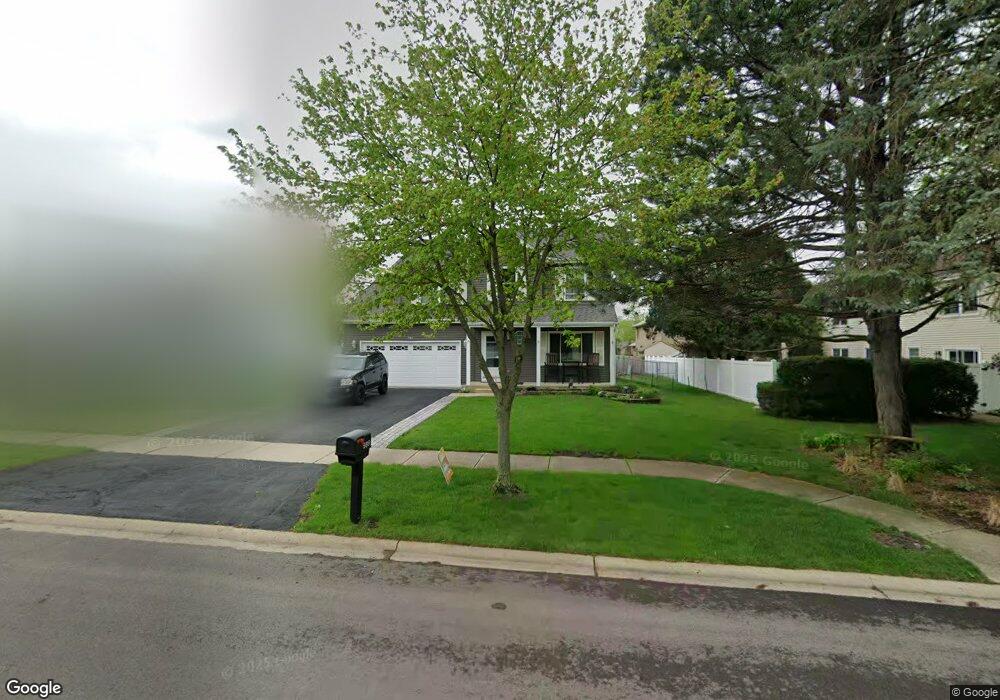

989 Legrande Ave Aurora, IL 60506

Edgelawn Randall NeighborhoodEstimated Value: $375,937 - $394,000

4

Beds

3

Baths

2,000

Sq Ft

$191/Sq Ft

Est. Value

About This Home

This home is located at 989 Legrande Ave, Aurora, IL 60506 and is currently estimated at $382,234, approximately $191 per square foot. 989 Legrande Ave is a home located in Kane County with nearby schools including Smith Elementary School, Jewel Middle School, and West Aurora High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 29, 2017

Sold by

Hauk Richard L and Hauk Diane M

Bought by

Bjork Lorri

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,232

Outstanding Balance

$171,546

Interest Rate

4.12%

Mortgage Type

FHA

Estimated Equity

$210,688

Purchase Details

Closed on

Mar 31, 2005

Sold by

Somhell Timothy L and Somhell Christina M

Bought by

Hauk Richard L and Hauk Diane M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,000

Interest Rate

5.89%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Mar 27, 1995

Sold by

Lasalle National Trust Na

Bought by

Somheil Timothy L and Somheil Christina M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,800

Interest Rate

8.25%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bjork Lorri | $208,000 | Chicago Title Insurance Co | |

| Hauk Richard L | $215,000 | Chicago Title Insurance Comp | |

| Somheil Timothy L | $143,500 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bjork Lorri | $204,232 | |

| Previous Owner | Hauk Richard L | $172,000 | |

| Previous Owner | Somheil Timothy L | $135,800 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,303 | $112,857 | $18,563 | $94,294 |

| 2023 | $7,952 | $100,837 | $16,586 | $84,251 |

| 2022 | $7,613 | $92,004 | $15,133 | $76,871 |

| 2021 | $7,278 | $85,657 | $14,089 | $71,568 |

| 2020 | $6,887 | $79,563 | $13,087 | $66,476 |

| 2019 | $6,727 | $74,795 | $12,125 | $62,670 |

| 2018 | $6,213 | $68,231 | $11,215 | $57,016 |

| 2017 | $7,189 | $75,848 | $10,334 | $65,514 |

| 2016 | $6,346 | $65,737 | $8,858 | $56,879 |

| 2015 | -- | $57,101 | $7,617 | $49,484 |

| 2014 | -- | $51,999 | $7,326 | $44,673 |

| 2013 | -- | $54,781 | $7,221 | $47,560 |

Source: Public Records

Map

Nearby Homes

- 1229 Yellowpine Dr

- 833 Sheldon Ave

- 1387 S Glen Cir Unit D

- 1351 Monomoy St Unit D

- 847 Foran Ln

- 833 N Randall Rd Unit C4

- 811 N Randall Rd Unit B

- 1358 Monomoy St Unit A

- 1421 Heather Dr

- 742 N Glenwood Place

- 1039 S Pleasure Ct

- 735 Westgate Dr

- 991 Sapphire Ln

- 959 Sapphire Ln

- 975 Sapphire Ln

- 963 Sapphire Ln

- 987 Sapphire Ln

- 983 Sapphire Ln

- 980 Sapphire Ln

- 968 Sapphire Ln

- 997 Legrande Ave

- 1155 Colorado Ave

- 970 N Commonwealth Ave

- 1005 Legrande Ave

- 980 N Commonwealth Ave

- 1141 Colorado Ave Unit 2

- 990 N Commonwealth Ave

- 992 Legrande Ave

- 1013 Legrande Ave

- 1191 Colorado Ave

- 1210 Cottonwood Dr

- 1000 N Commonwealth Ave

- 1150 Colorado Ave

- 1164 Colorado Ave

- 1021 Legrande Ave

- 1140 Colorado Ave

- 1170 Colorado Ave

- 1010 N Commonwealth Ave

- 1218 Cottonwood Dr

- 1203 Colorado Ave Unit 2

Your Personal Tour Guide

Ask me questions while you tour the home.