodEstimated Value: $298,086

2

Beds

2

Baths

1,700

Sq Ft

$175/Sq Ft

Est. Value

About This Home

This home is located at 9870 Orchid Tree Trail Unit A, Boynton Beach, FL 33436 and is currently priced at $298,086, approximately $175 per square foot. 9870 Orchid Tree Trail Unit A is a home located in Palm Beach County with nearby schools including Galaxy Elementary School, Boynton Beach Community High School, and Congress Community Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2024

Sold by

Mcinnis Debra and Amato Norma J

Bought by

Mary Anne Szymanski Living Trust and Szymanski

Current Estimated Value

Purchase Details

Closed on

Apr 30, 2014

Sold by

Feder Stanley and Feder Marilyn

Bought by

Amato Norma

Purchase Details

Closed on

Mar 25, 2004

Sold by

The Elizabeth M Havill Trust

Bought by

Feder Stanley

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,648

Interest Rate

5.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 19, 2003

Sold by

Havill Elizabeth M

Bought by

Havill Elizabeth M and Elizabeth M Havill Trust

Purchase Details

Closed on

Apr 7, 1998

Sold by

Fortney Marveen V

Bought by

Havill Elizabeth M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mary Anne Szymanski Living Trust | $300,000 | Alliant Title & Escrow | |

| Mary Anne Szymanski Living Trust | $300,000 | Alliant Title & Escrow | |

| Mary Anne Szymanski Living Trust | $300,000 | Alliant Title & Escrow | |

| Amato Norma | $130,000 | Trident Title Llc | |

| Feder Stanley | $132,000 | Direct Title Insurance Ltd | |

| Havill Elizabeth M | -- | -- | |

| Havill Elizabeth M | $74,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Feder Stanley | $107,648 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,291 | $65,542 | -- | -- |

| 2024 | $2,291 | $165,734 | -- | -- |

| 2023 | $2,232 | $154,944 | $0 | $0 |

| 2022 | $2,004 | $145,011 | $0 | $0 |

| 2021 | $1,880 | $135,860 | $0 | $0 |

| 2020 | $1,843 | $132,485 | $0 | $0 |

| 2019 | $1,857 | $131,080 | $0 | $0 |

| 2018 | $1,694 | $124,441 | $0 | $0 |

| 2017 | $1,652 | $121,208 | $0 | $0 |

| 2016 | $1,595 | $115,000 | $0 | $0 |

| 2015 | $2,143 | $100,000 | $0 | $0 |

| 2014 | $1,719 | $73,700 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 9975 Ligustrum Tree Way Unit B

- 9885 Orchid Tree Trail Unit B

- 4260 Mango Tree Ct Unit B

- 9855 Loquat Tree Run A Run Unit A

- 4180 Mango Tree Ct Unit B

- 9740 Pecan Tree Dr Unit A

- 9890 Pecan Tree Dr Unit B

- 4355 Cedar Tree Place Unit B

- 4360 Eucalyptus Tree Ct Unit A

- 4380 Pear Tree Cir Unit A

- 10119 42nd Terrace S Unit 129

- 9800 Pecan Tree Dr Unit B

- 10110 42nd Way S Unit 168

- 9800 Tabebuia Tree Dr Unit A

- 9790 Tabebuia Tree Dr Unit A

- 9750 Tabebuia Tree Dr Unit A

- 10137 40th Way S Unit 233

- 4555 Apple Tree Cir Unit A

- 10170 40th Way S Unit 258

- 10164 40th Way S Unit 256

- 9870 Orchid Tree Trail Unit A

- 9870 Orchid Tree Trail Unit B

- 9850 Orchid Tree Trail Unit B

- 9850 Orchid Tree Trail Unit A

- 9890 Orchid Tree Trail

- 9890 Orchid Tree Trail Unit B

- 9890 Orchid Tree Trail Unit B

- 9890 Orchid Tree Trail Unit A

- 9730 Pecan Tree Dr Unit A

- 9730 Pecan Tree Dr Unit B

- 9730 Pecan Tree Dr Unit A

- 9880 Loquat Tree Run

- 9880 Loquat Tree Run Unit A

- 9880 Loquat Tree Run Unit A

- 9880 Loquat Tree Run Unit B

- 9865 Orchid Tree Trail Unit B

- 9865 Orchid Tree Trail Unit A

- 9885 Orchid Tree Trail Unit A

- 9855 Loquat Tree Run

- 9855 Loquat Tree Run Unit A