10 Lynne Rd Wareham, MA 02571

Wareham Center NeighborhoodEstimated Value: $599,375 - $683,000

2

Beds

2

Baths

1,660

Sq Ft

$390/Sq Ft

Est. Value

About This Home

This home is located at 10 Lynne Rd, Wareham, MA 02571 and is currently estimated at $647,594, approximately $390 per square foot. 10 Lynne Rd is a home located in Plymouth County with nearby schools including Tabor Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 28, 2007

Sold by

Fritschmann Robert D

Bought by

Leal Manuel A and Leal Maria C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,000

Outstanding Balance

$177,550

Interest Rate

6.24%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$470,044

Purchase Details

Closed on

Oct 22, 2004

Sold by

Porcaro Llc and Bachant William P

Bought by

Fritschmann Robert D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

5.85%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Leal Manuel A | $360,000 | -- | |

| Leal Manuel A | $360,000 | -- | |

| Fritschmann Robert D | $347,850 | -- | |

| Fritschmann Robert D | $347,850 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fritschmann Robert D | $288,000 | |

| Closed | Fritschmann Robert D | $288,000 | |

| Previous Owner | Fritschmann Robert D | $270,000 | |

| Previous Owner | Fritschmann Robert D | $125,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,559 | $533,500 | $120,900 | $412,600 |

| 2024 | $5,853 | $521,200 | $94,500 | $426,700 |

| 2023 | $5,148 | $465,700 | $85,900 | $379,800 |

| 2022 | $5,148 | $390,600 | $85,900 | $304,700 |

| 2021 | $5,064 | $376,500 | $85,900 | $290,600 |

| 2020 | $4,682 | $353,100 | $85,900 | $267,200 |

| 2019 | $4,699 | $353,600 | $82,700 | $270,900 |

| 2018 | $4,358 | $319,700 | $82,700 | $237,000 |

| 2017 | $4,036 | $300,100 | $82,700 | $217,400 |

| 2016 | $3,622 | $267,700 | $80,100 | $187,600 |

| 2015 | $3,499 | $267,700 | $80,100 | $187,600 |

| 2014 | $3,265 | $254,100 | $80,100 | $174,000 |

Source: Public Records

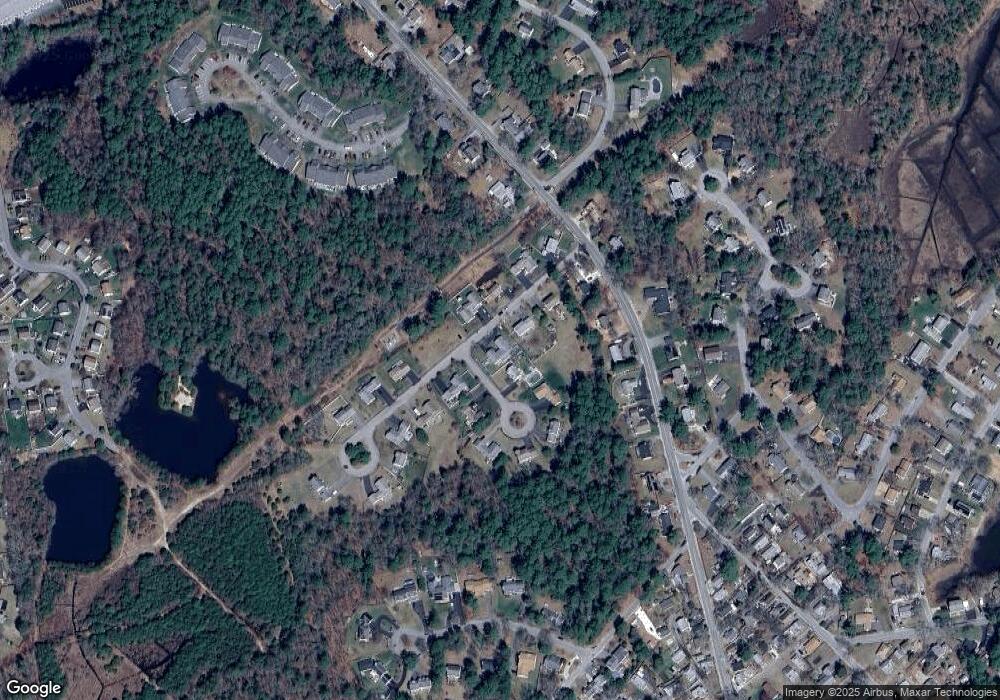

Map

Nearby Homes

- 15 Broadmarsh Ave

- 20 Grant St

- 6 Allen Ave

- 43 Shore Ave

- 21 Bayview St

- 58 Shady Ln

- 10 Barnes St

- 233 Marion Rd

- 1 Nimrod Way

- 6 Bourne Terrace

- 10 Longmeadow Dr

- 9 Woodville Way

- 0 Cromesett Rd (Off) Unit 73385395

- 14 Briarwood Dr

- 4 Roosevelt St

- 12 Taft St

- 437 Main St

- 10 Oak St

- 12 Oakdale St

- 110 Mayflower Ridge Dr

Your Personal Tour Guide

Ask me questions while you tour the home.