Estimated Value: $484,000 - $579,000

3

Beds

2

Baths

2,112

Sq Ft

$256/Sq Ft

Est. Value

About This Home

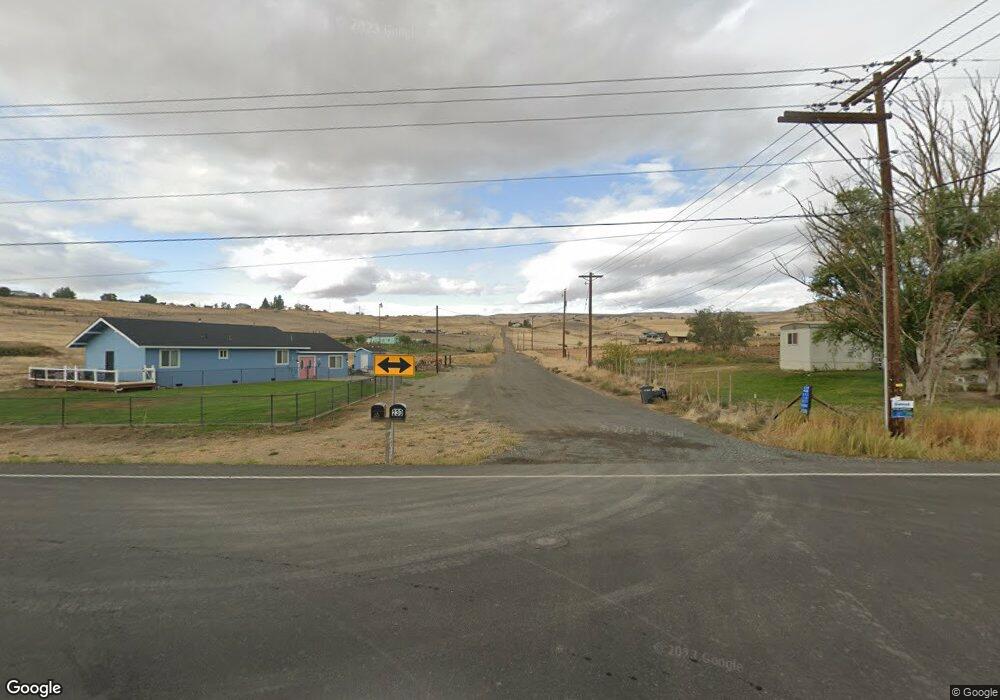

This home is located at 000 Beane Postma Lot #3 Rd, Moxee, WA 98936 and is currently estimated at $540,615, approximately $255 per square foot. 000 Beane Postma Lot #3 Rd is a home located in Yakima County with nearby schools including East Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 11, 2012

Sold by

Jones Kathleen and Jones Jason R

Bought by

Jones Jason R and Jones Kathleen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$265,000

Outstanding Balance

$113,150

Interest Rate

3.5%

Mortgage Type

New Conventional

Estimated Equity

$427,465

Purchase Details

Closed on

Aug 16, 2007

Sold by

Burgess Marvin and Burgess Cheryl

Bought by

Elrich Kathleen and Jones Jason R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$274,550

Interest Rate

6.73%

Mortgage Type

Construction

Purchase Details

Closed on

Feb 25, 2005

Sold by

Belaire Victor W

Bought by

Burgess Marvin and Burgess Cheryl

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jones Jason R | -- | Performance Title Inc | |

| Elrich Kathleen | $52,000 | Valley Title Company | |

| Burgess Marvin | $44,573 | Fidelity Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jones Jason R | $265,000 | |

| Closed | Elrich Kathleen | $274,550 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,136 | $511,600 | $67,800 | $443,800 |

| 2023 | $4,596 | $393,500 | $61,300 | $332,200 |

| 2022 | $4,272 | $347,700 | $59,700 | $288,000 |

| 2021 | $3,956 | $308,900 | $57,600 | $251,300 |

| 2019 | $3,269 | $250,300 | $57,600 | $192,700 |

| 2018 | $3,204 | $230,100 | $54,200 | $175,900 |

| 2017 | $3,142 | $237,600 | $57,000 | $180,600 |

| 2016 | $3,295 | $237,200 | $57,000 | $180,200 |

| 2015 | $3,295 | $238,900 | $57,000 | $181,900 |

| 2014 | $3,295 | $239,700 | $57,000 | $182,700 |

| 2013 | $3,295 | $239,700 | $57,000 | $182,700 |

Source: Public Records

Map

Nearby Homes

- 401 Schut Rd Unit 99

- NKA Mieras Rd

- NKA Desmarais Rd

- 505 Faucher Rd

- 110 Bravo St

- 104 Bravo St

- 206 S Zeus St

- 519 Lacoursiere St

- NKA High Point Landing

- 103 Lenseigne Place

- 207 Clemans Ave

- 204 Clemans Ave

- NKA Rivard Rd

- NKA 2013220-11002 12mg9a8rk0nh

- NKA 201320-12001 12mg9a8rk0nh

- NKA 201320-13001 12mg9a8rk0nh

- NKA 201320-42001 12mg9a8rk0nh

- NKA 201320-14001 12mg9a8rk0nh

- NKA 201320-41001 12mg9a8rk0nh

- 1303 Nightingale Rd

- 77 Beane Rd

- 205 Beane Rd

- 75 Beane Rd

- 73 Beane Rd

- 71 Beane Rd

- 71 Beane Rd Unit 5 Level Acres

- 201 Beane Rd

- 12381 Postma Rd

- 12411 Postma Rd

- NNA Beane Lot 1 Rd

- 203 Beane Rd

- NNA Beane Lot 3 Rd

- 12341 Postma Rd

- 12401 Postma Rd

- 30 Beane Rd

- 50 N Beane Rd

- 150 Beane Rd

- 12698 Postma Rd

- 220 Beane Rd

- 151 N Beane Rd

Your Personal Tour Guide

Ask me questions while you tour the home.