999 SW 146th Terrace Unit 1 Pembroke Pines, FL 33027

Hollywood Lakes Country Club NeighborhoodEstimated Value: $561,979 - $580,000

3

Beds

3

Baths

2,241

Sq Ft

$254/Sq Ft

Est. Value

About This Home

This home is located at 999 SW 146th Terrace Unit 1, Pembroke Pines, FL 33027 and is currently estimated at $568,495, approximately $253 per square foot. 999 SW 146th Terrace Unit 1 is a home located in Broward County with nearby schools including Silver Shores Elementary School, Walter C. Young Middle School, and Charles W Flanagan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 15, 2022

Sold by

Muller Freddy I

Bought by

Romero Orlando

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$443,454

Interest Rate

6%

Mortgage Type

Balloon

Purchase Details

Closed on

May 31, 2011

Sold by

Us Bank National Association

Bought by

Muller Freddy I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$179,200

Interest Rate

4.62%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 13, 2010

Sold by

Aular Annielys and Urdaneta Herving

Bought by

U S Bank National Association

Purchase Details

Closed on

Dec 29, 2006

Sold by

Standard Pacific Of South Florida

Bought by

Urdaneta Herving and Aular Annielys

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$322,637

Interest Rate

7.75%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Romero Orlando | $470,300 | New Title Company Name | |

| Muller Freddy I | $224,000 | Attorney | |

| U S Bank National Association | -- | None Available | |

| Urdaneta Herving | $403,300 | Universal Land Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Romero Orlando | $443,454 | |

| Previous Owner | Muller Freddy I | $179,200 | |

| Previous Owner | Urdaneta Herving | $322,637 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $444,540 | -- | -- |

| 2024 | $8,588 | $432,020 | $49,420 | $370,020 |

| 2023 | $8,588 | $419,440 | $49,420 | $370,020 |

| 2022 | $8,739 | $388,550 | $0 | $0 |

| 2021 | $7,989 | $353,230 | $49,420 | $303,810 |

| 2020 | $7,873 | $345,480 | $49,420 | $296,060 |

| 2019 | $8,334 | $365,910 | $49,420 | $316,490 |

| 2018 | $7,787 | $343,370 | $49,420 | $293,950 |

| 2017 | $5,044 | $239,600 | $0 | $0 |

| 2016 | $5,035 | $234,680 | $0 | $0 |

| 2015 | $5,094 | $233,050 | $0 | $0 |

| 2014 | $5,088 | $231,210 | $0 | $0 |

| 2013 | -- | $250,230 | $49,420 | $200,810 |

Source: Public Records

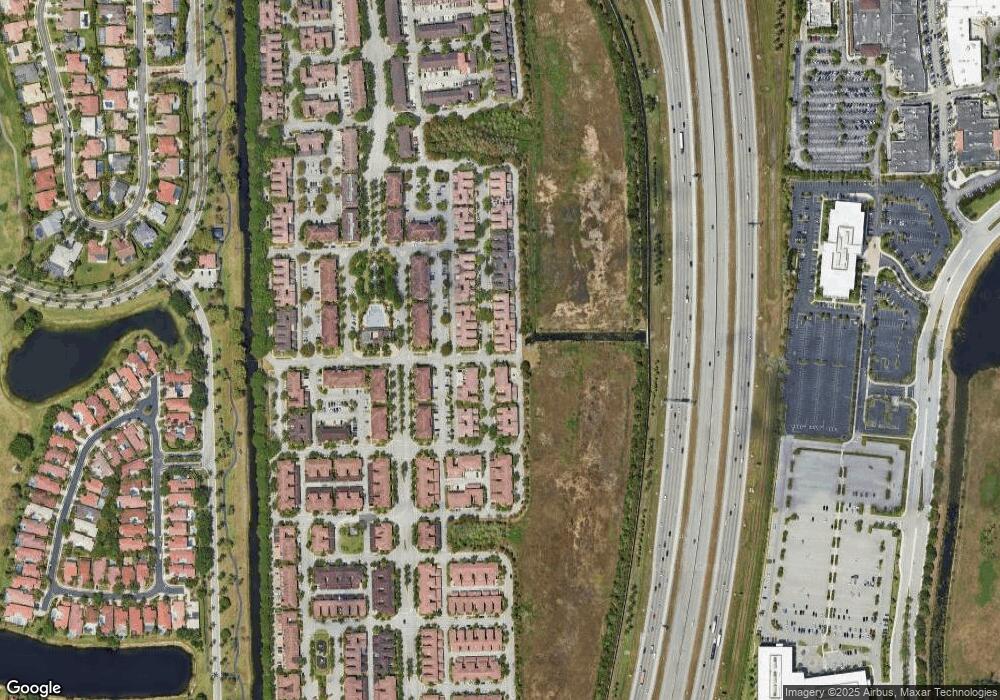

Map

Nearby Homes

- 817 SW 147th Ave Unit 817

- 14749 SW 9th St Unit 3110

- 14774 SW 10th St Unit 10502

- 14776 SW 10th St Unit 10501

- 14745 SW 9th St Unit 3109

- 1112 SW 146th Terrace

- 706 SW 147th Ave

- 803 SW 147th Terrace

- 14614 SW 6th St Unit 611

- 14615 SW 14th St Unit 14615

- 531 SW 147th Ave Unit 24

- 14709 SW 6th St

- 1302 SW 147th Terrace

- 14634 SW 5th St Unit 15

- 1404 SW 147th Ave

- 14637 SW 15th St

- 1413 SW 147th Terrace

- 14620 SW 15th St

- 14650 SW 15th St

- 430 SW 147th Ave Unit 5015

- 999 SW 146th Terrace Unit 999

- 997 SW 146th Terrace

- 995 SW 146th Terrace Unit 3

- 1001 SW 146th Terrace

- 975 SW 146th Terrace

- 1003 SW 146th Terrace Unit 5304

- 973 SW 146th Terrace

- 949 SW 146th Te

- 1023 SW 146th Terrace Unit 5303

- 1023 SW 146th Terrace Unit 1023

- 978 SW 146th Terrace

- 1002 SW 146th Terrace Unit 5201

- 953 SW 146th Terrace

- 976 SW 146th Terrace Unit 976

- 976 SW 146th Terrace

- 976 SW 146th Terrace Unit 4

- 1025 SW 146th Terrace

- 962 SW 146th Terrace

- 1004 SW 146th Terrace Unit 1004