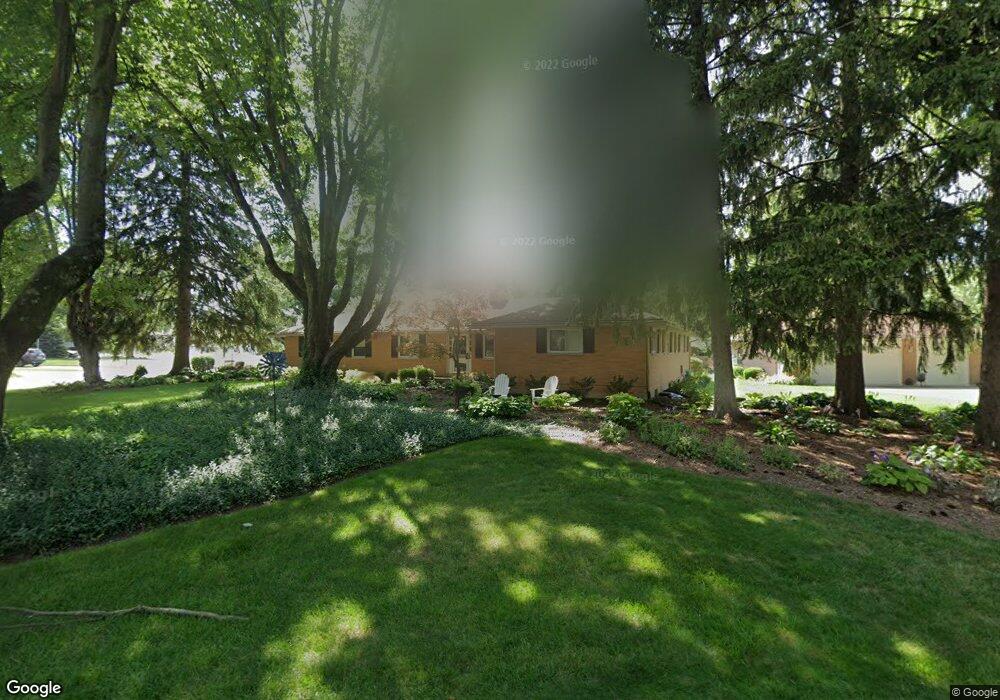

101 Laurelann Dr Dayton, OH 45429

Estimated Value: $233,000 - $352,000

3

Beds

3

Baths

1,694

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 101 Laurelann Dr, Dayton, OH 45429 and is currently estimated at $319,746, approximately $188 per square foot. 101 Laurelann Dr is a home located in Montgomery County with nearby schools including Oakview Elementary School, Van Buren Middle School, and Kettering Fairmont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2018

Sold by

Leighty Clifford and Estate Of Paula Hawthorne

Bought by

Eberg Danny L and Eberg Gloria J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,000

Outstanding Balance

$162,952

Interest Rate

4.6%

Mortgage Type

New Conventional

Estimated Equity

$156,794

Purchase Details

Closed on

Jun 18, 2018

Sold by

Frank Larry E and Frank Vicki L

Bought by

Elberg Danny L and Eberg Gloria L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,000

Outstanding Balance

$162,952

Interest Rate

4.6%

Mortgage Type

New Conventional

Estimated Equity

$156,794

Purchase Details

Closed on

Apr 21, 2010

Sold by

Frank Larry E

Bought by

Frank Larry E and Hawthorne Paula J

Purchase Details

Closed on

May 25, 2001

Sold by

Morrison John H and Morrison Harmie N

Bought by

Frank Larry E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eberg Danny L | $117,500 | Landmark Title Agency South | |

| Elberg Danny L | $117,500 | Landmark Title Agency South | |

| Frank Larry E | -- | Attorney | |

| Frank Larry E | $178,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Eberg Danny L | $188,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,926 | $104,690 | $23,070 | $81,620 |

| 2023 | $5,926 | $104,690 | $23,070 | $81,620 |

| 2022 | $5,663 | $80,940 | $17,880 | $63,060 |

| 2021 | $5,238 | $80,940 | $17,880 | $63,060 |

| 2020 | $5,875 | $80,940 | $17,880 | $63,060 |

| 2019 | $5,809 | $70,760 | $16,250 | $54,510 |

| 2018 | $5,121 | $70,760 | $16,250 | $54,510 |

| 2017 | $4,715 | $70,760 | $16,250 | $54,510 |

| 2016 | $4,304 | $61,910 | $16,250 | $45,660 |

| 2015 | $4,111 | $61,910 | $16,250 | $45,660 |

| 2014 | $4,111 | $61,910 | $16,250 | $45,660 |

| 2012 | -- | $67,400 | $18,770 | $48,630 |

Source: Public Records

Map

Nearby Homes

- 4808 Judith Dr

- 4816 Judith Dr

- 4824 Far Hills Ave

- 101 Enid Ave

- 501 Judith Dr

- 5016 Far Hills Ave

- 617 Laurelann Dr

- 215 Colonial Ln

- 4817 Ackerman Blvd

- 5328 Landau Dr Unit 49

- 5328 Landau Dr

- 5017 Ackerman Blvd

- 4259 Maxlin Rd

- 5380 Landau Dr Unit 40

- 804 Lovetta Dr

- 5416 Landau Dr Unit 7

- 5416 Landau Dr Unit 5

- 791 Willowdale Ave

- 321 Princewood Ave

- 5095 Wheaton St

- 4739 Judith Dr

- 11 Laurelann Dr

- 4740 Far Hills Ave

- 201 Laurelann Dr

- 4740 Judith Dr

- 4731 Judith Dr

- 4732 Far Hills Ave

- 4800 Far Hills Ave

- 211 Laurelann Dr

- 4800 Judith Dr

- 4723 Judith Dr

- 4724 Far Hills Ave

- 300 Stoneybrook Dr

- 4809 Judith Dr

- 4724 Judith Dr

- 301 Laurelann Dr

- 4808 Far Hills Ave

- 107 Stoneybrook Dr

- 4716 Far Hills Ave

- 4711 Judith Dr