10 Winter St Rehoboth, MA 02769

Estimated Value: $876,000 - $1,264,000

4

Beds

2

Baths

3,954

Sq Ft

$276/Sq Ft

Est. Value

About This Home

This home is located at 10 Winter St, Rehoboth, MA 02769 and is currently estimated at $1,092,292, approximately $276 per square foot. 10 Winter St is a home located in Bristol County with nearby schools including Dighton-Rehoboth Regional High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2022

Sold by

Rupp Ronald T and Rupp Patricia I

Bought by

Rupp

Current Estimated Value

Purchase Details

Closed on

Nov 10, 1993

Sold by

Case Steven A and Hallquist Ernest

Bought by

Case Steven A and Case Margaret E

Purchase Details

Closed on

Sep 8, 1993

Sold by

Case Steven A and Case Margaret

Bought by

Rupp Ronald T and Rupp Patricia I

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rupp | -- | None Available | |

| Rupp | -- | None Available | |

| Case Steven A | $1,000 | -- | |

| Rupp Ronald T | $225,000 | -- | |

| Case Steven A | $1,000 | -- | |

| Rupp Ronald T | $225,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rupp Ronald T | $317,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $67 | $599,800 | $200,100 | $399,700 |

| 2024 | $5,707 | $502,400 | $200,100 | $302,300 |

| 2023 | $5,699 | $499,100 | $196,100 | $303,000 |

| 2022 | $5,699 | $449,800 | $187,700 | $262,100 |

| 2021 | $5,773 | $436,000 | $171,400 | $264,600 |

| 2020 | $5,628 | $429,000 | $171,400 | $257,600 |

| 2018 | $4,805 | $401,400 | $163,600 | $237,800 |

| 2017 | $4,637 | $369,200 | $163,600 | $205,600 |

| 2016 | $4,401 | $362,200 | $163,600 | $198,600 |

| 2015 | $4,295 | $348,900 | $156,400 | $192,500 |

| 2014 | $4,251 | $341,700 | $149,200 | $192,500 |

Source: Public Records

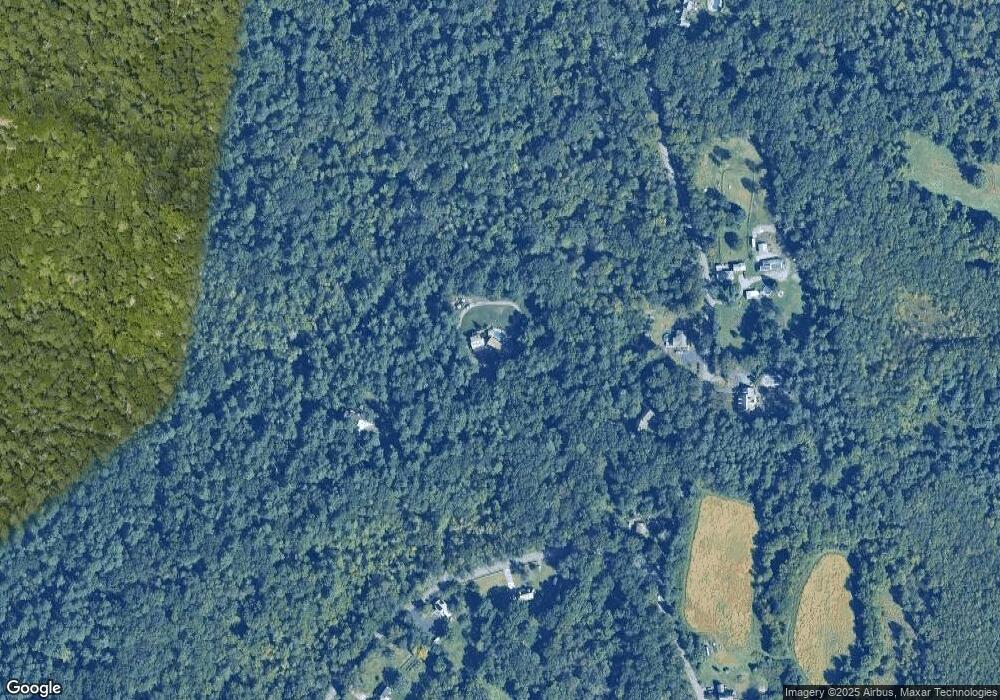

Map

Nearby Homes

- 0 Winter St

- 20 School St

- 111 Summer St

- 197 Chestnut St

- 8 Linden Ln

- 8 Linden Ln

- 67 Wheeler St

- 185 Moulton St

- 42 Linden Ln

- 23 Colonial Way

- 248 County

- 321 Winthrop St

- 205 Providence St Bldr Lot 3

- 203 Providence St Bldr Lot 5

- 0 Wheaton Ave

- 145 Winthrop St

- 139 Winthrop St

- 46 Mikayla Ann Dr

- 15 Hickory Ridge Rd

- 23 Bay State Rd

Your Personal Tour Guide

Ask me questions while you tour the home.