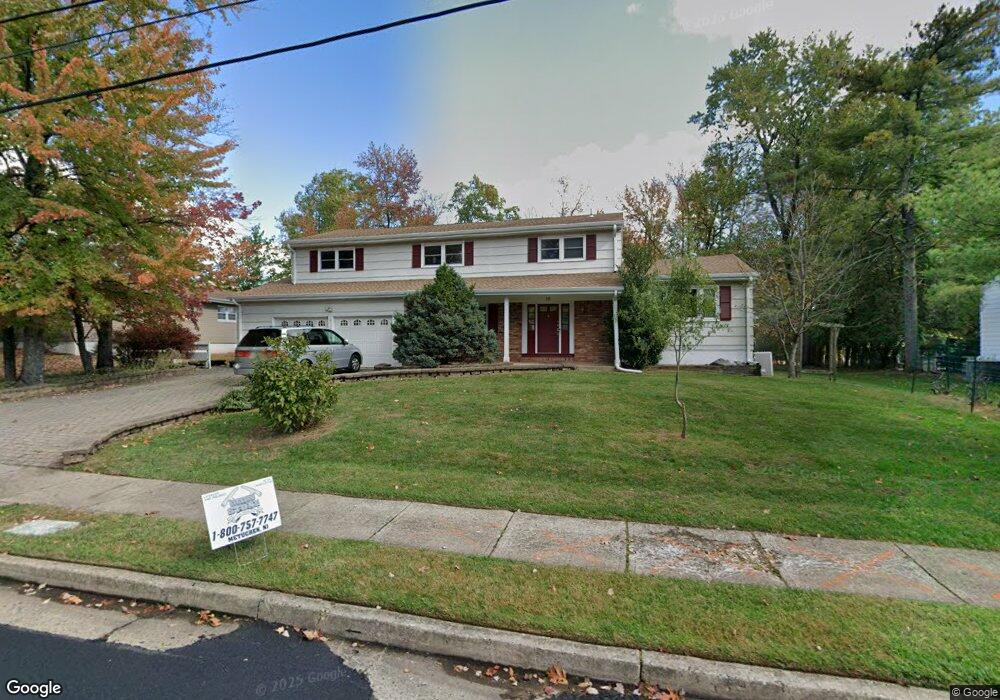

10 Whitewood Rd Edison, NJ 08820

Estimated Value: $931,325 - $1,093,000

--

Bed

--

Bath

2,856

Sq Ft

$349/Sq Ft

Est. Value

About This Home

This home is located at 10 Whitewood Rd, Edison, NJ 08820 and is currently estimated at $996,081, approximately $348 per square foot. 10 Whitewood Rd is a home located in Middlesex County with nearby schools including Menlo Park Elementary School, Woodrow Wilson Middle School, and J.P. Stevens High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 1, 2005

Sold by

Chaobhui Andrew Pa

Bought by

Trousdale John and Trousdale Sushma

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$520,000

Outstanding Balance

$273,163

Interest Rate

5.66%

Mortgage Type

New Conventional

Estimated Equity

$722,918

Purchase Details

Closed on

Feb 18, 1998

Sold by

Adler Herbert

Bought by

Pu Chaohui and Long Yin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$272,000

Interest Rate

7.03%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Trousdale John | $650,000 | -- | |

| Pu Chaohui | $302,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Trousdale John | $520,000 | |

| Previous Owner | Pu Chaohui | $272,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $15,323 | $257,400 | $120,000 | $137,400 |

| 2024 | $15,241 | $257,400 | $120,000 | $137,400 |

| 2023 | $15,241 | $257,400 | $120,000 | $137,400 |

| 2022 | $15,246 | $257,400 | $120,000 | $137,400 |

| 2021 | $14,628 | $257,400 | $120,000 | $137,400 |

| 2020 | $14,489 | $257,400 | $120,000 | $137,400 |

| 2019 | $13,636 | $257,400 | $120,000 | $137,400 |

| 2018 | $13,387 | $257,400 | $120,000 | $137,400 |

| 2017 | $13,259 | $257,400 | $120,000 | $137,400 |

| 2016 | $13,014 | $257,400 | $120,000 | $137,400 |

| 2015 | $12,520 | $257,400 | $120,000 | $137,400 |

| 2014 | $12,165 | $257,400 | $120,000 | $137,400 |

Source: Public Records

Map

Nearby Homes

- 9 Marlin Ave W

- 41 Oliver Ave

- 177 Mundy Ave

- 133 Christie St

- 25 Turner Ave

- 25 Lamar Ave

- 70 Livingston Ave

- 33 Nottingham Rd

- 34 Nottingham Rd

- 513 Grove Ave

- 73 Christie St

- 29 Remington Dr

- 24 Norton St

- 23 Jonathan Dr

- 10 Cutter Ave

- 354 Plainfield Rd

- 454 Plainfield Rd

- 36 Clive Hills Rd

- 6 Sunset Ave

- 1610 Oak Tree Rd