TR545-NR Dunbar Dr Dunbar, PA 15431

Dunbar Township NeighborhoodEstimated Value: $128,000 - $172,000

3

Beds

1

Bath

1,008

Sq Ft

$141/Sq Ft

Est. Value

About This Home

This home is located at TR545-NR Dunbar Dr, Dunbar, PA 15431 and is currently estimated at $142,446, approximately $141 per square foot. TR545-NR Dunbar Dr is a home with nearby schools including Connellsville Area Senior High School, Conn Area Catholic School, and Geibel Catholic Middle/High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 19, 2024

Sold by

Cebulak Ronald E and Cebulak Ronald E

Bought by

Shultz Brittany N and Shultz Anthony C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$113,131

Outstanding Balance

$111,249

Interest Rate

6.63%

Mortgage Type

New Conventional

Estimated Equity

$31,197

Purchase Details

Closed on

Jul 27, 2022

Sold by

Cebulak Sr Ronald E

Bought by

Cebulak Ronald E

Purchase Details

Closed on

Jul 2, 2008

Sold by

Threshhold Housing Development Inc

Bought by

Henry Ncole

Purchase Details

Closed on

Jan 1, 1968

Bought by

Cebulak Ronald E and Cebulak Delores J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shultz Brittany N | $110,000 | Experienced Closing Services | |

| Cebulak Ronald E | -- | -- | |

| Henry Ncole | $27,777 | None Available | |

| Cebulak Ronald E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Shultz Brittany N | $113,131 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $613 | $26,015 | $10,800 | $15,215 |

| 2024 | $584 | $26,015 | $10,800 | $15,215 |

| 2023 | $1,123 | $26,015 | $10,800 | $15,215 |

| 2022 | $1,123 | $26,015 | $10,800 | $15,215 |

| 2021 | $1,123 | $26,015 | $10,800 | $15,215 |

| 2020 | $1,123 | $26,015 | $10,800 | $15,215 |

| 2019 | $1,058 | $26,015 | $10,800 | $15,215 |

| 2018 | $1,058 | $26,015 | $10,800 | $15,215 |

| 2017 | $1,058 | $26,015 | $10,800 | $15,215 |

| 2016 | -- | $26,015 | $10,800 | $15,215 |

| 2015 | -- | $26,015 | $10,800 | $15,215 |

| 2014 | -- | $52,030 | $21,600 | $30,430 |

Source: Public Records

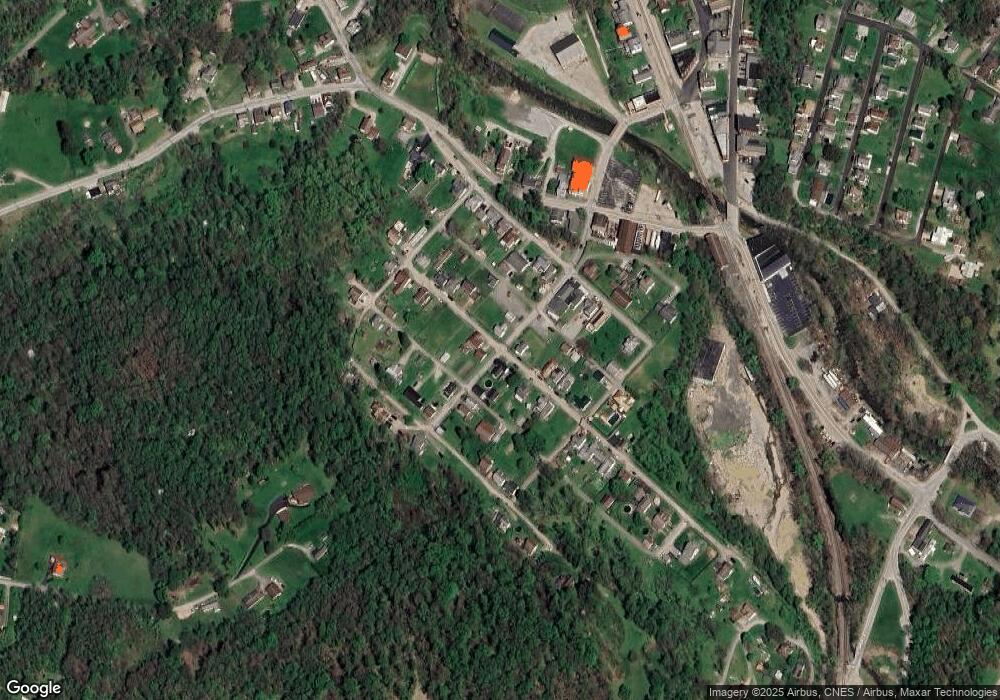

Map

Nearby Homes

- 135 Friendship Ln

- . Main St

- 9 Church St

- 103 Memorial St

- 57 Connellsville St

- 128 Connellsville St

- 34 Walnut Ave

- 42 Walnut Ave

- 48 2nd St

- 3117 W Crawford Ave

- 161 Cambria St

- 25 Shear St

- 502 Ferguson Rd

- 220 Oglevee Ln

- 1047 Cinder Rd

- 0 Ferguson Rd

- 14 Picketts Ln

- 1019 Morrell Ave

- 1823 Baldridge Ave

- 235 Little Summit Rd