W187S7032 Gold Dr Muskego, WI 53150

Estimated Value: $738,000 - $912,000

2

Beds

2

Baths

1,432

Sq Ft

$599/Sq Ft

Est. Value

About This Home

This home is located at W187S7032 Gold Dr, Muskego, WI 53150 and is currently estimated at $858,170, approximately $599 per square foot. W187S7032 Gold Dr is a home located in Waukesha County with nearby schools including Mill Valley Elementary School, Muskego Lakes Middle School, and Muskego High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 31, 2017

Sold by

Murphy Reid A

Bought by

Felch Fred J and Felch Mary

Current Estimated Value

Purchase Details

Closed on

Jul 1, 2015

Sold by

Naus Patricia R

Bought by

Murphy Reid A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$306,800

Interest Rate

3.62%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Nov 17, 2008

Sold by

Rosenow Patricia A and Naus Patricia R

Bought by

Naus Thomas R and Naus Patricia R

Purchase Details

Closed on

Jun 19, 1997

Sold by

Szczesny Noel E

Bought by

Rosenow Robert E and Rosenow Patricia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

8%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Felch Fred J | $475,000 | None Available | |

| Murphy Reid A | $191,800 | None Available | |

| Murphy Reid A | $191,800 | None Available | |

| Naus Thomas R | -- | None Available | |

| Rosenow Robert E | $208,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Murphy Reid A | $306,800 | |

| Previous Owner | Rosenow Robert E | $150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,472 | $599,300 | $347,300 | $252,000 |

| 2023 | $7,407 | $599,300 | $347,300 | $252,000 |

| 2022 | $7,232 | $599,300 | $347,300 | $252,000 |

| 2021 | $7,184 | $599,300 | $347,300 | $252,000 |

| 2020 | $7,062 | $472,600 | $303,600 | $169,000 |

| 2019 | $6,657 | $472,600 | $303,600 | $169,000 |

| 2018 | $6,724 | $472,600 | $303,600 | $169,000 |

| 2017 | $7,714 | $472,600 | $303,600 | $169,000 |

| 2016 | $6,240 | $392,600 | $293,500 | $99,100 |

| 2015 | $6,289 | $392,600 | $293,500 | $99,100 |

| 2014 | -- | $392,600 | $293,500 | $99,100 |

| 2013 | -- | $392,600 | $293,500 | $99,100 |

Source: Public Records

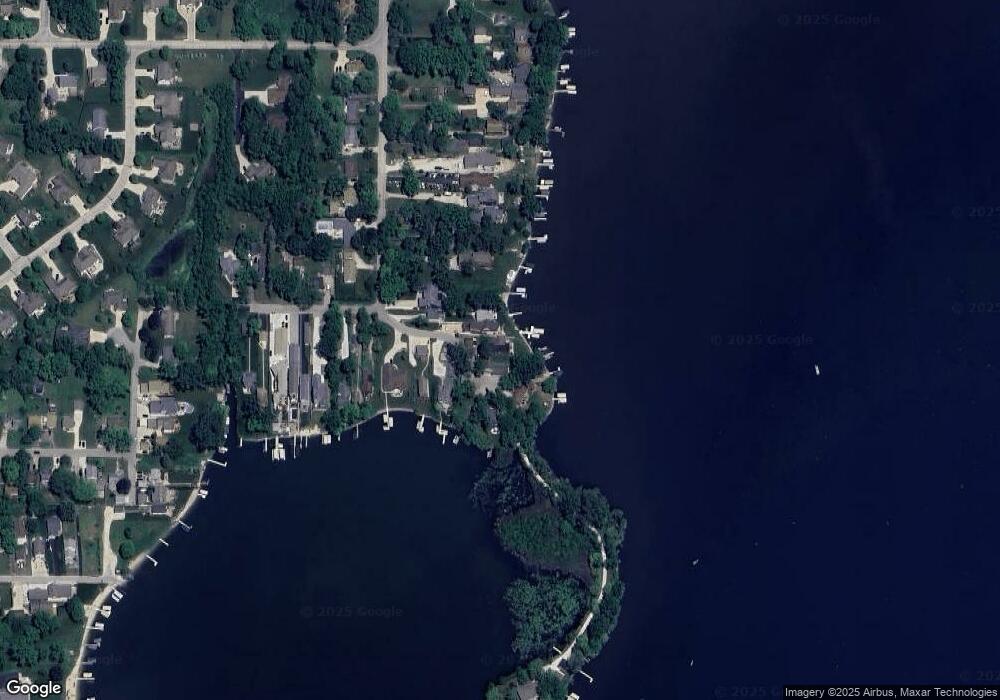

Map

Nearby Homes

- S70W19133 Kenwood Dr

- W183S6558 Jewel Crest Dr

- Lt2 Racine Ave

- W188S7598 Oak Grove Dr

- W188S7634 Oak Grove Dr

- W177S7495 Harbor Cir Unit 6D

- S76W19414 Prospect Dr

- S70W20099 Adrian Dr

- S77W19351 Lakewood Dr Unit 31

- S73W17268 Lake Dr

- W171S7452 Lannon Dr

- Lt4 Lannon Dr

- W170S7361 Parkland Dr Unit 13

- The Wicklow Plan at Kirkland Crossing

- The Walnut Plan at Kirkland Crossing

- The Sycamore Plan at Kirkland Crossing

- The Sweetbriar Plan at Kirkland Crossing

- The Mulberry Plan at Kirkland Crossing

- The Savannah Plan at Kirkland Crossing

- The Monterey Plan at Kirkland Crossing

- S70W18786 Gold Dr

- W187S7040 Gold Dr

- W186S7048 Gold Dr

- S70W18739 Gold Dr

- W187S7041 Gold Dr

- W187S7045 Gold Dr

- W187S7008 Gold Dr

- W187S6996 Gold Dr

- S70W18761 Gold Dr

- S70W18785 Gold Dr

- W187S6984 Gold Dr

- W187S6974 Gold Dr

- S70W18805 Gold Dr

- W187S6966 Gold Dr

- S70W18819 Gold Dr

- W187S6960 Gold Dr

- W188S7001 Gold Dr

- S70W18837 Gold Dr

- W187S6952 Gold Dr

- W188S6983 Gold Dr