9879 E Chiricahua Pass Unit 45 Scottsdale, AZ 85262

Desert Mountain NeighborhoodEstimated Value: $4,528,503 - $5,678,000

4

Beds

7

Baths

7,130

Sq Ft

$698/Sq Ft

Est. Value

About This Home

This home is located at 9879 E Chiricahua Pass Unit 45, Scottsdale, AZ 85262 and is currently estimated at $4,980,168, approximately $698 per square foot. 9879 E Chiricahua Pass Unit 45 is a home located in Maricopa County with nearby schools including Black Mountain Elementary School, Cactus Shadows High School, and Sonoran Trails Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 18, 2019

Sold by

Magnuson Donald L and Magnuson Lynn J

Bought by

Magnuson Donald and Magnuson Lynn

Current Estimated Value

Purchase Details

Closed on

Dec 13, 2009

Sold by

Saguaro Forest #45 Llc

Bought by

Magnuson Donald L and Magnuson Lynn J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,375,500

Interest Rate

5.25%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 10, 2004

Sold by

Mcadam Charles V

Bought by

Saguaro Forest #45 Llc

Purchase Details

Closed on

Nov 14, 2003

Sold by

Mcadam Cynthia L

Bought by

Mcadam Charles V

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Magnuson Donald | -- | None Available | |

| Magnuson Donald L | $1,965,000 | Security Title Agency | |

| Saguaro Forest #45 Llc | $625,000 | Tsa Title Agency | |

| Mcadam Charles V | -- | Tsa Title Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Magnuson Donald L | $1,375,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,754 | $252,593 | -- | -- |

| 2024 | $12,349 | $240,565 | -- | -- |

| 2023 | $12,349 | $272,510 | $54,500 | $218,010 |

| 2022 | $11,951 | $269,280 | $53,850 | $215,430 |

| 2021 | $12,937 | $266,420 | $53,280 | $213,140 |

| 2020 | $12,893 | $249,900 | $49,980 | $199,920 |

| 2019 | $12,419 | $234,680 | $46,930 | $187,750 |

| 2018 | $12,029 | $216,330 | $43,260 | $173,070 |

| 2017 | $11,495 | $208,800 | $41,760 | $167,040 |

| 2016 | $11,533 | $193,750 | $38,750 | $155,000 |

| 2015 | $10,845 | $180,150 | $36,030 | $144,120 |

Source: Public Records

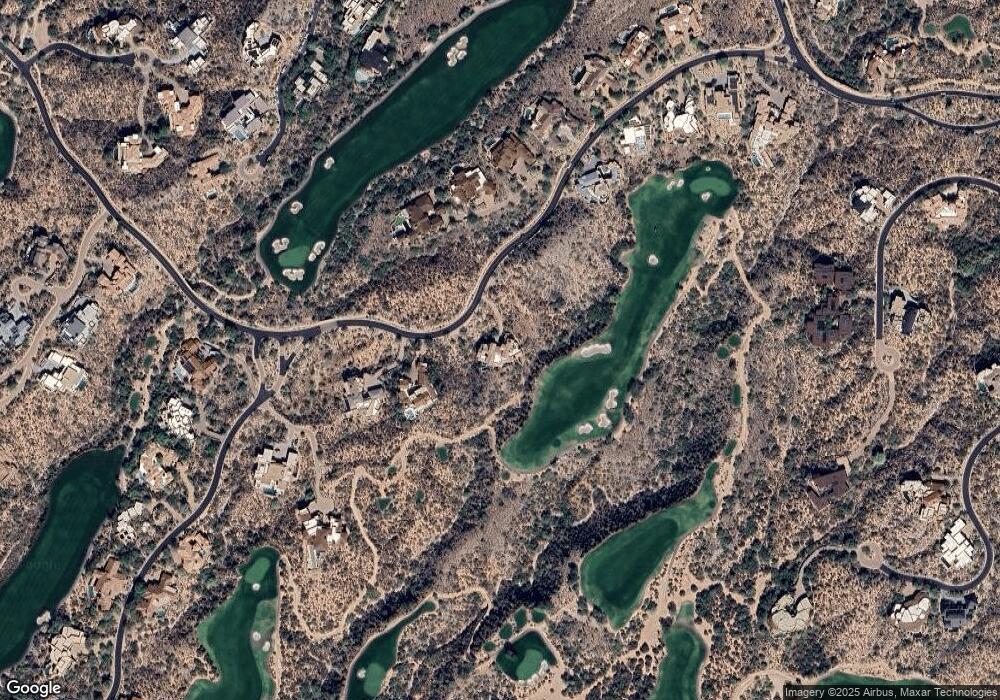

Map

Nearby Homes

- 10020 E Relic Rock Rd Unit 18

- 41399 N 96th St

- 40980 N 97th St Unit 61

- 9808 E Honey Mesquite Dr

- 41248 N 96th St

- 41324 N 95th St Unit 278

- 41862 N 101st Place Unit 103

- 41927 N Saguaro Forest Dr Unit 107

- 41996 N 100th Way Unit 165

- 9675 E Legacy Ridge Rd Unit 81

- 40853 N 94th St Unit 271

- 41965 N Charbray Dr Unit 24

- 9444 E Brahma Rd Unit 14

- 41731 N Stone Cutter Dr

- 9312 E Brahma Rd Unit 12A

- 01 Red Rover Mine Rd --

- 39954 N 98th Way Unit 47

- 9264 E Brahma Rd Unit 12B

- 41966 N Stone Cutter Dr Unit 25

- 9514 E Madera Dr

- 9863 E Chiricahua Pass Unit 46

- 9847 E Chiricahua Pass Unit 47

- 9847 E Chiricahua Pass

- 9894 E Chiricahua Pass

- 9910 E Chiricahua Pass Unit 67

- 9910 E Chiricahua Pass

- 9926 E Chiricahua Pass Unit 68

- 9927 E Chiricahua Pass Unit 43

- 9942 E Chiricahua Pass Unit 69

- 41269 N 97th St Unit 49

- 41455 N Saguaro Forest Dr Unit 49

- 41455 N Saguaro Forest Dr

- 41173 N 97th St Unit 50

- 41173 N 97th St

- 9943 E Chiricahua Pass Unit 42

- 41228 N 97th St

- 9958 E Chiricahua Pass Unit 70

- 9959 E Chiricahua Pass Unit 41

- 41172 N 97th St Unit 63

- 9745 E Honey Mesquite Dr