S9329 Cross Rd Sauk City, WI 53583

Estimated Value: $552,000 - $744,000

--

Bed

3

Baths

--

Sq Ft

29.19

Acres

About This Home

This home is located at S9329 Cross Rd, Sauk City, WI 53583 and is currently estimated at $679,266. S9329 Cross Rd is a home located in Sauk County with nearby schools including Sauk Prairie Middle School and Sauk Prairie High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 3, 2024

Sold by

Barnes Ryan and Foster Kali

Bought by

Warren Craig and Warren Courtney J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$395,000

Outstanding Balance

$385,303

Interest Rate

6.73%

Mortgage Type

New Conventional

Estimated Equity

$293,963

Purchase Details

Closed on

Sep 1, 2022

Sold by

Stephanie Quinn

Bought by

Barnes Ryan and Foster Kali

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$473,600

Interest Rate

5.54%

Mortgage Type

Balloon

Purchase Details

Closed on

Jul 6, 2016

Sold by

Moyer Dennis J

Bought by

Griesen Hans and Griesen Dorthe

Purchase Details

Closed on

Dec 4, 2015

Sold by

Moyer Dennis J

Bought by

John M Lohr Family Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Warren Craig | $695,000 | Essential Title | |

| Barnes Ryan | $592,000 | Knight Barry Title | |

| Griesen Hans | $69,000 | None Available | |

| John M Lohr Family Trust | $1,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Warren Craig | $395,000 | |

| Previous Owner | Barnes Ryan | $473,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,597 | $499,100 | $40,800 | $458,300 |

| 2023 | $6,417 | $498,900 | $40,600 | $458,300 |

| 2022 | $5,252 | $262,300 | $11,700 | $250,600 |

| 2021 | $5,147 | $262,500 | $11,900 | $250,600 |

| 2020 | $5,324 | $262,300 | $11,700 | $250,600 |

| 2019 | $5,079 | $262,500 | $11,900 | $250,600 |

| 2018 | $4,914 | $262,500 | $11,900 | $250,600 |

| 2017 | $36 | $1,900 | $1,900 | $0 |

| 2016 | $39 | $2,000 | $2,000 | $0 |

| 2015 | $41 | $2,000 | $2,000 | $0 |

| 2014 | $38 | $2,000 | $2,000 | $0 |

Source: Public Records

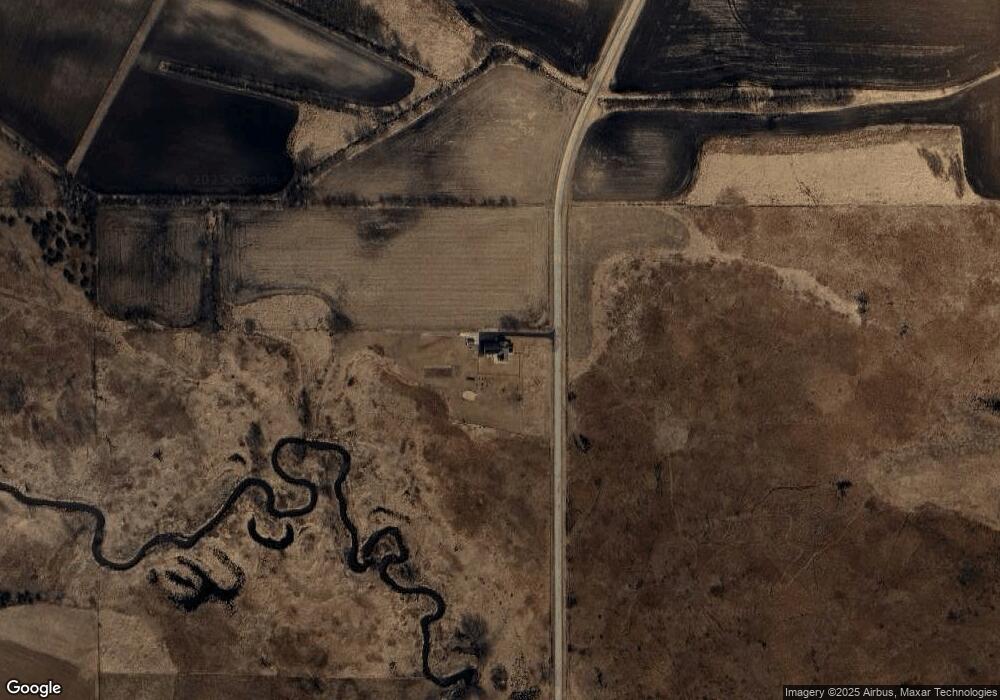

Map

Nearby Homes

- E7498 Mill Rd

- S8302A Denzer Rd

- E9275 Prairie Rd

- S9331 Valley View Rd

- S7711 Freedom Rd

- S10970 Butternut Rd

- 125A Swiss Valley Rd

- E6367 Cold Spring Rd

- 0 Plainview Rd

- Lot 27 Westbrook Dr

- 0 Westbrook Dr

- 985 Fairway Cir

- 1060 Oak St

- 1115 Clover St

- 1180 Clover St

- 1545 Honey Creek Dr

- 1155 Nachreiner Ave

- 1175 Cherry St

- 208 Falcon Ct

- 237 Falcon Ct

- S9329 Cross Rd

- 29.96 Ac Cross Rd

- 0 Cross Rd Unit 1593831

- 0 Cross Rd Unit 1613631

- S9478 County Road C

- S9270 Cedar Rd

- E7722 County Road Pf

- E8058 Elm Rd

- Parcel #6 63+ - Acres Elm Rd

- E8210 Elm Rd

- E7618 County Road Pf

- L1 Elm Rd

- E8119 Elm Rd

- E7568 County Road Pf

- E7568 County Road Pf

- E7860 County Road Pf

- E7417 Ochsner Rd

- 68.53 Ac Elm Rd

- 40 Ac Elm Rd

- 60.07 Ac Elm Rd