1002 Verbena Dr Unit 1144 Austin, TX 78750

Anderson Mill NeighborhoodEstimated Value: $280,000 - $291,000

2

Beds

3

Baths

1,140

Sq Ft

$252/Sq Ft

Est. Value

About This Home

This home is located at 1002 Verbena Dr Unit 1144, Austin, TX 78750 and is currently estimated at $286,890, approximately $251 per square foot. 1002 Verbena Dr Unit 1144 is a home located in Williamson County with nearby schools including Anderson Mill Elementary School, Noel Grisham Middle, and Westwood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2015

Sold by

Crowe Claude Murry and Crowe Monica G

Bought by

Gray Michael and Gray Nancy

Current Estimated Value

Purchase Details

Closed on

Mar 14, 2014

Sold by

Kimmelman Neil B

Bought by

Crowe Claude Murry and Crowe Monica G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,400

Interest Rate

4.36%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 16, 2010

Sold by

Chrisman Richard L

Bought by

Kimmelman Neil B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,544

Interest Rate

4.88%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 7, 2008

Sold by

Rossmiller Joanne M

Bought by

Chrisman Richard L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,000

Interest Rate

6.38%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gray Michael | -- | None Available | |

| Crowe Claude Murry | -- | Itc | |

| Kimmelman Neil B | -- | Itc | |

| Chrisman Richard L | -- | Gracy |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Crowe Claude Murry | $116,400 | |

| Previous Owner | Kimmelman Neil B | $119,544 | |

| Previous Owner | Chrisman Richard L | $92,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,049 | $262,156 | $72,547 | $189,609 |

| 2024 | $6,049 | $300,938 | $72,971 | $227,967 |

| 2023 | $5,602 | $282,861 | $72,971 | $209,890 |

| 2022 | $7,018 | $326,846 | $50,000 | $276,846 |

| 2021 | $5,153 | $209,768 | $34,147 | $175,621 |

| 2020 | $4,208 | $176,859 | $28,808 | $148,051 |

| 2019 | $4,546 | $185,841 | $29,116 | $156,725 |

| 2018 | $4,240 | $173,352 | $20,564 | $152,788 |

| 2017 | $4,387 | $175,758 | $20,564 | $155,194 |

| 2016 | $3,937 | $157,715 | $20,564 | $137,151 |

| 2015 | $3,149 | $148,268 | $14,554 | $133,714 |

| 2014 | $3,149 | $132,983 | $0 | $0 |

Source: Public Records

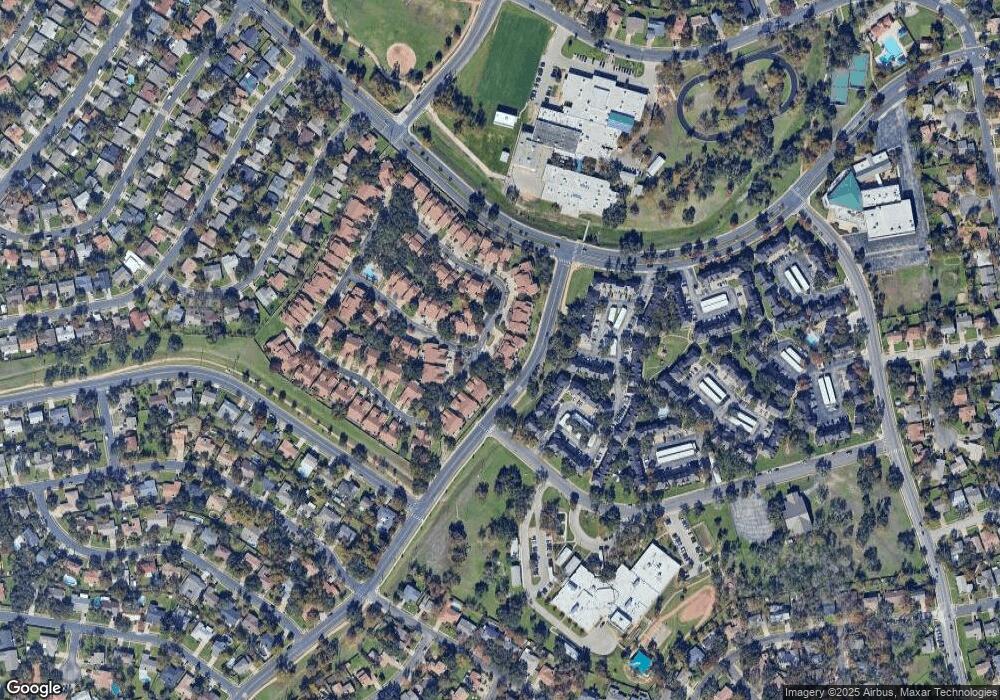

Map

Nearby Homes

- 1028 Verbena Dr

- 12106 Grey Fawn Path

- 12306 Split Rail Pkwy

- 12300 Wipple Tree Cove

- 12208 Double Tree Ln

- 12306 Double Tree Ln

- 12206 Saber Trail

- 12314 Double Tree Ln

- 10606 Mourning Dove Dr

- 10404 Mourning Dove Dr

- 10408 Firethorn Ln

- 12319 Double Tree Ln

- 11007 Opal Trail

- 10401 Mourning Dove Dr

- 11908 Stout Oak Trail

- 11902 Millwright Pkwy

- 11010 Froke Cedar Trail

- 11100 Alison Parke Trail

- 11905 Millwright Pkwy

- 10229 Missel Thrush Dr

- 1004 Verbena Dr

- 1002 Verbena Dr

- 1000 Verbena Dr

- 1006 Verbena Dr

- 1006 Verbena Dr Unit 1357

- 1008 Verbena Dr

- 1010 Verbena Dr

- 1012 Verbena Dr

- 1014 Verbena Dr

- 1000 Solano Dr

- 1002 Solano Dr

- 2058 Verbena Dr

- 2056 Verbena Dr

- 1004 Solano Dr

- 1004 Solano Dr Unit 1474

- 2054 Verbena Dr

- 1016 Verbena Dr

- 1023 Verbena Dr

- 1018 Verbena Dr

- 1025 Verbena Dr