9990 Hyland Croy Rd Plain City, OH 43064

Estimated Value: $559,000 - $631,000

3

Beds

3

Baths

2,244

Sq Ft

$269/Sq Ft

Est. Value

About This Home

This home is located at 9990 Hyland Croy Rd, Plain City, OH 43064 and is currently estimated at $603,860, approximately $269 per square foot. 9990 Hyland Croy Rd is a home located in Union County with nearby schools including Glacier Ridge Elementary School, Willard Grizzell Middle School, and Dublin Jerome High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2017

Sold by

Sparks Sparks F and Sparks Elaine A

Bought by

Paszke Jamon M and Paszke Megan K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$254,000

Outstanding Balance

$211,943

Interest Rate

3.96%

Mortgage Type

New Conventional

Estimated Equity

$391,917

Purchase Details

Closed on

Oct 14, 2005

Sold by

Sparks Steven C and Sparks Vicki L

Bought by

Sparks F Edward and Sparks Elaine A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$290,000

Interest Rate

5.25%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Paszke Jamon M | -- | None Available | |

| Sparks F Edward | $240,000 | Valley Title & Escrow Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Paszke Jamon M | $254,000 | |

| Previous Owner | Sparks F Edward | $290,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,556 | $139,480 | $25,030 | $114,450 |

| 2023 | $8,556 | $139,480 | $25,030 | $114,450 |

| 2022 | $8,585 | $139,480 | $25,030 | $114,450 |

| 2021 | $7,337 | $113,190 | $19,250 | $93,940 |

| 2020 | $6,261 | $100,730 | $19,250 | $81,480 |

| 2019 | $6,901 | $100,730 | $19,250 | $81,480 |

| 2018 | $5,695 | $81,150 | $14,530 | $66,620 |

| 2017 | $5,195 | $81,020 | $14,530 | $66,490 |

| 2016 | $5,561 | $81,020 | $14,530 | $66,490 |

| 2015 | $5,119 | $73,190 | $14,530 | $58,660 |

| 2014 | $5,119 | $72,430 | $14,530 | $57,900 |

| 2013 | $5,216 | $72,430 | $14,530 | $57,900 |

Source: Public Records

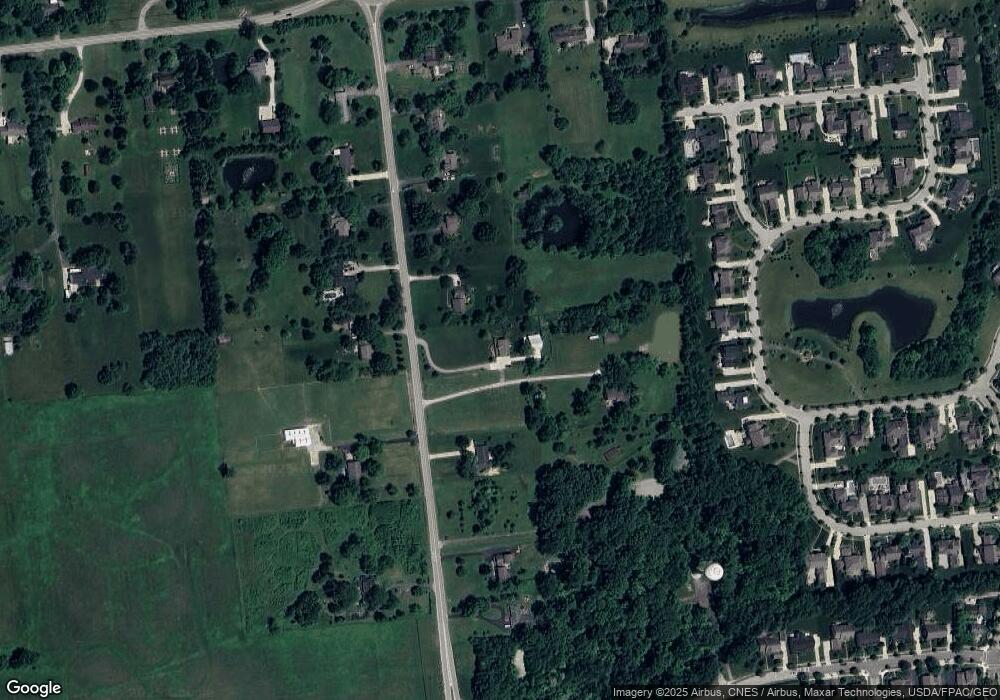

Map

Nearby Homes

- 7379 Brock Rd

- 9238 Golden Rose Way

- 9351 Burnett Ln

- 9653 Persimmon Place

- 9533 Tartan Ridge Ct

- 9707 Persimmon Place

- 10520 Berry Ln

- 6754 Baronet Blvd

- 10543 Calla Lily Way

- 10541 Clare Way

- 10540 Berry Ln

- Promenade Plan at The Courtyards at White Oaks

- Palazzo Plan at The Courtyards at White Oaks

- Torino Plan at The Courtyards at White Oaks

- Provenance Plan at The Courtyards at White Oaks

- Portico Plan at The Courtyards at White Oaks

- Verona Plan at The Courtyards at White Oaks

- 7026 Claymore Dr

- 7018 Claymore Dr

- 7010 Claymore Dr

- 10019 Hyland Croy Rd

- 9980 Hyland Croy Rd

- 10050 Hyland Croy Rd

- 10057 Hyland Croy Rd

- 10070 Hyland Croy Rd

- 9940 Hyland Croy Rd

- 10081 Hyland Croy Rd

- 9949 Hyland Croy Rd

- 10098 Hyland Croy Rd

- 9910 Hyland-Croy Rd

- 10121 Hyland Croy Rd

- 9900 Hyland Croy Rd

- 9870 Hyland Croy Rd

- 10150 Hyland Croy Rd

- 10154 Hyland Croy Rd

- 9855 Hyland Croy Rd

- 10186 Hyland Croy Rd

- 9836 Hyland Croy Rd

- 7219 Wilton Chase St

- 7227 Wilton Chase