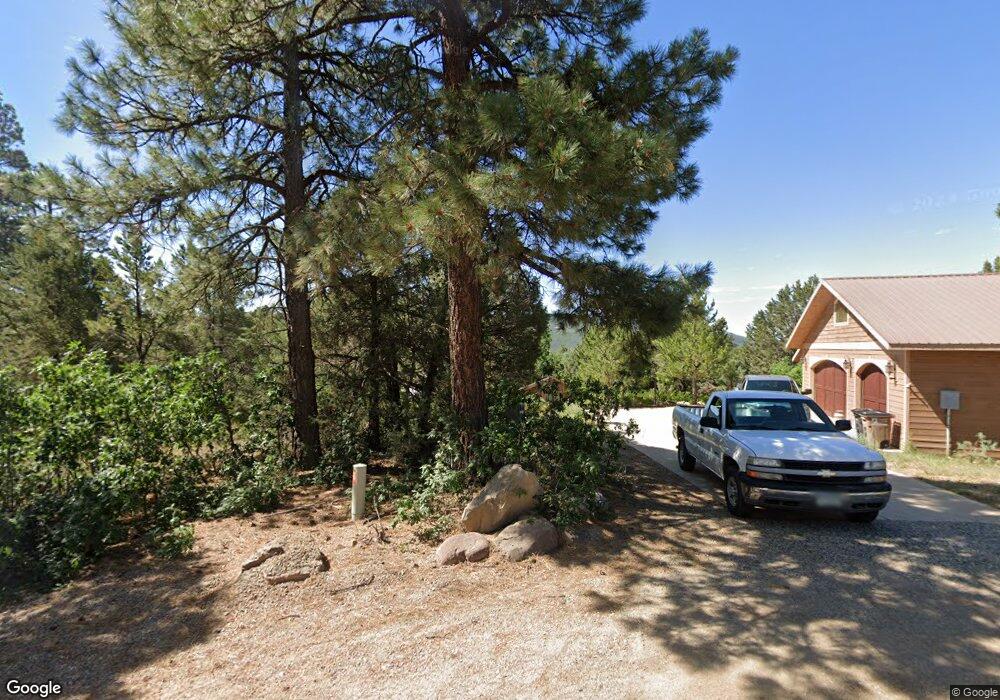

100 Cheyenne Dr Durango, CO 81303

Estimated Value: $738,686 - $797,000

2

Beds

2

Baths

1,512

Sq Ft

$508/Sq Ft

Est. Value

About This Home

This home is located at 100 Cheyenne Dr, Durango, CO 81303 and is currently estimated at $767,422, approximately $507 per square foot. 100 Cheyenne Dr is a home located in La Plata County with nearby schools including Fort Lewis Mesa Elementary School, Escalante Middle School, and Durango High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 31, 2012

Sold by

Smith Ronald W and Bayly Sonja K

Bought by

Smith Ronald W and Bayly Sonja K

Current Estimated Value

Purchase Details

Closed on

May 18, 2006

Sold by

Rabby Tommie Sue

Bought by

Smith Ronald W and Bayly Sonja K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,000

Interest Rate

6.5%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Nov 6, 1995

Bought by

Smith Ronald W & Bayly Sonja K Trustee

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Ronald W | -- | None Available | |

| Smith Ronald W | $369,900 | Land Title | |

| Smith Ronald W & Bayly Sonja K Trustee | $54,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Smith Ronald W | $74,000 | |

| Open | Smith Ronald W | $295,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,468 | $42,980 | $16,640 | $26,340 |

| 2024 | $1,257 | $36,630 | $13,130 | $23,500 |

| 2023 | $1,257 | $40,310 | $14,450 | $25,860 |

| 2022 | $1,400 | $41,810 | $14,990 | $26,820 |

| 2021 | $1,407 | $33,920 | $11,870 | $22,050 |

| 2020 | $1,323 | $32,890 | $11,080 | $21,810 |

| 2019 | $1,269 | $32,890 | $11,080 | $21,810 |

| 2018 | $1,076 | $27,920 | $11,150 | $16,770 |

| 2017 | $1,053 | $27,920 | $11,150 | $16,770 |

| 2016 | $1,038 | $29,830 | $12,980 | $16,850 |

| 2015 | $977 | $29,830 | $12,980 | $16,850 |

| 2014 | -- | $26,980 | $12,980 | $14,000 |

| 2013 | -- | $26,980 | $12,980 | $14,000 |

Source: Public Records

Map

Nearby Homes

- 285 Logging Trail Rd

- 275 Logging Trail Rd

- 481 Far View Rd

- 1172 Ridge Rd

- 269 North Rd

- 307 Deer Trail Rd

- 111 Rendezvous Trail

- 1969 County Road 142

- 290 Blue Ridge

- TBD Vaquero Way

- 149 Tipple Ave

- 122 Tipple Ave

- 146 Tipple Ave

- 148 Tipple Ave

- 143 Tipple Ave

- 121 Tipple Ave

- 147 Tipple Ave

- 841 Oak Dr

- 23 Hunter Ct

- 127 Wild Chives Ct

- 99 Cheyenne Dr

- 0 Cheyenne Dr

- 0 Tomahawk Trail Unit 668704

- 704 Spring Rd

- 37 Cheyenne Dr

- 180 Tomahawk Trail

- 91 Arapahoe Dr

- 40 Tomahawk Trail

- 37 Arapahoe Dr

- 665 Spring Rd

- 792 Spring Rd

- 616 Spring Rd

- 2433 County Road 141

- 2437 County Road 141

- TBD Spring Rd

- 90 Arapahoe Dr

- 38 Arapahoe Dr

- 929 Spring Rd

- 2627 County Road 141

- 585 Spring Rd