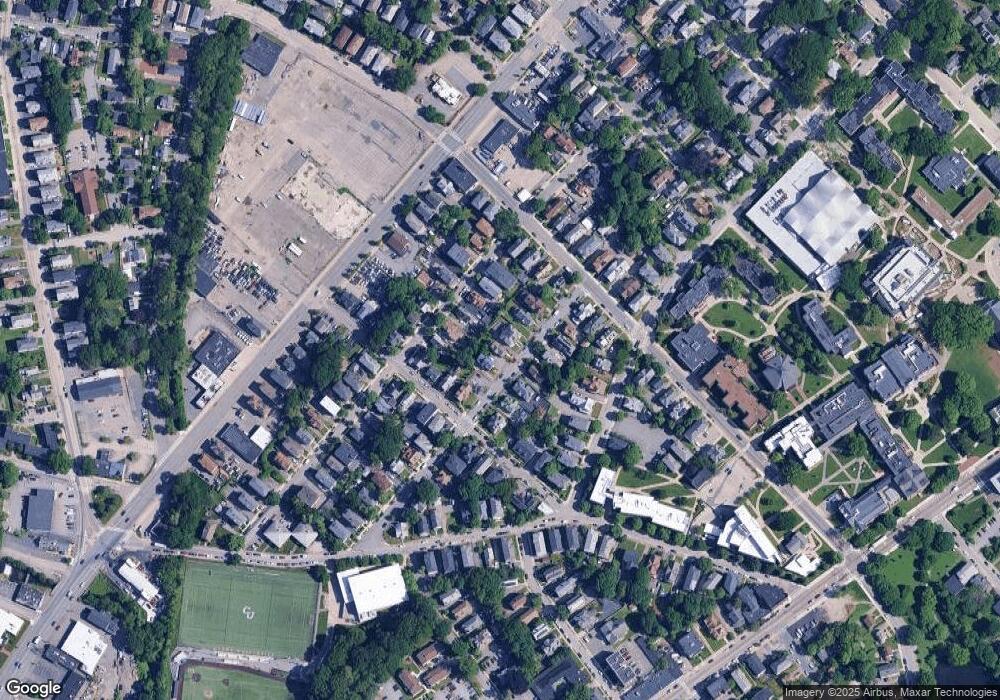

10 Woodbine St Worcester, MA 01603

University Park NeighborhoodEstimated Value: $526,849 - $666,000

6

Beds

3

Baths

2,119

Sq Ft

$290/Sq Ft

Est. Value

About This Home

This home is located at 10 Woodbine St, Worcester, MA 01603 and is currently estimated at $613,462, approximately $289 per square foot. 10 Woodbine St is a home located in Worcester County with nearby schools including Columbus Park Preparatory Academy, Jacob Hiatt Magnet School, and Chandler Magnet.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 10, 2017

Sold by

Maxmia Properties Llc

Bought by

Djafari North Llc

Current Estimated Value

Purchase Details

Closed on

Jun 15, 2011

Sold by

Residential Credit Sol and Jackson

Bought by

Maxmia Props Llc

Purchase Details

Closed on

Jul 7, 2005

Sold by

Sullivan Marybeth

Bought by

Jackson Samuel J

Purchase Details

Closed on

Mar 22, 2005

Sold by

Metropolis Inc

Bought by

Sullivan Mary Beth

Purchase Details

Closed on

Apr 28, 2004

Sold by

Rogers Christine

Bought by

Metropolis Inc

Purchase Details

Closed on

Apr 15, 2003

Sold by

Department Of Housing & Urban Dev

Bought by

Rogers Chritsine

Purchase Details

Closed on

Apr 19, 2000

Sold by

Comtois Clifford G

Bought by

Atlantic Mtg & Invest

Purchase Details

Closed on

Sep 1, 1988

Sold by

Westwood Dev Co

Bought by

Orkin Arthur

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Djafari North Llc | -- | -- | |

| Djafari North Llc | -- | -- | |

| Maxmia Props Llc | $120,000 | -- | |

| Maxmia Props Llc | $120,000 | -- | |

| Jackson Samuel J | $286,900 | -- | |

| Jackson Samuel J | $286,900 | -- | |

| Sullivan Mary Beth | $295,000 | -- | |

| Sullivan Mary Beth | $295,000 | -- | |

| Metropolis Inc | -- | -- | |

| Metropolis Inc | -- | -- | |

| Rogers Chritsine | $168,000 | -- | |

| Rogers Chritsine | $168,000 | -- | |

| Atlantic Mtg & Invest | $139,844 | -- | |

| Atlantic Mtg & Invest | $139,844 | -- | |

| Orkin Arthur | $176,750 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Orkin Arthur | $216,000 | |

| Previous Owner | Orkin Arthur | $150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,847 | $443,300 | $77,500 | $365,800 |

| 2024 | $5,705 | $414,900 | $77,500 | $337,400 |

| 2023 | $5,281 | $368,300 | $67,400 | $300,900 |

| 2022 | $4,750 | $312,300 | $53,900 | $258,400 |

| 2021 | $3,959 | $243,200 | $43,100 | $200,100 |

| 2020 | $3,556 | $209,200 | $42,800 | $166,400 |

| 2019 | $3,668 | $203,800 | $37,400 | $166,400 |

| 2018 | $3,725 | $197,000 | $37,400 | $159,600 |

| 2017 | $3,533 | $183,800 | $37,400 | $146,400 |

| 2016 | $3,438 | $166,800 | $27,200 | $139,600 |

| 2015 | $3,348 | $166,800 | $27,200 | $139,600 |

| 2014 | $3,259 | $166,800 | $27,200 | $139,600 |

Source: Public Records

Map

Nearby Homes