9925 Edgewood Ln Unit 8B Cincinnati, OH 45241

West Chester Township NeighborhoodEstimated Value: $221,000 - $246,000

2

Beds

2

Baths

1,086

Sq Ft

$217/Sq Ft

Est. Value

About This Home

This home is located at 9925 Edgewood Ln Unit 8B, Cincinnati, OH 45241 and is currently estimated at $235,310, approximately $216 per square foot. 9925 Edgewood Ln Unit 8B is a home located in Butler County with nearby schools including Stewart Elementary School, Princeton Community Middle School, and Princeton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 28, 2025

Sold by

Brown Charles Joseph

Bought by

Miller Darrell D and Miller Shannon

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$199,828

Interest Rate

6.75%

Mortgage Type

New Conventional

Estimated Equity

$35,482

Purchase Details

Closed on

Sep 20, 2019

Sold by

Bobinger Linda S and White Darrell

Bought by

Brown Charles Joseph

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,585

Interest Rate

3.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 6, 2009

Sold by

Bockhold Jerome and Bockhold Rebecca

Bought by

Bobinger Linda S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,200

Interest Rate

5.09%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 29, 2002

Sold by

Welage Brad M

Bought by

Bockhold Jerome and Bockhold Rebecca

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$113,390

Interest Rate

6.87%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 13, 1999

Sold by

The Dress Company

Bought by

Welage Brad M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,150

Interest Rate

7.54%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miller Darrell D | $250,000 | None Listed On Document | |

| Miller Darrell D | $250,000 | None Listed On Document | |

| Brown Charles Joseph | $130,500 | None Available | |

| Bobinger Linda S | $101,500 | Prominent Title Agency Llc | |

| Bockhold Jerome | $116,000 | -- | |

| Welage Brad M | $111,745 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Miller Darrell D | $200,000 | |

| Closed | Miller Darrell D | $200,000 | |

| Previous Owner | Brown Charles Joseph | $126,585 | |

| Previous Owner | Bobinger Linda S | $81,200 | |

| Previous Owner | Bockhold Jerome | $113,390 | |

| Previous Owner | Welage Brad M | $106,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,953 | $56,800 | $8,750 | $48,050 |

| 2023 | $1,935 | $56,800 | $8,750 | $48,050 |

| 2022 | $1,694 | $39,990 | $8,750 | $31,240 |

| 2021 | $1,619 | $39,990 | $8,750 | $31,240 |

| 2020 | $1,695 | $39,990 | $8,750 | $31,240 |

| 2019 | $2,470 | $31,440 | $8,750 | $22,690 |

| 2018 | $1,354 | $31,440 | $8,750 | $22,690 |

| 2017 | $1,369 | $31,440 | $8,750 | $22,690 |

| 2016 | $1,253 | $27,960 | $8,750 | $19,210 |

| 2015 | $1,243 | $27,960 | $8,750 | $19,210 |

| 2014 | $1,430 | $27,960 | $8,750 | $19,210 |

| 2013 | $1,430 | $33,030 | $10,500 | $22,530 |

Source: Public Records

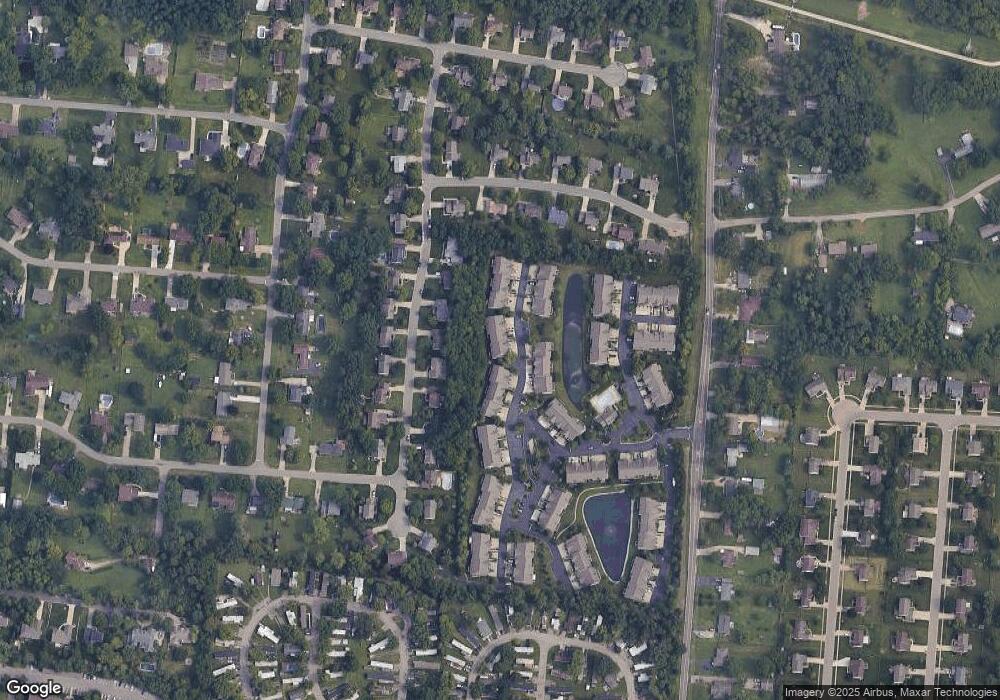

Map

Nearby Homes

- 7199 Fieldstone Ct

- 9609 Cedar Knoll Dr

- 9669 Old Stable Ct

- 6712 Hummingbird Dr

- 9729 Old Stable Ct

- 9731 Montclaire Dr

- 9509 Butler Warren Rd

- 8391 Dimmick Rd

- 12152 3rd Ave

- 12121 3rd Ave

- 12105 4th Ave

- 6424 Camp Superior Dr

- 8830 Butler Warren Rd

- 8820 Butler Warren Rd

- 7879 Hickory Hill Ln

- 9616 Holly Leaf Cir

- 6520 Lewis Clark Trail

- 8178 Stone Dr

- 8141 Stone Dr

- 7774 School Rd

- 9925 Edgewood Ln Unit D

- 9925 Edgewood Ln

- 9925 Edgewood Ln Unit 8C

- 9925 Edgewood Ln Unit 8A

- 9925 Edgewood Ln Unit 15A

- 9925 Edgewood Ln Unit C

- 9925 Edgewood Ln Unit A

- 9925 Edgewood Ln Unit B

- 9925 Edgewood Ln Unit E

- 9921 Edgewood Ln

- 9921 Edgewood Ln Unit 8F

- 9921 Edgewood Ln Unit 8H

- 9921 Edgewood Ln Unit G

- 9921 Edgewood Ln Unit H

- 9921 Edgewood Ln Unit F

- 9928 Edgewood Ln Unit 9E

- 9928 Edgewood Ln

- 9928 Edgewood Ln

- 9928 Edgewood Ln

- 9928 Edgewood Ln Unit 9F