0 Bear Scat Trail Unit 711939 Durango, CO 81301

Estimated Value: $1,327,000 - $1,744,000

4

Beds

3

Baths

3,553

Sq Ft

$417/Sq Ft

Est. Value

About This Home

This home is located at 0 Bear Scat Trail Unit 711939, Durango, CO 81301 and is currently estimated at $1,480,665, approximately $416 per square foot. 0 Bear Scat Trail Unit 711939 is a home located in La Plata County with nearby schools including Needham Elementary School, Miller Middle School, and Durango High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 7, 2017

Sold by

Tannehill Scott P and Tannehill Jennifer D

Bought by

Tannehill King Trust

Current Estimated Value

Purchase Details

Closed on

Mar 31, 2017

Sold by

Badalati James J and Badalati Jill L

Bought by

Tannehill Scott P and King Jennifer D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$637,500

Outstanding Balance

$521,704

Interest Rate

3.62%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$958,961

Purchase Details

Closed on

Aug 23, 2010

Sold by

Arland Thomas C and Arland Winyfred M

Bought by

Badalati James J and Badalati Jill L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$600,000

Interest Rate

4.58%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 20, 2004

Bought by

Tannehill King Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tannehill King Trust | -- | None Available | |

| Tannehill Scott P | $845,000 | Land Title | |

| Badalati James J | $750,000 | Colorado Land Title Co | |

| Tannehill King Trust | $473,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tannehill Scott P | $637,500 | |

| Previous Owner | Badalati James J | $600,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,644 | $83,070 | $17,560 | $65,510 |

| 2024 | $3,132 | $72,780 | $15,690 | $57,090 |

| 2023 | $3,132 | $76,200 | $16,430 | $59,770 |

| 2022 | $2,811 | $64,640 | $13,900 | $50,740 |

| 2021 | $2,828 | $66,500 | $14,300 | $52,200 |

| 2020 | $2,611 | $63,220 | $13,280 | $49,940 |

| 2019 | $2,506 | $63,220 | $13,280 | $49,940 |

| 2018 | $2,317 | $59,160 | $15,200 | $43,960 |

| 2017 | $2,213 | $57,660 | $15,200 | $42,460 |

| 2016 | $2,064 | $58,200 | $16,430 | $41,770 |

| 2015 | $1,944 | $58,200 | $16,430 | $41,770 |

| 2014 | -- | $52,680 | $15,040 | $37,640 |

| 2013 | -- | $52,680 | $15,040 | $37,640 |

Source: Public Records

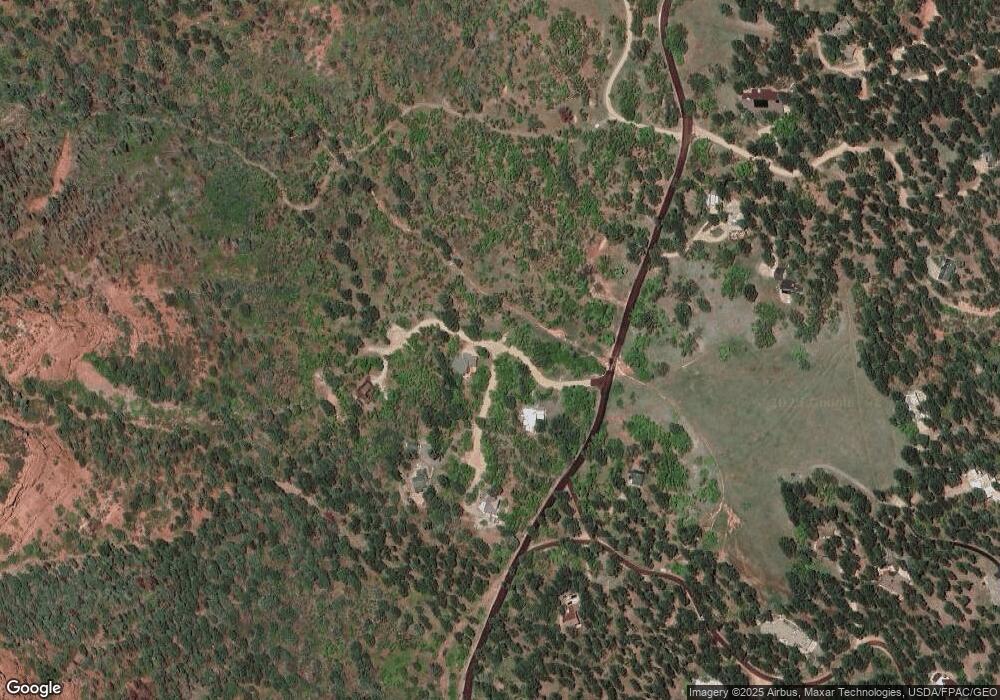

Map

Nearby Homes

- 66 Bear Scat Trail

- 108 Ponderosa Park Dr

- 5711 County Road 203

- 574 Horse Thief Ln

- 514 Horse Thief Ln

- 378 Horse Thief Ln

- 310 Horse Thief Ln

- 46 Elkview Ct

- 78 Elkview Ct

- 63 Fairway Dr

- 416, 422 & 428 Trimble Crossing Dr

- 402 & 408 Trimble Crossing Dr

- 380 & 390 Trimble Crossing Dr

- 275 & 213 Cr 252 Aka Trimble Ln

- 18 Fairway Dr

- 42 Fairway Dr

- 62 Elkview Ct

- 45 Fairway Dr

- 76 Fairway Dr

- 74 W Dalton Rd

- 66 Bear Scat Trail Unit Falls Creek Ranch

- 0 Bear Scat Trail Unit 729950

- 0 Bear Scat Trail Unit Falls Creek Ranch

- 0 Bear Scat Trail Unit 691494

- 0 Bear Scat Trail Unit 697933

- 0 Bear Scat Trail Unit 703296

- 143 Dyke Canyon Trail

- 20 Bear Scat Trail

- 0 Dyke Canyon Trail Unit 757812

- 0 Dyke Canyon Trail Unit 743832

- 0 Dyke Canyon Trail Unit 738701

- 21 Dyke Canyon Trail

- 40 Snowshoe Ln

- 55 Snowshoe Ln

- 0 Snowshoe Ln

- 0 Falls Creek Main

- 7531 Falls Creek Main

- 19 Saddle Ln

- 56 Saddle Ln

- 7400 Falls Creek Main